- Most Ethereum stablecoin transactions still come from individuals, but businesses now account for the majority of total value moved on-chain.

- Business-to-business and person-to-business payments are growing rapidly, with transaction sizes increasing as institutions move larger sums.

- The trend suggests Ethereum is maturing into a core settlement layer for real-world payments, not just crypto speculation.

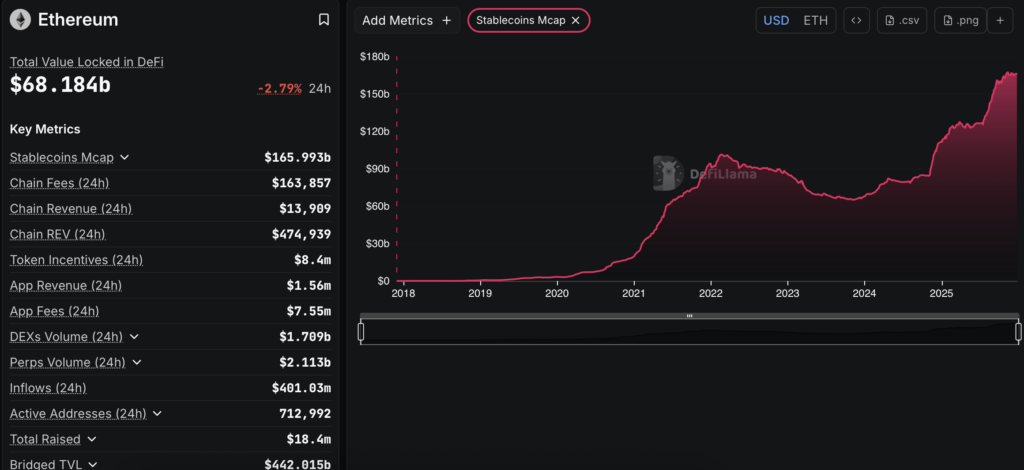

Ethereum’s stablecoin activity is quietly shifting gears, and the numbers tell an interesting story. New data shows that while individuals still make up most transactions by count, businesses and merchants are now moving the majority of value on-chain. In practice, that means Ethereum is starting to look less like a peer-to-peer transfer network and more like a behind-the-scenes settlement layer for real payments.

Most stablecoin transfers still happen between people, at least on the surface. But when you zoom in on where the money actually goes, it’s business-linked wallets doing the heavy lifting. That’s a subtle change, but an important one, especially for anyone watching Ethereum’s long-term role beyond trading and speculation.

Institutions Move The Money, Users Drive The Activity

The shift was outlined in a recent Artemis research report that analyzed stablecoin transactions on Ethereum from August 2024 to August 2025. Since Ethereum hosts close to half of the global stablecoin supply, the dataset offers a pretty solid snapshot of what’s happening on-chain. Artemis separated wallets into personal and business categories to see who was really using stablecoins, and how.

What stood out was the imbalance. Person-to-person transfers made up about 67% of all transactions, yet accounted for just 24% of the total dollar value. Business-related payments, on the other hand, were fewer in number but dominated volume. In short, individuals send often, businesses send big.

That trend picked up pace over the past year. Business-to-business stablecoin volume jumped 156%, and the average transaction size climbed by roughly 45%. That suggests companies aren’t necessarily making more payments, they’re just moving much larger sums. As James, Head of Ecosystem at the Ethereum Foundation, put it online, institutions aren’t increasing frequency, they’re increasing size.

Even more striking was the growth in person-to-business payments. That category saw a 167% increase in volume, hinting that consumers are increasingly paying merchants directly with stablecoins. It’s a small signal, but one that points toward everyday usage starting to creep in.

What This Shift Says About Ethereum’s Direction

All of this is happening while ETH itself trades just below the $3,000 mark. The token slipped about 2.5% in the past 24 hours, is slightly up on the week, and still sits well below its August peak near $5,000. Price action, for now, feels hesitant.

But analysts argue that stablecoin usage may end up mattering more than short-term price moves. If Ethereum continues to anchor real payment flows, that utility could become one of its strongest long-term demand drivers, even during quiet market phases.

Artemis’ broader Stablecoin Wrapped 2025 report adds more context. USDT has added more supply this year than the next five issuers combined, and on-chain business-to-business payments are now running at an annual pace close to $77 billion. That kind of scale suggests companies are increasingly comfortable using blockchain rails for actual settlement, not just experiments.

There are still caveats. Around 84% of stablecoin volume flows through the top 1,000 wallets, which raises fair questions about concentration and decentralization. Big players still control most of the traffic, even as adoption widens.

Still, taken together, the data points to a maturing stablecoin economy on Ethereum. The network is slowly evolving from a place where individuals send small amounts to one another, into financial infrastructure that businesses rely on. If that trend holds, Ethereum’s future may be shaped less by hype cycles and more by its role as the plumbing for a digital, on-chain economy that actually gets used.