- Stablecoins are becoming a critical bridge between DeFi and traditional finance

- Ripple’s strategy prioritizes institutional adoption over short-term price moves

- Whale behavior and on-chain data point to accumulation, not selling

There’s little debate at this point that stablecoins sit at the center of the bridge between DeFi and traditional finance. They’re the connective tissue. And in that context, blockchains that can offer a native, layer-1 stablecoin tend to look more attractive to banks and regulated financial players. The trade-off, though, is that these strategies usually favor slow buildouts over quick price pops, which isn’t always easy for holders to sit through.

Ripple’s Stablecoin Strategy Is Playing the Long Game

Ripple fits this pattern almost perfectly. In a recent move, the company partnered with LMAX to integrate its native stablecoin, RLUSD, directly into LMAX’s infrastructure. On the surface, it’s another step aimed at increasing adoption and making Ripple’s ecosystem more compatible with institutional workflows. It’s not flashy, but it’s deliberate.

Still, the announcement stirred debate among XRP holders. Many were expecting price to respond more aggressively, and that hasn’t happened. Despite a steady stream of partnerships, institutional-facing initiatives, and even solid XRP ETF flows, the market response has been muted. Price, at least in the short term, just hasn’t kept up.

XRP vs Solana Shows a Different Story Depending on the Lens

So far in 2026, XRP has continued to trail Solana in relative performance, and on a chart, that gap can look frustrating. But zooming out changes the narrative a bit. During the 2025 cycle, XRP limited its losses to roughly 12%, while SOL saw drawdowns closer to 35%. That kind of resilience doesn’t usually happen by accident, even if it goes underappreciated in real time.

That contrast raises a fair question. Are Ripple’s recent moves actually laying the groundwork for something longer term, even if price hasn’t reacted yet? The market often rewards momentum first, and structure later, which can distort perception in the moment.

Whale Behavior Suggests Conviction, Not Distribution

Looking back at 2025 offers some clues. XRP outperformed a wide range of assets during that period, and it coincided with several meaningful strategic decisions. GTreasury’s $1 billion acquisition and Ripple’s partnership with BDACS to expand institutional custody services in South Korea weren’t headline grabs, but they mattered. Those moves added infrastructure, not hype.

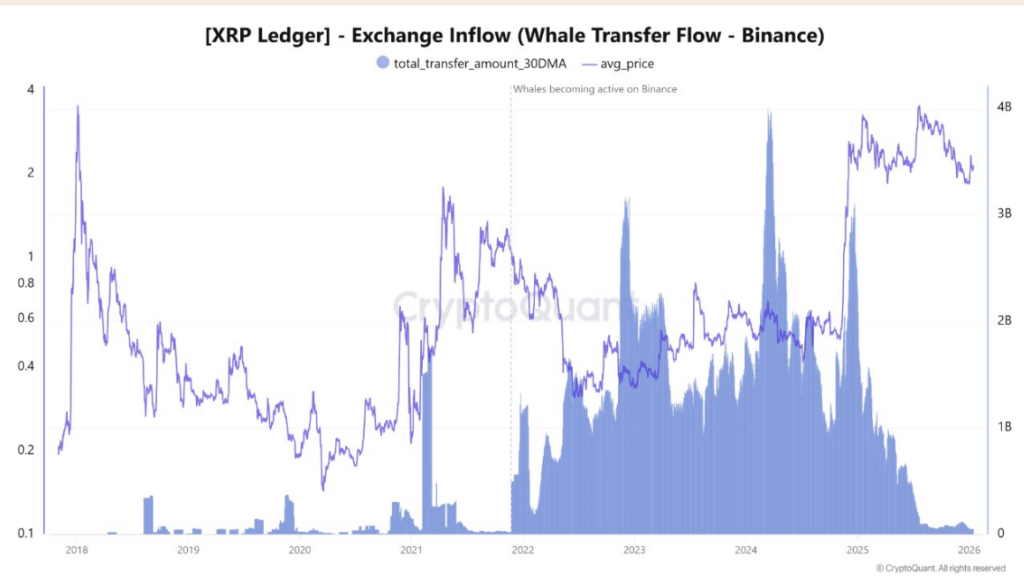

Fast forward to now, and on-chain data seems to echo that same pattern. According to CryptoQuant, whale inflows to Binance have dropped to their lowest level since 2021. In simple terms, large XRP holders aren’t rushing to sell. If anything, they’re sitting tight, which says more than any single price candle ever could.

XRP’s Setup Looks Quiet, but Intentionally So

This behavior lines up with the broader thesis that XRP’s underperformance on shorter timeframes may be misleading. While it continues to lag some other large-cap assets in near-term momentum, the underlying setup looks different. The word that keeps coming up is conviction.

A mix of steady on-chain activity and Ripple’s slow, institution-first strategy points more toward accumulation than distribution. It’s not exciting, and it doesn’t move fast, but it tends to matter over longer horizons. Because of that, XRP’s longer-term outlook heading deeper into 2026 may be more supported than current price action suggests.