- U.S. interest in Greenland is driven by strategy and resources, not crypto fundamentals.

- Bitcoin mining narratives tied to Greenland lack operational and logistical grounding.

- Crypto markets often price uncertainty as narrative bets rather than policy reality.

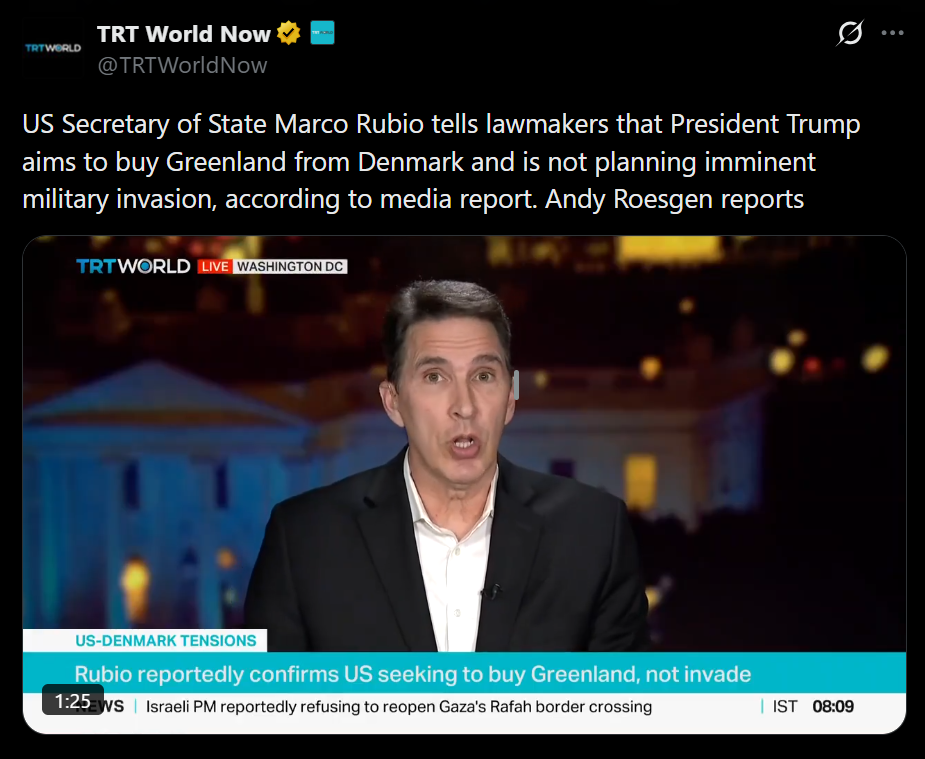

The United States is once again engaging with Danish and Greenlandic officials over deeper cooperation tied to Greenland, and the renewed attention has predictably stirred headlines. Meetings are happening, diplomacy is active, and President Trump, along with allied lawmakers, is openly pushing for expanded American influence in the region. None of that is speculative. What is speculative is the attempt to frame this as a Bitcoin-driven story.

The Real Drivers Have Nothing to Do With Crypto

Greenland matters because of where it sits and what it holds. Its geographic position is strategically valuable for defense, surveillance, and Arctic access. On top of that, the island has known rare earth and mineral resources that matter to high-tech supply chains and national security planning. Those factors alone are enough to explain U.S. interest. Crypto, blockchain, and Bitcoin mining do not meaningfully factor into that calculus, no matter how creatively some headlines try to connect the dots.

Why the Bitcoin Mining Angle Falls Apart

Some crypto commentators have treated Greenland chatter as a potential Bitcoin mining windfall, pointing to cold weather and renewable energy as if that’s the end of the analysis. It isn’t. Greenland has minimal existing mining infrastructure, extreme logistical constraints, and vast ice coverage that complicates development rather than accelerates it. Turning Arctic geopolitics into a mining thesis makes for clickable content, but it’s not grounded in operational reality.

Why Crypto Markets Stretch Every Narrative

This is less about Greenland and more about how modern crypto markets behave. Traders are wired to price narratives, even when causal links are weak. On-chain prediction markets are already offering odds on everything from U.S. acquisition scenarios to military outcomes. That activity reflects speculation under uncertainty, not informed policy forecasts. When geopolitical risk rises, people look for instruments that let them express views quickly and cheaply. Bitcoin often gets pulled into that orbit by default.

Strategy, Resources, and Alliances Come First

Strip away the noise and the picture becomes clearer. U.S. interest in Greenland is about strategic geography, long-term resource access, and alliance positioning in an increasingly contested Arctic region. The Bitcoin angle is largely an overlay imposed by markets hungry for a familiar narrative. That doesn’t make it malicious, but it does make it misleading.

Why This Matters

Not every geopolitical event is a crypto catalyst. Markets can price stories faster than they price truth, and the crypto crowd is especially prone to stretching relevance. In this case, Greenland is a serious geopolitical topic with real-world consequences, while Bitcoin’s role is mostly peripheral. Separating signal from noise matters more than ever when headlines travel faster than facts.