- Tron’s daily perpetual futures volume exceeded $1 billion for two straight days

- Weekly perps volume jumped 176% to $5.7 billion, defying broader market slowdown

- TRX price remains subdued, suggesting positioning may be ahead of a larger move

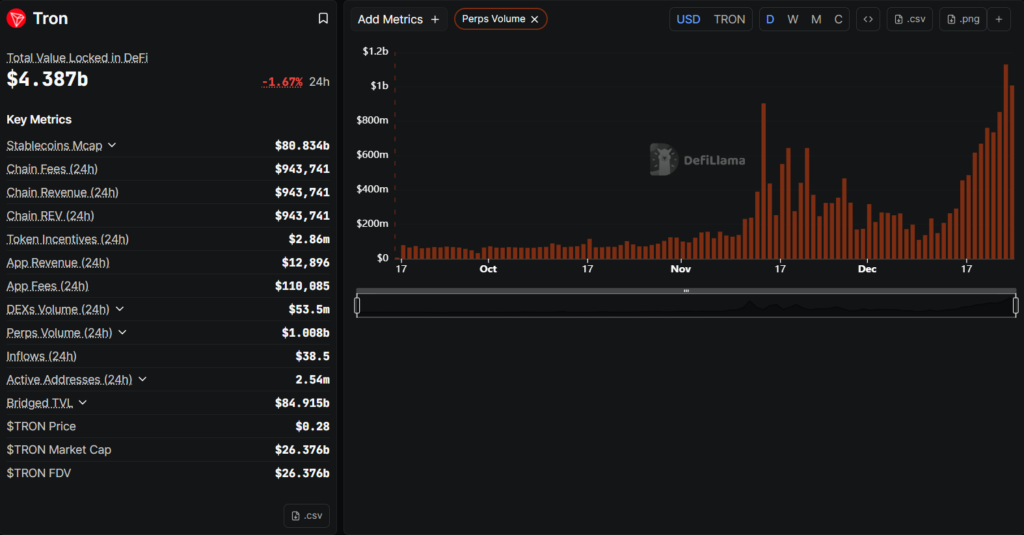

Tron is quietly seeing a surge in derivatives activity, even as the broader crypto market struggles to find direction. According to DefiLlama data, Tron’s daily perpetual futures trading volume crossed $1 billion for two consecutive days, a rare move at a time when on-chain trading is slowing across most blockchains. The jump signals growing interest in Tron-based DeFi and derivatives platforms despite ongoing market uncertainty.

Trading Activity on Tron Nearly Triples Week Over Week

Over the past seven days, total perpetual futures volume on Tron reached $5.7 billion, marking a 176% increase compared to the previous week. This surge stands out because it comes while many other networks are seeing declining derivatives activity as traders pull back risk. The data suggests that liquidity and speculative interest are increasingly concentrating on Tron’s ecosystem.

This rise in activity may point to improving infrastructure, better capital efficiency, or traders rotating into networks they view as undervalued relative to larger chains. While the broader market remains cautious, Tron appears to be capturing attention from more active traders.

Outperformance Comes as Broader Market Stalls

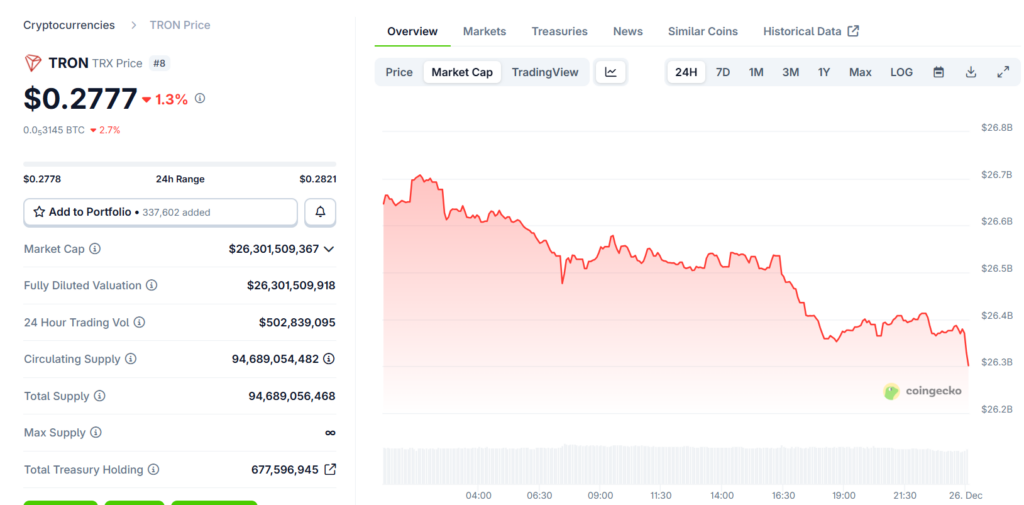

The increase in Tron’s trading volume comes as Bitcoin remains largely range-bound near the $87,000 level, limiting momentum across most crypto assets. Despite the spike in derivatives activity, TRON’s native token TRX has not yet reflected the surge in price, trading around $0.28 and down nearly 2% over the past 24 hours, according to CoinGecko.

This divergence between network activity and token price suggests traders may be positioning ahead of a potential move, or using Tron-based platforms primarily for short-term trading rather than spot accumulation. If elevated volume persists, it could eventually translate into stronger price action.

Why Tron’s Activity Matters Right Now

In periods of market weakness, rising derivatives volume on a single network often signals shifting trader behavior rather than broad speculation. Tron’s ability to attract perps volume while others slow down may indicate growing confidence in its DeFi stack or lower trading friction compared to competing chains.

Whether this momentum holds will depend on overall market conditions and whether Tron can sustain user activity beyond short-term positioning.