- XRP is down sharply from its 2024 peak, with growing concern it could revisit $1.

- Whale selling and weak demand near $2 are adding pressure.

- ETF inflows remain strong, but macro uncertainty continues to cap upside.

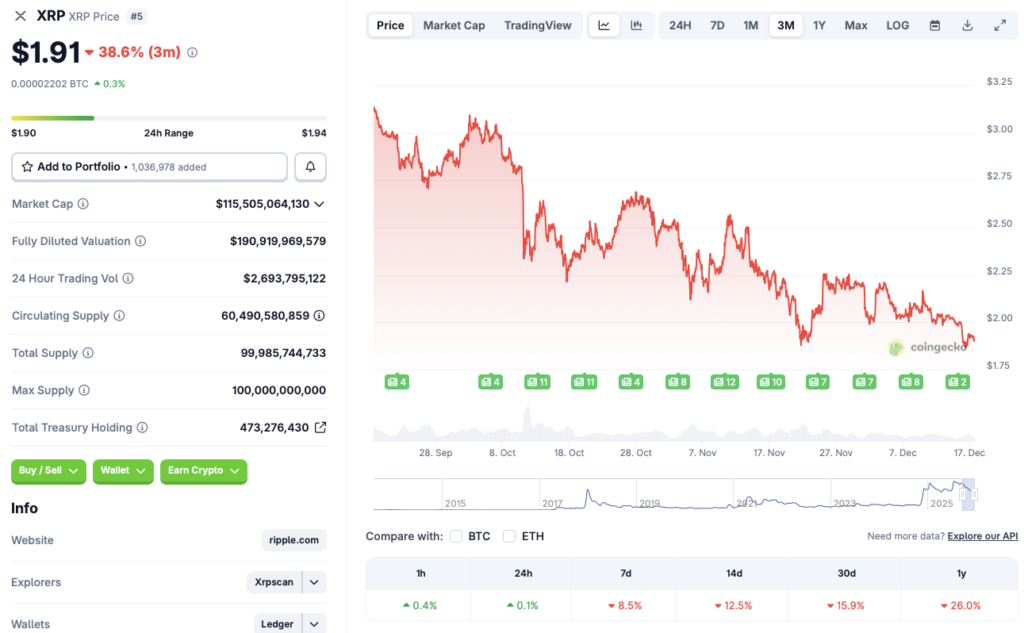

Ripple’s XRP entered the year with strong momentum, but that early optimism has faded fast. The token broke above $3 in January for the first time in seven years and later pushed to an all-time high of $3.65 in July. Since then, the trend has steadily reversed. CoinGecko data shows XRP is down 8.5% over the last week, 12.5% over the past 14 days, nearly 16% on the month, and about 26% since December 2024. With selling pressure building, the risk of XRP revisiting the $1 level is becoming harder to ignore.

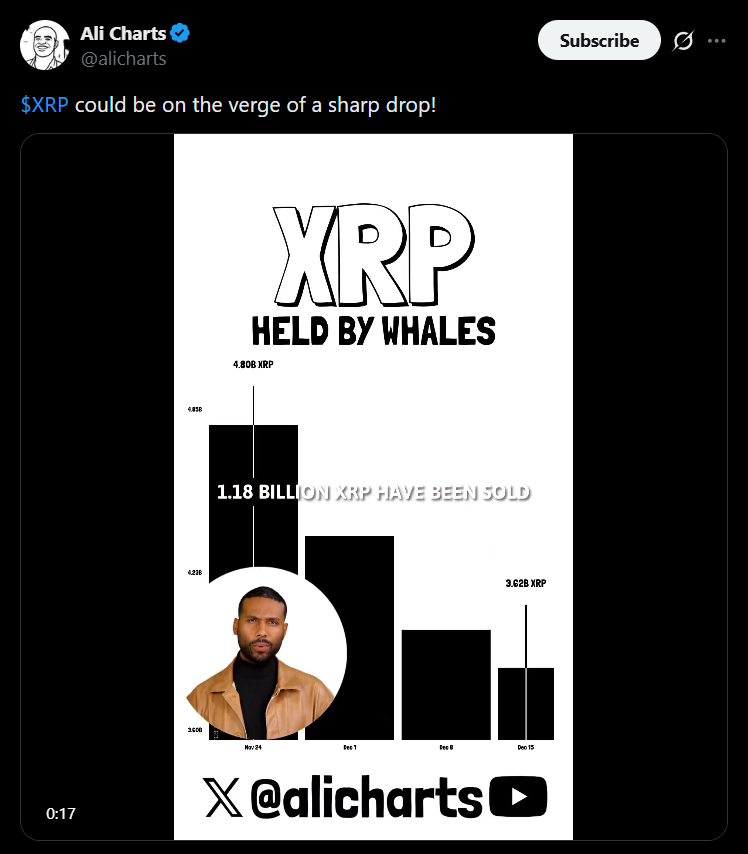

Whale Selling Adds Downward Pressure

One of the biggest concerns right now is activity from large holders. According to crypto analyst Ali Martinez, whale wallets have unloaded roughly 1.18 billion XRP over the last four weeks. That scale of distribution has significantly increased downside risk, especially in a market already leaning bearish. When large holders sell into weakness, it often accelerates declines rather than stabilizing price action.

Weak Demand Around Key Levels

Another issue weighing on XRP is the apparent lack of strong demand near the $2 range. Without a clear support zone, selling pressure can build quickly as traders look for lower levels to step in. This absence of meaningful buy-side interest makes it easier for price to slide, even without a major negative catalyst.

ETF Inflows Haven’t Moved the Needle

Interestingly, XRP ETFs have continued to attract capital despite the falling price. Total inflows recently surpassed the $1 billion mark, signaling ongoing institutional interest. Still, those inflows haven’t translated into upward price momentum. As with other crypto ETFs, share creation doesn’t always result in immediate spot buying, which helps explain the disconnect between flows and price.

Macro Conditions Could Decide What Comes Next

XRP’s near-term outlook likely hinges on broader market conditions. Persistent macro uncertainty and a risk-off mindset have driven heavy liquidations across crypto. There are some early signs of potential relief — UK inflation dropped to 3.2% in November, its lowest level in eight months, raising expectations of rate cuts. If global conditions ease and risk appetite returns, XRP and other digital assets could see some breathing room. Until then, downside pressure remains the dominant force.