- Coinbase introduced Agentic Wallets that let AI agents hold and spend crypto

- The system runs on x402, a machine-to-machine payments protocol

- Built-in guardrails aim to keep autonomous finance compliant and secure

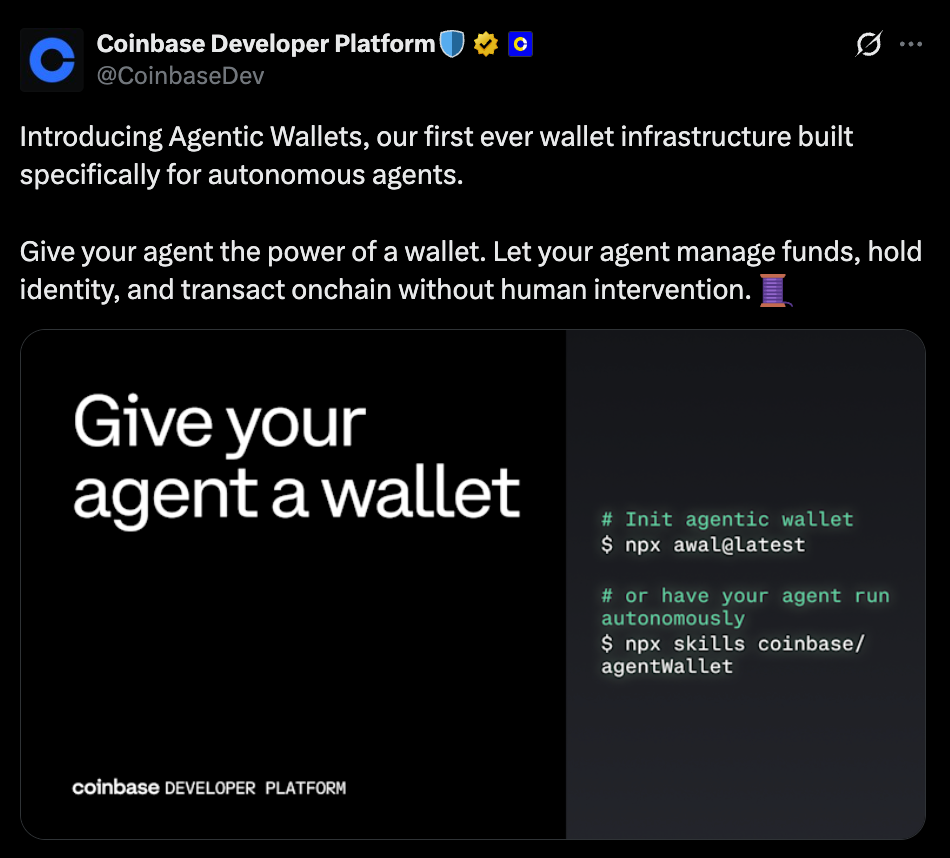

Coinbase just launched something far more ambitious than a developer experiment. Agentic Wallets are designed to let AI systems hold, spend, trade, and earn crypto independently. That means AI agents can move capital without waiting for a human to click confirm, which fundamentally changes how automation interacts with money.

These aren’t wallets tucked inside backend scripts or loose API keys floating in a server. They’re programmable, standalone accounts meant to function as financial personas. The idea is simple but bold: if AI systems are going to act on our behalf, they may need their own balance sheets.

x402 Is the Quiet Backbone

At the center of this system is Coinbase’s x402 payments protocol. Unlike standard wallet infrastructure, x402 is built specifically for machine-to-machine payments. It allows agents to pay for compute, APIs, liquidity access, and digital services without human sign-off at every step.

Coinbase says x402 has already processed tens of millions of transactions, which suggests this isn’t conceptual vaporware. It’s already functioning as a transactional rail. That matters because autonomous finance only works if the plumbing is stable and scalable, not theoretical.

Security Is the Real Make-or-Break

The biggest criticism of AI-driven wallets so far has been safety. Many so-called “agent wallets” today are nothing more than private keys stored on disk. That’s fine for experiments. It’s reckless for scale. Coinbase is clearly aware of that narrative and is pushing guardrails hard.

Agentic Wallets include spending limits, compliance controls, and isolated key infrastructure. The goal is to prevent bots from draining funds or interacting with malicious contracts unchecked. If AI agents are going to touch serious capital, oversight mechanisms aren’t optional. They’re survival tools.

This Is a Bet on Autonomous Commerce

The deeper play isn’t flashy AI demos. It’s autonomous economic participation. If AI agents can manage their own funds, rebalance positions, pay for services they use, and react to market opportunities in real time, the concept of “agentic commerce” becomes real infrastructure rather than marketing language.

That could reshape how automated trading strategies are deployed. It could also alter how digital services are paid for. Instead of humans paying subscriptions, agents could transact directly with other agents, negotiating access and pricing on the fly. That’s a very different internet.

Conclusion

Coinbase’s Agentic Wallets represent a serious attempt to merge crypto rails with AI autonomy. It moves AI from being a suggestion engine to being a financial actor. Skepticism is warranted, especially around risk management at scale, but the direction is unmistakable.

This isn’t just a feature update. It’s a structural bet that the next phase of crypto won’t just be human-to-human finance. It will include machines participating directly in economic activity.