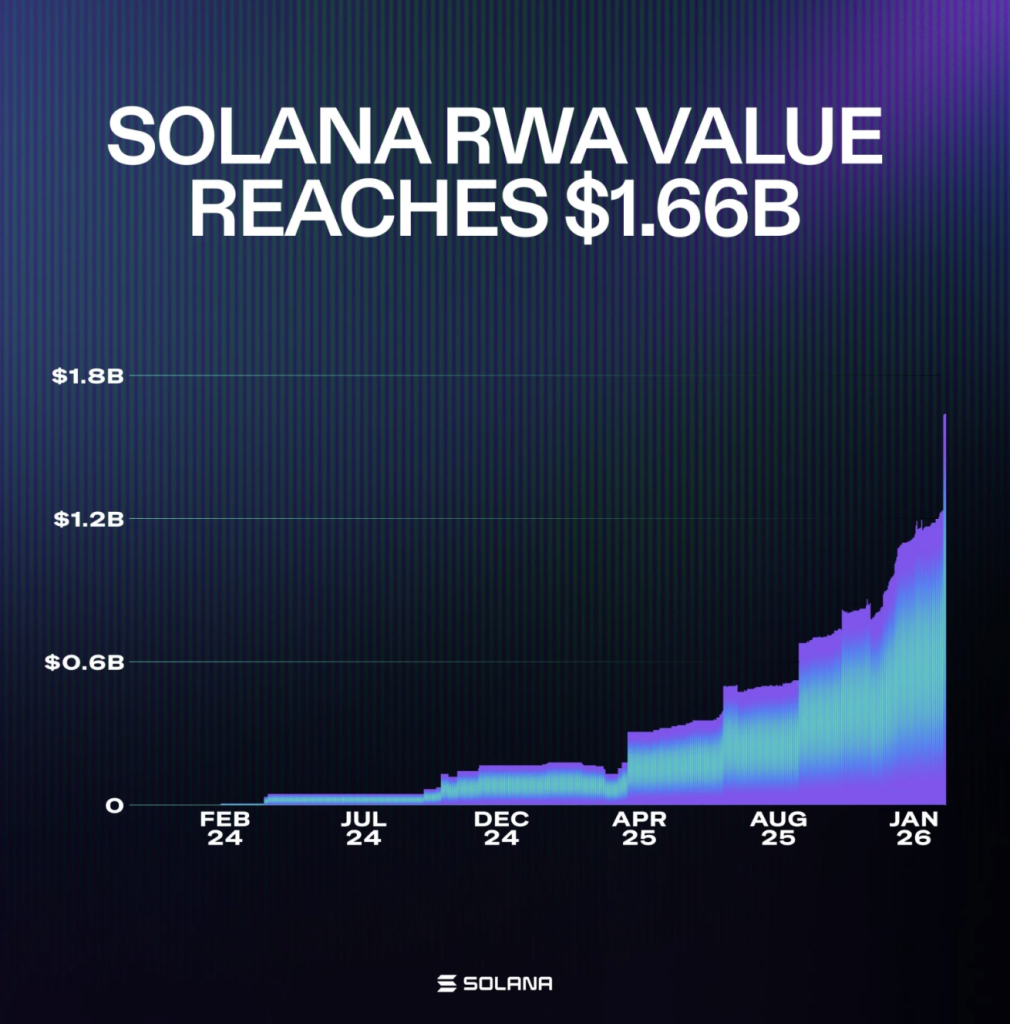

- Solana’s RWA ecosystem surpassed $1.66 billion in tokenized assets, reflecting growing institutional and DeFi participation.

- SOL is testing key $90 resistance, with a confirmed 4H close above that level needed to validate a breakout.

- Momentum indicators support recovery, but overbought signals raise the risk of a short-term pullback toward $82.5 or $77.

Solana’s real-world asset ecosystem just hit a fresh milestone. On Sunday, February 15, tokenized assets on the network climbed past $1.66 billion, marking a new all-time high. That’s not just a headline number either, it reflects a steady flow of capital moving on-chain, not a one-day spike.

Institutions and on-chain investors alike are leaning into Solana’s high-throughput, low-fee infrastructure to access tokenized treasuries, private credit, and other yield-generating traditional assets. In simple terms, they’re using the blockchain as settlement rails for real-world finance. And that shift says something about where the industry is heading.

Tokenization Momentum Is Picking Up

This surge in RWAs isn’t happening in isolation. It’s part of a broader tokenization wave across crypto, where traditional financial instruments are being issued and traded on-chain. Solana has been one of the main beneficiaries, partly because its network speed and cost structure make it appealing for high-volume activity.

DeFi integrations on Solana have also expanded, giving these tokenized assets more utility once they’re issued. Strong developer adoption adds another layer of confidence, because infrastructure only works long-term if builders keep building. And right now, they are.

As more capital rotates into on-chain RWAs, Solana is quietly strengthening its position in the race to modernize financial markets. Ethereum still dominates in many areas, but Solana’s growth in tokenization shows it’s not just competing, it’s carving out its own lane.

SOL Price Now Faces a $90 Decision Point

While the ecosystem celebrates a milestone, SOL’s price is battling a technical wall. On February 15, the token pushed into the $90 resistance zone, a level that has repeatedly stalled bullish attempts in recent sessions. It’s become a kind of short-term ceiling.

Crypto analyst Crypto Pulse pointed out that a real breakout would require a clean four-hour candle close above $90. Not just a quick wick, not a brief spike. A close. Without that confirmation, the breakout thesis remains fragile.

If SOL fails to secure that 4H close above resistance, a short-term pullback becomes more likely. The first downside area to watch sits around the $82.5 Fair Value Gap, where price could move to rebalance that technical inefficiency. If selling pressure accelerates beyond that, the $77 zone comes into view, an area where aggressive buyers previously stepped in.

Momentum Is Improving, But Not Without Risk

According to TradingView data from February 15, SOL is hovering near $90 after recovering from an early February drop that dragged price from the $115–$120 range down to roughly $74. That slide was sharp. The bounce that followed lifted SOL back into the mid-$80s, where it consolidated in a choppy pattern of lower highs and higher lows.

Recently, momentum has turned positive again, with price testing the $92–$94 resistance region. That zone represents the next supply area if $90 can be decisively cleared. But bulls are cautious here, and you can feel it in the price action.

The RSI (14) is sitting around 70, which reflects strong buying pressure but also signals that the asset is approaching overbought territory in the short term. The MACD, on the other hand, shows a bullish crossover with expanding green bars, suggesting that upside momentum is still building. It’s a mixed signal situation, strength with a side of caution.

If SOL can hold above the $88–$90 range, the path toward $94 and possibly $100 opens up. But if resistance holds firm and momentum fades, a retrace back into the mid-$80s, or even deeper, wouldn’t be surprising. For now, Solana’s fundamentals look strong, but the chart is demanding confirmation before the next leg higher.