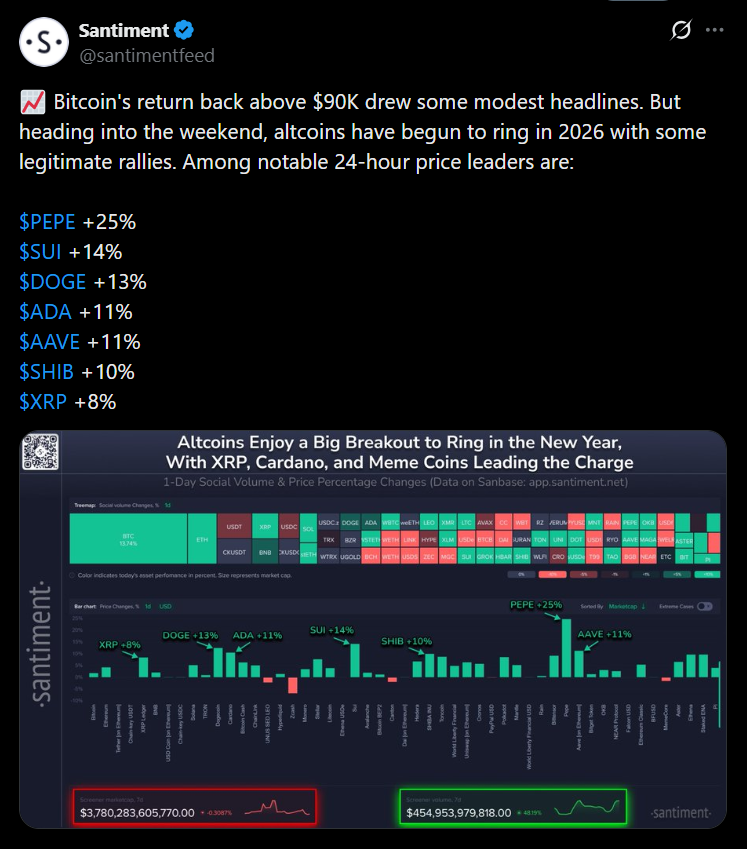

- XRP is benefiting from early 2026 altcoin rotation.

- Analysts are watching key levels around $2.22 to $2.39 in the near term.

- Longer-term targets near $5 remain possible under favorable conditions.

Ripple’s XRP has never taken the easy route. Its climb back into relevance has been slow, contested, and at times frustrating, which is exactly why many investors now view it as resilient rather than fragile. As Ripple continues to expand its strategy across payments, banking infrastructure, and broader financial rails, the question isn’t whether XRP has ambition. It’s whether that ambition shows up in price as 2026 unfolds.

Why XRP Is Moving Again

XRP’s recent price action has been less about headlines and more about rotation. As Bitcoin pushed back above the $90,000 level, attention began drifting toward altcoins with established narratives. XRP benefited from that shift, rising roughly 8% in the first week of 2026. It wasn’t alone. The broader altcoin space has been showing signs of life as investors reassess risk and positioning after a cautious end to last year.

That matters because XRP tends to move when capital starts looking beyond Bitcoin, not when the market is purely defensive.

Near-Term Levels Traders Are Focused On

According to analyst Dark Defender, XRP is currently navigating a technically sensitive zone. Near-term upside levels being watched sit around $2.22, $2.26, and $2.39. The emphasis here isn’t on predicting every tick, but on structure. The idea is simple: sustained closes above key levels suggest continuation, while repeated closes below support open the door to downside tests.

Momentum indicators like RSI are already elevated on shorter time frames, which means volatility is likely. That doesn’t invalidate the move, but it does raise the importance of confirmation rather than blind conviction.

Bigger Targets Are Still on the Table

Zooming out, longer-term projections haven’t disappeared. In previous commentary, the same analyst pointed to a potential move toward the $5 to $6 range if XRP completes a full higher-timeframe cycle. That kind of target assumes favorable macro conditions, continued regulatory clarity, and sustained institutional interest. It’s not a short-term call. It’s a scenario.

Whether or not XRP reaches those levels in 2026 depends less on charts and more on execution, adoption, and how the broader crypto market behaves once liquidity conditions shift.

What This Means for Investors

XRP isn’t being treated like a speculative flyer right now. It’s being evaluated as a structured asset within a rotating market. That doesn’t guarantee upside, but it does explain why it keeps reappearing in serious discussions. Price targets will change. Narratives will evolve. What hasn’t changed is XRP’s role as a bridge between crypto and traditional finance.

Conclusion

XRP’s outlook for 2026 sits somewhere between cautious optimism and conditional upside. Short-term levels matter for traders, while longer-term targets hinge on macro trends and Ripple’s continued integration into financial systems. For now, XRP is back on the radar, not because of hype, but because the market is starting to rotate again.