- A long-term XRP forecast shifts focus from short-term price action to infrastructure and adoption

- XRP’s value thesis centers on utility, payments, and institutional integration rather than scarcity

- A $100 target is possible but depends on sustained adoption and regulatory clarity over time

In a market that’s usually obsessed with short-term price swings and fast-moving narratives, long-range projections tend to land differently. They slow the conversation down. When analysts stop watching daily candles and start talking in years, attention shifts away from momentum and toward fundamentals, infrastructure, and whether an asset can realistically grow into its valuation over time.

A recent XRP price forecast has done exactly that, reopening debate around XRP’s long-term potential rather than its next short-term move.

Why This Forecast Gained Attention

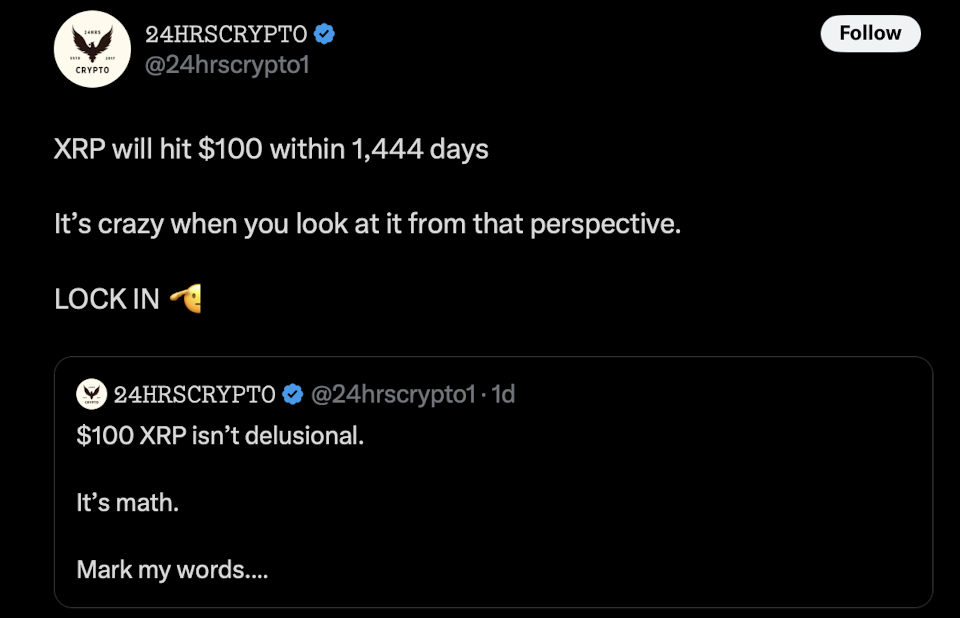

The discussion picked up momentum after an X post by 24HOURSCRYPTO, which referenced commentary attributed to an XRPL validator. Instead of pushing urgency or near-term targets, the post framed XRP’s outlook around a defined timeline, 1,444 days. That framing mattered. It encouraged investors to zoom out and reassess XRP’s future without reacting to short-term volatility.

The idea resonated precisely because it didn’t promise speed. It emphasized patience.

Why the Timeline Itself Matters

A projection spanning 1,444 days focuses on process rather than prediction. Historically, crypto assets that experienced meaningful revaluations didn’t do so overnight. They spent years building infrastructure, navigating regulation, and integrating with institutions before price reflected those changes.

This timeframe aligns more closely with real market cycles. It allows space for payment rails to scale, liquidity systems to deepen, and enterprise blockchain solutions to mature organically, rather than forcing growth into a speculative acceleration narrative.

XRP’s Utility-Driven Value Proposition

XRP’s long-term thesis has never leaned heavily on scarcity. Instead, Ripple positions XRP as a bridge asset for real-time, low-cost cross-border settlements, targeting inefficiencies in the global correspondent banking system.

Supporters argue that as transaction volumes grow and institutional usage expands, value accrual would be tied to actual network demand, not hype-driven speculation. It’s a slower path, but one that aims to be structurally sound.

The XRP Ledger Continues to Evolve

Under the hood, the XRP Ledger has grown beyond simple payments. Tokenization, on-chain liquidity tools, and decentralized infrastructure designed for enterprise use are now part of the ecosystem. Low fees, energy efficiency, and a built-in decentralized exchange continue to stand out, especially for institutions that prioritize reliability over experimentation.

Validators, who help secure and maintain the network, often point to these fundamentals when assessing long-term valuation potential. From that perspective, price becomes something that follows progress, not leads it.

Conviction Is Not the Same as Certainty

Even with growing confidence around projections like a $100 XRP, there is no data that guarantees such an outcome within a fixed window. Achieving that level would require sustained global adoption, deep liquidity, favorable macro conditions, and continued regulatory clarity across major jurisdictions. All are possible. None are assured.

That distinction matters. A strong thesis doesn’t eliminate risk, it just reframes it.

A Longer Lens on XRP’s Trajectory

At its core, the perspective shared by 𝟸𝟺𝙷𝚁𝚂𝙲𝚁𝚈𝙿𝚃𝙾 reflects a mindset that’s becoming more common among long-term XRP advocates. Time, infrastructure, and real-world usage are seen as the true drivers of value, not short-term price noise.

Whether XRP reaches $100 within 1,444 days remains uncertain. But the forecast itself reinforces a growing emphasis on patience, fundamentals, and letting the story develop naturally.