- Bitcoin continues to trade in a tight $86,500–$90,000 range, with analysts suggesting a prolonged consolidation could lead to a decisive breakout.

- A brief Binance flash crash was caused by thin liquidity in a niche trading pair, not by systemic market stress or liquidations.

- Long-term projections remain bullish, with some forecasts pointing to $110K–$160K in 2026 if adoption and market structure continue to improve.

Bitcoin continues to drift sideways just under the $90,000 mark, frustrating both bulls and bears. Price has been stuck in a tight range for weeks now, and traders are clearly waiting for something decisive to happen.

Despite short-lived volatility and the occasional scare, the broader structure hasn’t really changed. Support is holding, resistance is still overhead, and conviction feels… thin.

Why This Tight Range Could Matter More Than It Looks

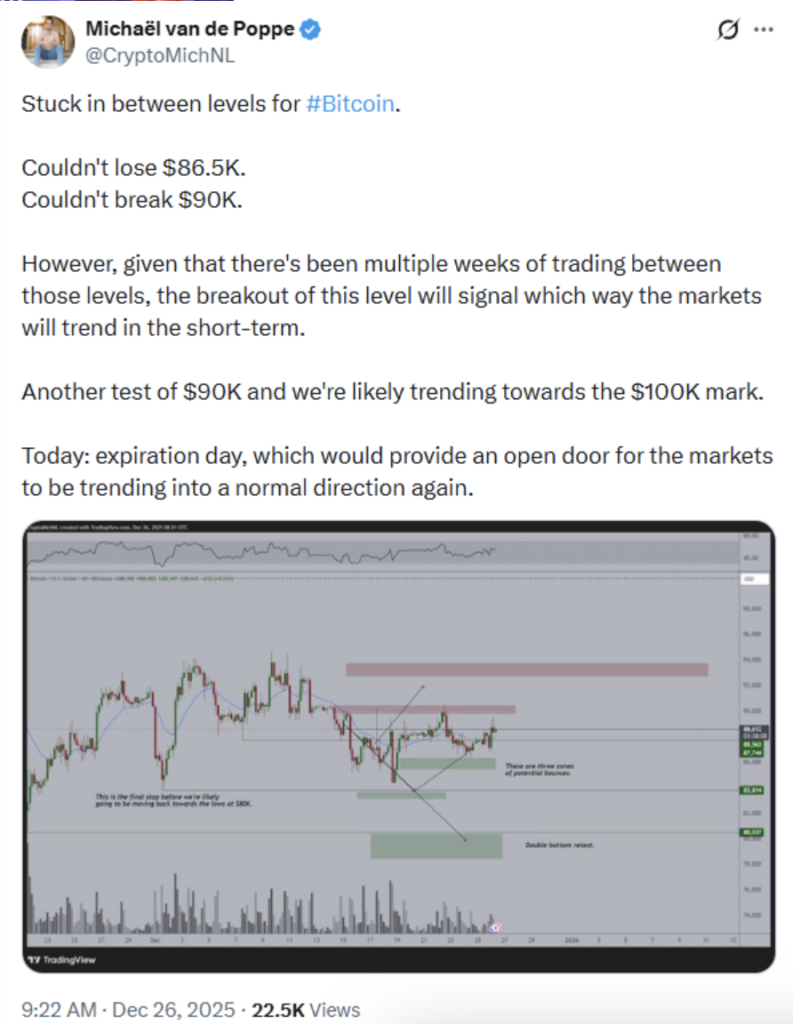

According to analyst Michaël van de Poppe, Bitcoin has repeatedly defended the $86,500 area while failing to push cleanly above $90,000. This range has survived multiple weekly closes, which is notable.

Long consolidations like this often don’t last forever. The longer price coils, the more aggressive the eventual move tends to be. Van de Poppe notes that if Bitcoin finally clears $90,000 with strong volume, the path toward $100,000 becomes much more realistic.

That said, nothing is guaranteed. Another rejection could simply extend the sideways grind. For now, the market remains balanced, almost stubbornly so.

At the time of writing, Bitcoin trades near $88,556, hovering close to resistance but still firmly inside the range.

Options Expiry and Short-Term Pressure Relief

One subtle factor traders are watching is derivatives expiration. When large option contracts roll off, short-term price pressure often fades.

This can allow Bitcoin to move more organically, without forced hedging or pinning effects. Historically, these periods sometimes coincide with momentum shifts, though not always. Still, it’s something desks tend to keep an eye on.

The Binance Flash Crash Wasn’t What It Looked Like

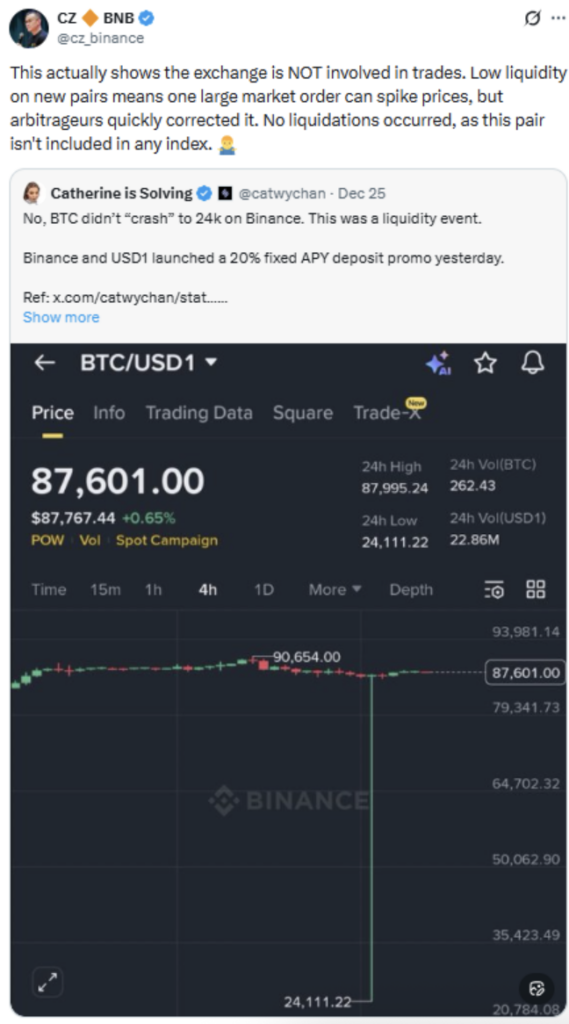

A sudden drop on Binance, where Bitcoin briefly traded near $24,000, caused panic across social media. At first glance, it looked like a major crash. It wasn’t.

The move was tied to a liquidity issue, not broader market stress. The trigger was a 20% fixed-yield promotion for USD1 deposits, which caused users to swap USDT into USD1 at scale. That demand pushed USD1 into a premium, an unusual situation for a stablecoin.

Some traders borrowed USD1 using Bitcoin-linked collateral and slowly sold into demand. One trader, however, placed a large market sell on the BTC/USD1 pair, a market with very thin liquidity.

That single order wiped out the order book. Algorithms immediately stepped in, bought the discounted Bitcoin, and price snapped back almost instantly.

Binance founder Changpeng Zhao later confirmed that no liquidations occurred and that the pair involved does not feed into major price indexes. In short, it looked dramatic, but it wasn’t systemic.

Long-Term Bitcoin Price Expectations Stretch Higher

Looking beyond the noise, long-term projections remain wide-ranging. One forecast attributed to ChatGPT places Bitcoin somewhere between $110,000 and $160,000 in 2026, with an average estimate around $135,000.

That outlook assumes Bitcoin holds above prior cycle highs and avoids major macro shocks. In that scenario, growth would be steady, not explosive.

Other commentators are more aggressive, floating targets as high as $250,000 by 2026. The logic is familiar: adoption builds quietly, infrastructure comes first, and price reacts later.

Examples like Visa enabling USDC settlements on Solana for U.S. banks are often cited as signals that the plumbing is being installed, even if markets haven’t fully priced it yet.

A Market Still Waiting for Its Signal

For now, Bitcoin remains in limbo. Support and resistance are clear, volatility is compressed, and sentiment feels cautious rather than euphoric.

Whether the next move is toward $100,000 or another stretch of consolidation will depend on volume, liquidity, and real adoption momentum. Until then, Bitcoin’s price action reflects a market that knows something big is coming, just not when.