- American Bitcoin director Richard Busch bought 175,000 ABTC shares after a sharp decline.

- The stock is down about 68% over the past month due to share unlock pressure.

- American Bitcoin holds over 5,000 BTC, ranking among the top public Bitcoin treasuries.

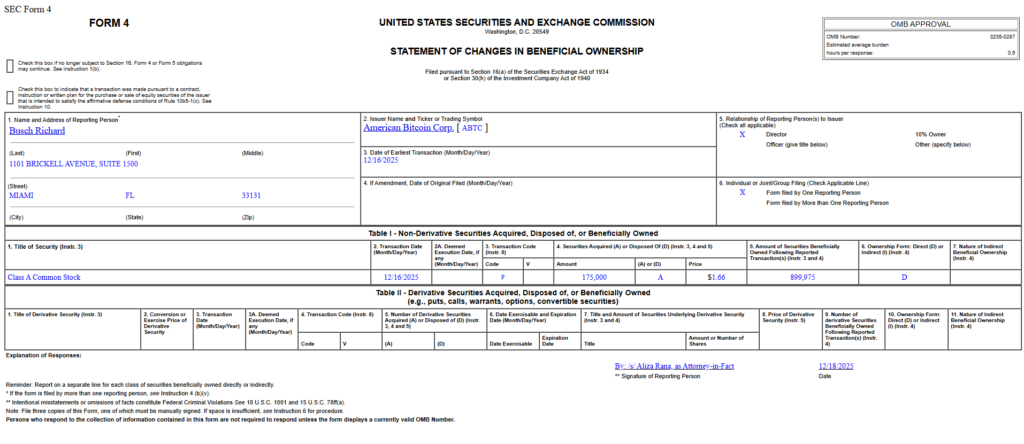

Richard Busch, a board member and director at American Bitcoin, has stepped in with a notable insider purchase after the company’s stock endured a steep selloff. According to a recent SEC filing, Busch acquired 175,000 ABTC shares for roughly $290,500, signaling confidence at a time when sentiment around the stock has been under pressure. The move comes as American Bitcoin continues to position itself as a major corporate holder of BTC.

Insider Buy Lifts Sentiment

Following the purchase, Busch now holds close to 900,000 ABTC shares, valued at approximately $1.4 million based on Thursday’s closing price. The market responded quickly, with shares rising around 5% in premarket trading on Friday, according to Yahoo Finance. Insider buying often draws attention during periods of weakness, as it can suggest conviction from those closest to the business.

Stock Pressured by Share Unlocks

Despite the bounce, ABTC has struggled in recent weeks. The stock has dropped roughly 68% over the past month, largely due to the release of pre-merger private placement shares into the public market. That influx added selling pressure, weighing heavily on price action and testing investor patience.

A Growing Bitcoin Treasury

Beyond short-term volatility, American Bitcoin continues to expand its balance sheet exposure to BTC. The company has now entered the top 20 list of publicly traded firms holding Bitcoin treasuries, reporting reserves of 5,098 BTC worth around $447 million. Those holdings have been built through a mix of mining operations and strategic purchases, reinforcing the firm’s identity as a Bitcoin-first vehicle.

What It Could Signal Next

Busch’s purchase doesn’t erase the recent drawdown, but it does add a layer of confidence during a difficult stretch. With insider accumulation, a growing Bitcoin treasury, and shares already deeply discounted, investors will be watching closely to see whether sentiment can stabilize or if further volatility lies ahead.