- Ethereum shows growing on-chain conviction as staking demand rises and liquid supply tightens.

- Price continues to build a base above key support despite remaining below major resistance levels.

- Institutional accumulation and improving structure reopen long-term upside scenarios toward $5,000.

Ethereum is starting to feel interesting again. After months of drifting sideways, a mix of on-chain signals, technical structure, and institutional behavior is lining up in a way that’s hard to ignore. Traders who tuned out during consolidation are slowly coming back, not because price is exploding, but because the groundwork looks different now.

That shift has reopened long-term conversations, including whether ETH could eventually revisit the $5,000 area. It’s not a call for tomorrow, but the discussion is back on the table as network activity improves and price holds steady around key demand zones.

Staking Data Points to Conviction, Not Fear

One of the quieter but more important signals is happening inside Ethereum’s staking system. Validator queues on both sides are busy. More than 772,000 ETH is currently waiting to enter staking, with activation delays stretching beyond 13 days. At the same time, exit queues hold roughly 288,000 ETH.

That balance matters. Heavy exits often show stress. Heavy entries show commitment. Seeing both suggests normal churn rather than panic. In other words, long-term holders appear to be adjusting positions, not rushing for the door.

Ethereum’s validator count continues to climb as well. Nearly one million validators now secure around 35.5 million ETH, representing over 29% of the total supply. Staking yields sit near 2.85%, modest, but steady. That yield, combined with long lockups, keeps a meaningful chunk of ETH off the open market during uncertain conditions.

Price Holds the Base While Momentum Cools

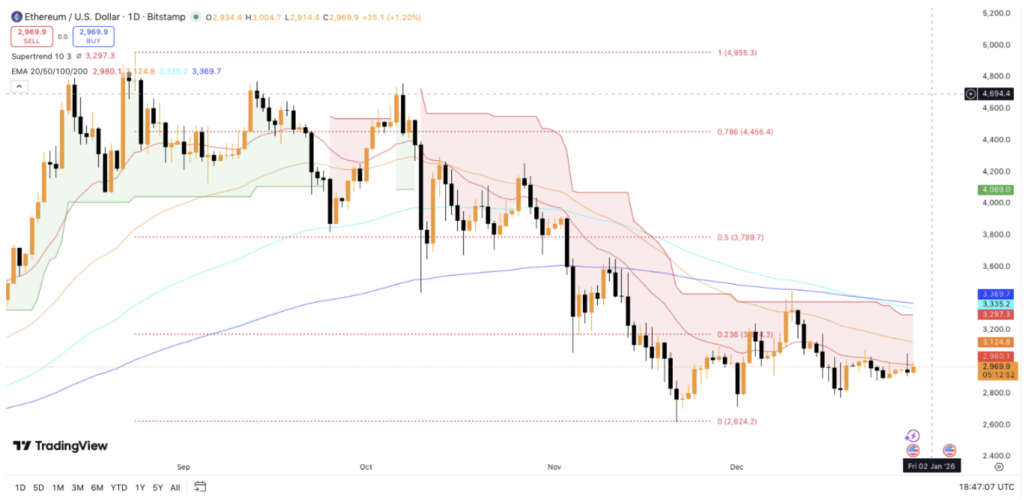

From a price perspective, Ethereum is trading near $2,970 after small daily and weekly gains. The broader trend is still corrective, and there’s no pretending otherwise. ETH remains below its major moving averages, with the 200-day EMA near $3,369 acting as heavy overhead resistance. The Supertrend indicator also stays bearish, reinforcing caution in the short term.

Still, something has changed. Downside momentum is slowing. Price continues to defend the $2,950 to $3,000 zone and remains comfortably above the prior cycle low near $2,624. That behavior leans more toward base-building than distribution. Traders are watching resistance levels now, not bracing for fresh lows.

Technically, the roadmap is fairly clear. A daily close above $3,125 would hint at early trend improvement and open room toward $3,350 to $3,400, roughly 13% upside from current levels. Reclaiming the 200-day EMA would be more meaningful, potentially unlocking a move toward $3,790.

Beyond that, attention shifts to the $4,450 to $4,800 zone. A sustained break there would bring long-term targets back into focus, including the $4,955 to $5,000 region that once felt distant, and lately, feels less so.

Analysts and Institutions Lean Into the Structure

Several analysts have highlighted Ethereum’s current positioning. Titan of Crypto has pointed to a deep retracement from ETH’s prior impulsive move, noting $2,750 as a key level during consolidation. Historically, similar retracement zones have preceded strong recoveries in past cycles.

Bitcoinsensus, meanwhile, sees a Wyckoff Accumulation structure forming on higher timeframes. That setup often signals late-stage consolidation, where strength quietly builds before expanding. Phase D characteristics, when confirmed by volume, tend to show up before decisive reversals.

Institutional behavior adds weight to the story. Tom Lee’s Bitmine has aggressively increased its Ethereum exposure, adding more than 44,000 ETH in a recent purchase worth roughly $130 million. That brings its total holdings to around 4.11 million ETH.

Bitmine has already staked over 408,000 ETH and plans to expand validator operations through the MAVAN network starting in 2026. The approach is clear, accumulate, stake, and optimize yield over time. That kind of strategy doesn’t chase short-term price moves. It aligns with patience, and right now, Ethereum’s on-chain data seems to reward exactly that.