- XRP is facing mounting pressure as institutions reportedly extract liquidity from retail holders

- Repeated failed price predictions are worsening investor confusion and mistrust

- Regulatory clarity in 2026 could reshape XRP’s market structure and restore balance

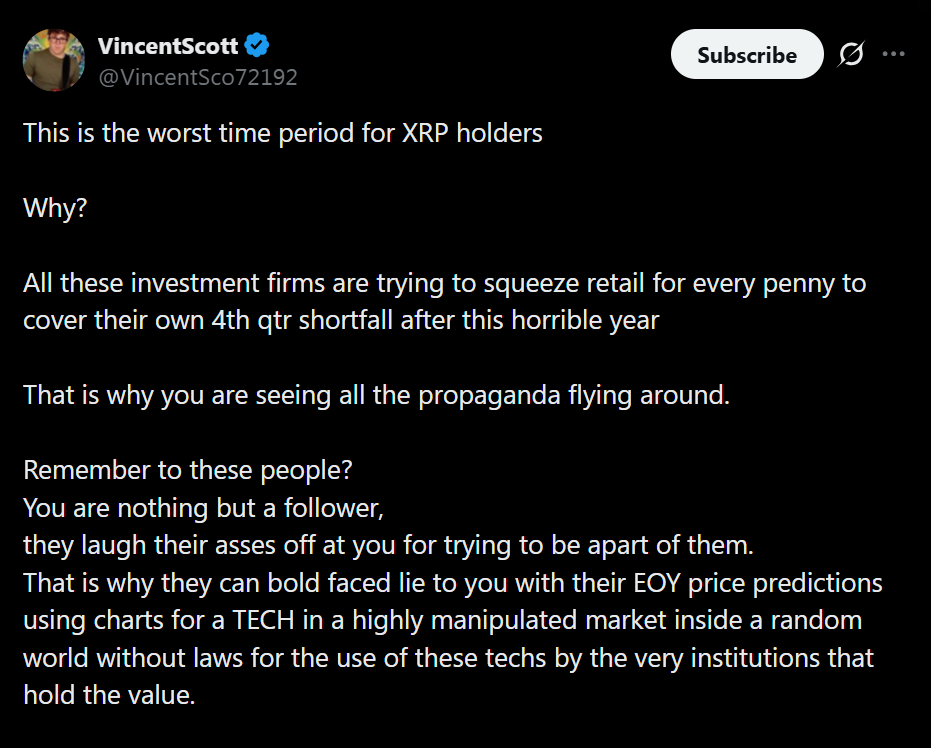

XRP is once again under heavy scrutiny as concerns grow that retail investors are being squeezed during one of the token’s most difficult phases in years. Analyst Vincent Scott argues that this is not a typical market cycle but a liquidity extraction phase, where large investment firms are pressuring retail holders to offset their own fourth-quarter losses. As XRP trades below $2 and sentiment weakens, many are questioning whether this is a buying opportunity or a structural trap.

Institutional Pressure Is Shaping XRP’s Price Action

According to Scott, the current XRP downturn is being driven less by fundamentals and more by institutional behavior. He claims major players are deliberately pulling liquidity from retail participants to repair balance sheets after a poor year. This dynamic, he argues, explains the flood of aggressive narratives and emotional messaging surrounding XRP, which tends to peak during periods of stress rather than organic growth.

This environment makes it harder for retail investors to navigate price volatility, as price discovery may be distorted by strategic positioning rather than genuine demand. For many holders, this has turned the current phase into what Scott describes as the worst period for XRP participation.

Price Predictions Are Losing Credibility

Scott is also critical of the broader XRP price prediction landscape. He points out that many bullish forecasts rely heavily on chart extrapolation without accountability when targets fail to materialize. When predictions break down, reassurance narratives often replace analysis, allowing the same cycle to repeat.

This pattern keeps retail investors locked into hope-driven decision-making rather than informed risk assessment. As a result, determining whether XRP is a good buy becomes increasingly difficult, especially during periods dominated by fear, uncertainty, and shifting narratives.

Why 2026 Regulation Could Change Everything

Despite the bleak near-term outlook, Scott believes regulation could eventually reset the playing field. He highlights upcoming U.S. legislative efforts, including the CLARITY framework expected to advance in 2026, as a potential turning point. If enforcement becomes consistent and transparent across institutions, the current imbalance between retail and large players could ease.

Until then, Scott expects pressure on retail holders to continue. Whether XRP stabilizes or enters another accumulation phase may depend less on price levels and more on how regulatory standards evolve over the next year.