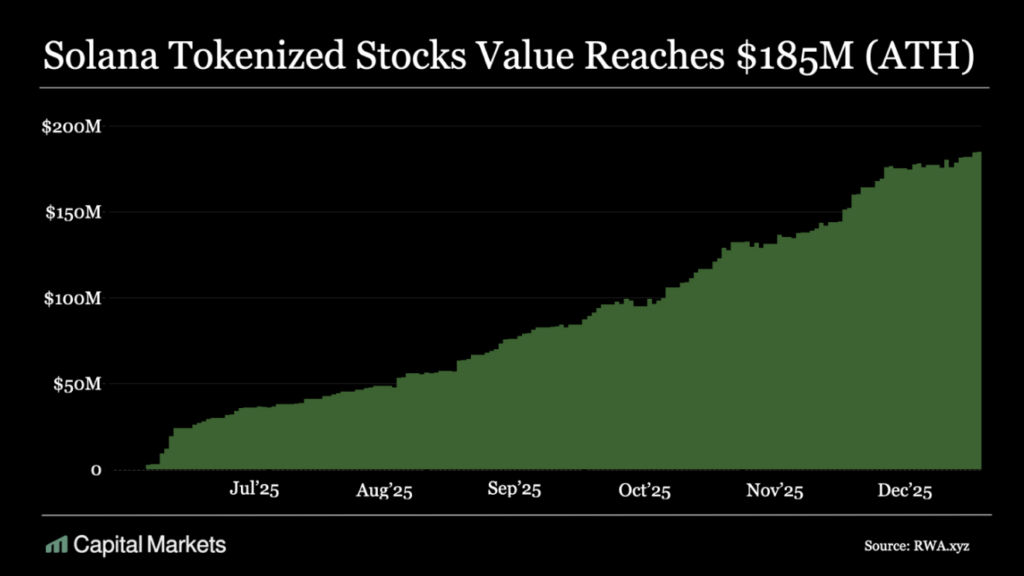

- Solana is attracting near-term adoption thanks to low fees, fast upgrades, and growing activity in tokenized equities, now nearing $185 million in value.

- Ethereum still dominates in total value locked, stablecoin usage, and financial depth, positioning it for long-term infrastructure relevance rather than rapid iteration.

- Hoskinson argues the competition is about timing: Solana captures speed-driven growth now, while Ethereum focuses on research-heavy systems designed to matter later.

Charles Hoskinson thinks the Solana vs. Ethereum debate depends a lot on when you’re looking. In the short run, Solana has the edge. It moves fast, ships upgrades quickly, and doesn’t get bogged down in long coordination cycles. Ethereum, on the other hand, seems content taking the longer road, building carefully and betting that depth will matter more than speed over time.

That contrast is starting to show up in how real projects choose their homes.

Why Solana Is Winning Attention Right Now

Solana’s appeal is pretty straightforward. The network handles a huge number of transactions, fees stay low, and teams can move quickly without waiting years for protocol changes. Hoskinson noted that this flexibility has made Solana especially attractive for experiments in tokenized finance.

Recently, tokenized equities on Solana crossed roughly $185 million in total value. Platforms like xStocksFi, Superstate, and Remora Markets are already live and pushing activity on-chain. For traders and institutions that care about execution speed and cost efficiency, that matters. A lot.

It’s not perfect, but it’s fast. And right now, speed is winning attention.

The Gap Beneath the Surface Is Still Massive

Still, the numbers tell a more complicated story. Solana’s total value locked and stablecoin usage sit at roughly 10% of Ethereum’s levels. That’s not a small difference, it’s a structural one.

Ethereum supports much deeper financial activity, from lending and staking to large-scale stablecoin flows. Those layers create stickiness. They make it easier for complex products to exist and harder for capital to leave once it’s settled.

So while Solana is growing, it hasn’t yet matched Ethereum’s financial gravity.

Ethereum Is Building for the Long Game

Ethereum’s approach is almost the opposite. Progress is slower, coordination is heavier, and research takes priority. A lot of focus is going into zero-knowledge proofs, advanced scaling, and moving validation toward cryptographic proof systems.

The idea is simple, even if the execution isn’t. Ethereum wants to become a verification and settlement layer that many other networks rely on, not just a fast execution chain. That takes time. And patience.

Hoskinson framed it as strategy versus speed. Solana can react quickly and capture early use. Ethereum is trying to build something that lasts longer, even if it means missing some short-term wins.

Speed Now, Structure Later

This difference shows up everywhere. Solana’s leadership model allows faster decisions and quicker feature rollouts. Ethereum’s governance is slower, but it’s designed to reduce risk and prioritize correctness.

Neither approach is clearly right or wrong. They’re just optimized for different outcomes. One favors rapid adoption. The other favors long-term reliability and deep infrastructure.

Markets will decide which matters more.

What This Means for Builders and Investors

For teams chasing growth today, Solana often looks like the easier choice. For those building systems that need deep liquidity, composability, and long-term guarantees, Ethereum still holds the advantage.

The $185 million tokenized stock milestone on Solana is meaningful, but it’s tiny compared to traditional markets or Ethereum’s on-chain economy. Still, it shows momentum.

In the end, both networks are being tested by real usage now, not theory. And whichever path wins won’t be decided by narratives, but by where users and institutions choose to operate over the next few years.