- Monero has surpassed $650, setting a new all-time high.

- Capital rotation from Zcash and renewed privacy demand appear to be driving the rally.

- A short-term correction is possible, but the broader trend remains strong.

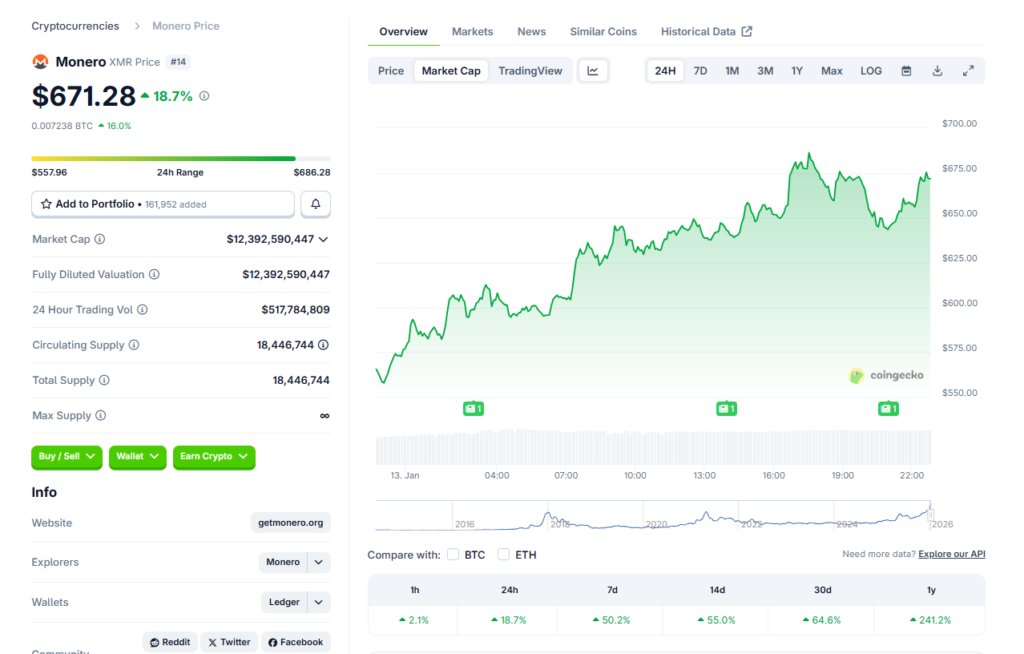

Monero (XMR) is showing no signs of slowing down after pushing above the $650 level for the first time in its history. The privacy-focused cryptocurrency hit a new peak near $650 earlier today, Jan. 13, 2026. According to CoinGecko data, XMR has rallied 14.4% in the last 24 hours, 43.5% over the past week, 49.7% in the 14-day charts, and 53.9% over the previous month. Since January 2025, the asset is up roughly 225%, making it one of the strongest performers in the market.

What makes the move notable is the backdrop. Bitcoin and Ethereum remain range-bound and fragile, yet Monero continues to trend higher. XMR is now the 15th-largest crypto asset by market cap, sitting around $11.8 billion, and its divergence from the broader market is becoming impossible to ignore.

Why Monero Is Rallying While Others Stall

Monero’s bullish phase began in late 2025, well before this latest breakout. At a time when most assets were correcting, XMR held firm and quietly built momentum. That resilience set the stage for the explosive move seen this month.

A major catalyst appears to be turmoil within the Zcash ecosystem. ZEC’s core development team, Electric Coin Company, exited en masse following internal disputes, shaking investor confidence. Capital likely rotated from ZEC into Monero, which many view as the most established and uncompromising privacy coin. Layer on momentum traders and FOMO, and inflows accelerated rapidly.

Is a Pullback Inevitable?

Despite the strength, risk is rising. Monero’s rally has been sharp and somewhat isolated, especially given the broader market’s weakness. As early buyers take profits and momentum cools, volatility could increase. A correction would not be unusual after such a vertical move, particularly if inflows slow.

That said, Monero has already proven it can outperform during market stress. If privacy concerns, regulatory pressure, and demand for censorship-resistant assets stay elevated, XMR may continue carving higher highs even if the rest of crypto struggles.

Conclusion

Breaking above $650 is a milestone moment for Monero. Whether this move extends or pauses, XMR has firmly reasserted itself as a market outlier. In a cycle defined by caution and selective conviction, Monero’s strength stands out — and that alone keeps it squarely in focus.