- BlackRock moved roughly $360M in Bitcoin and Ethereum to Coinbase Prime.

- ETF flows flipped from strong inflows to sharp outflows in early January.

- The transfers likely reflect liquidity management rather than outright selling.

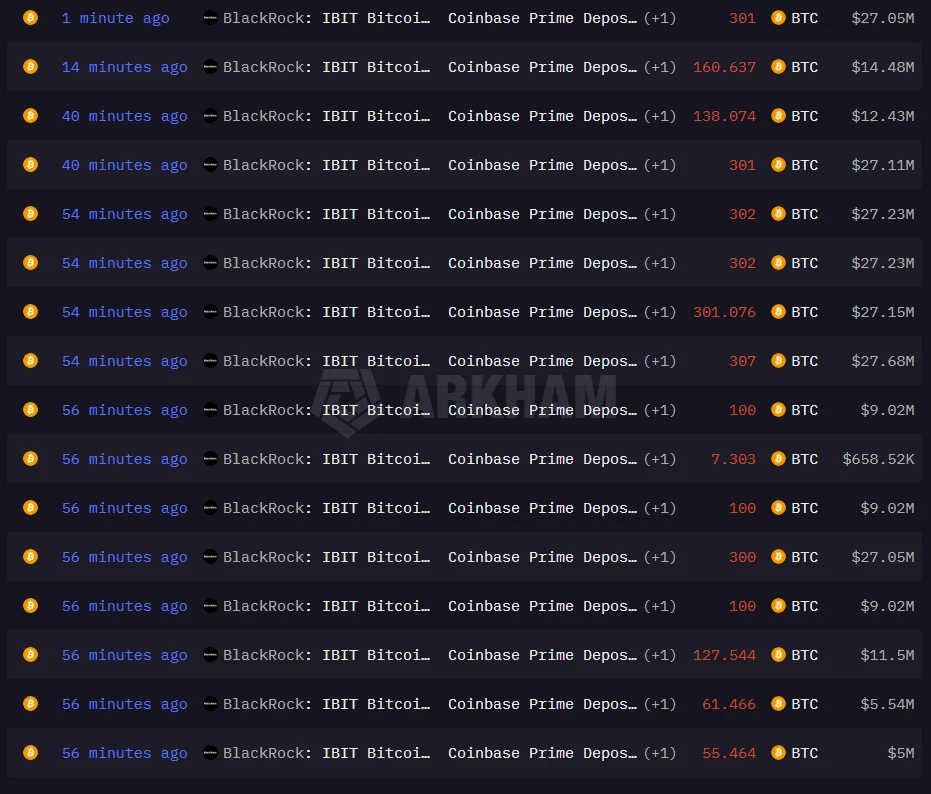

BlackRock shifted a sizable amount of crypto to Coinbase Prime today, moving roughly 3,064 Bitcoin worth about $276 million alongside 26,723 Ethereum valued at more than $83 million, according to Arkham Intelligence. Large transfers like this tend to grab attention quickly, especially when they coincide with changing ETF flow dynamics. The timing matters, not because it guarantees selling, but because it reflects how institutions manage liquidity when sentiment starts to wobble.

ETF Momentum Flipped Fast in Early 2026

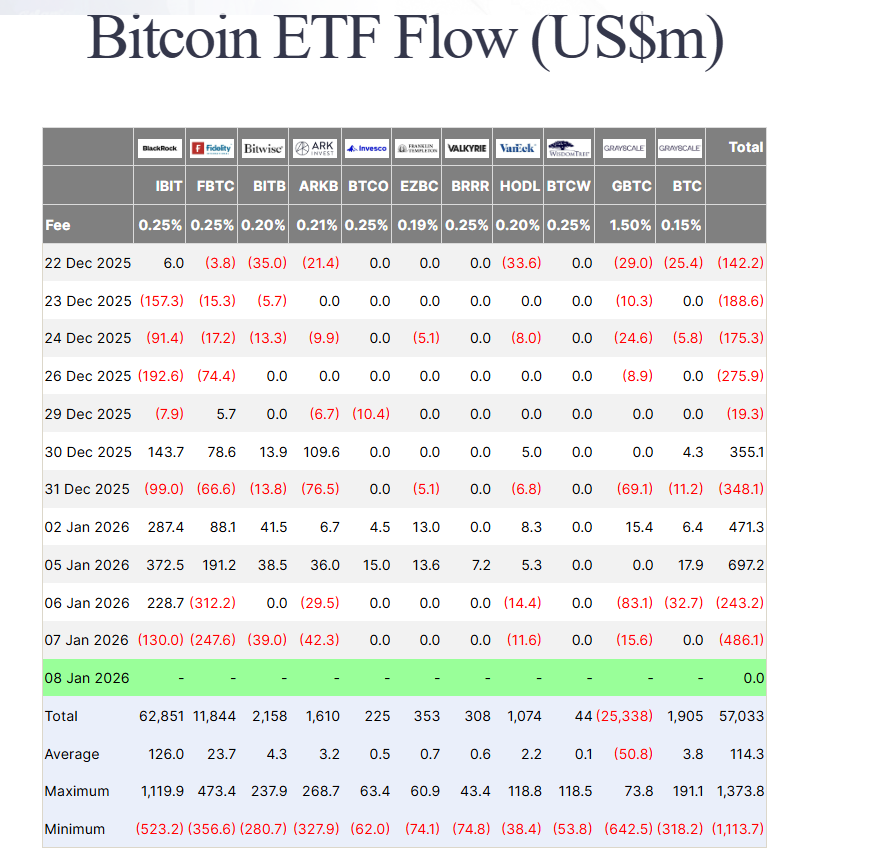

The transfers arrive after a sharp reversal in ETF flows during the first week of the year. Strong inflows on January 2 and January 5 gave way to heavy redemptions on January 6 and January 7, according to data from Farside Investors. That swing pushed the overall picture into net outflow territory, reminding the market how quickly institutional positioning can change once momentum cools.

IBIT Redemptions Lead the Pullback

BlackRock’s own Bitcoin ETF, IBIT, recorded $130 million in redemptions yesterday as U.S. spot Bitcoin ETFs collectively saw $486 million in net outflows. That marked the largest single-day drawdown since late November. Bitcoin funds bore the brunt of the pressure, but the Ethereum transfer suggests portfolio-level rebalancing rather than a single-asset decision.

What These Transfers Likely Represent

Sending assets to Coinbase Prime doesn’t automatically mean liquidation. For institutions, it’s often about flexibility — preparing for redemptions, facilitating settlement, or managing short-term liquidity during volatile flow periods. With ETF sentiment flipping quickly, these moves look more like risk management than a directional bet against crypto.

Why This Doesn’t Break the Bigger Trend

Short-term ETF volatility can create noise, but it doesn’t erase the structural role these products now play. Institutions rebalance constantly, especially during the early weeks of the year. What matters more is whether sustained selling follows or if flows stabilize once the initial repositioning passes. For now, this looks like adjustment, not an abandonment.