- XRP remains below key moving averages, keeping the broader trend tilted bearish

- Weak volume and declining OBV suggest buyers are still cautious near $1.85

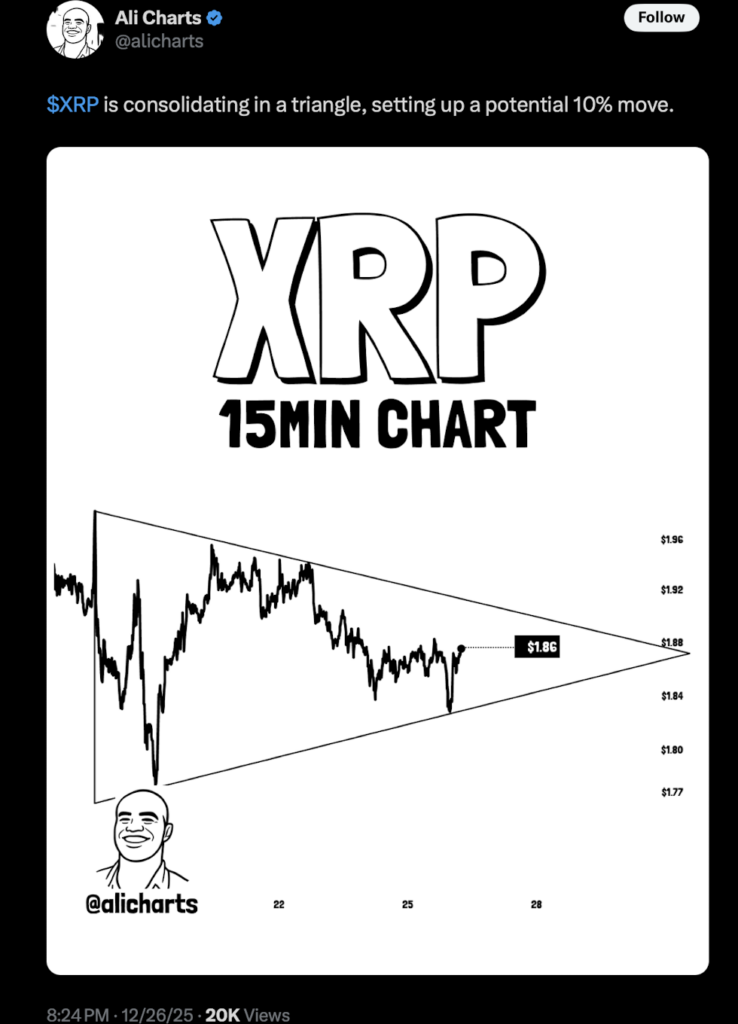

- A tightening consolidation pattern hints that a sharp move could be approaching

The crypto market is drifting into a strange end-of-year mood. Volatility hasn’t vanished, but conviction feels thinner, and traders are clearly weighing macro uncertainty against fading momentum. In the middle of all that, XRP finds itself parked at a technically important level.

At the time of writing, XRP trades around $1.84, down just over 1% on the day. That move may look minor on the surface, but structurally, the asset is sitting at a spot that often precedes bigger decisions. Short-term noise is building, while longer-term charts are still fragile, not broken, just fragile.

XRP Remains Trapped in a Broader Bearish Structure

On the daily chart, XRP is still leaning bearish. Price remains below both the 50-day and 200-day moving averages, which continue to cap upside attempts and act as overhead resistance. The MACD stays below the zero line, with no bullish crossover in sight yet, a sign that downside momentum hasn’t fully burned out.

This doesn’t rule out a bounce, but it does suggest that any upside move, for now, would likely be corrective rather than the start of a clean trend reversal. Until XRP reclaims higher levels with strength, sellers still have the structural advantage.

Volume and OBV Show Buyers Are Still Hesitant

Volume behavior tells a similar story. On-Balance Volume continues to slope lower, showing that distribution is still outweighing accumulation near the $1.85 area. In simple terms, buyers are present, but not aggressive.

Sell-offs have consistently printed with heavier volume than recovery attempts, which helps explain why upside moves fade quickly. As long as this imbalance persists, XRP may struggle to build sustained momentum, even if short-term relief rallies appear.

Analysts See a Compression That Could Lead to a Sharp Move

Adding another layer to the setup, crypto analyst Ali Charts recently noted that XRP has formed a triangular consolidation pattern. Structures like this rarely resolve quietly. Instead, they often precede sharp moves, sometimes in either direction, around the 10% range.

Shorter timeframes already show tightening price action, hinting that pressure is building beneath the surface. However, higher timeframe confirmation will ultimately decide whether that release favors bulls or bears.

Why the $1.85 Level Matters More Than It Looks

Right now, the $1.85 region is doing a lot of heavy lifting. Holding above it keeps XRP in a consolidation phase. Losing it decisively, especially with volume, could accelerate downside momentum and open the door to deeper retracements.

On the flip side, reclaiming $2.05 with strong participation would shift the narrative. That move would signal improving confidence and could challenge the broader bearish structure. Until one of those scenarios plays out, patience remains the smartest posture.

XRP isn’t broken, but it isn’t convincing yet either. The next move may not take long, and when it comes, it likely won’t be subtle.