- BlackRock transferred $140 million worth of Ethereum to Coinbase Prime amid a market downturn.

- Ethereum ETFs saw heavy outflows, with ETHA accounting for most of the selling pressure.

- BlackRock now trails BitMine Immersion in total ETH holdings after recent accumulation.

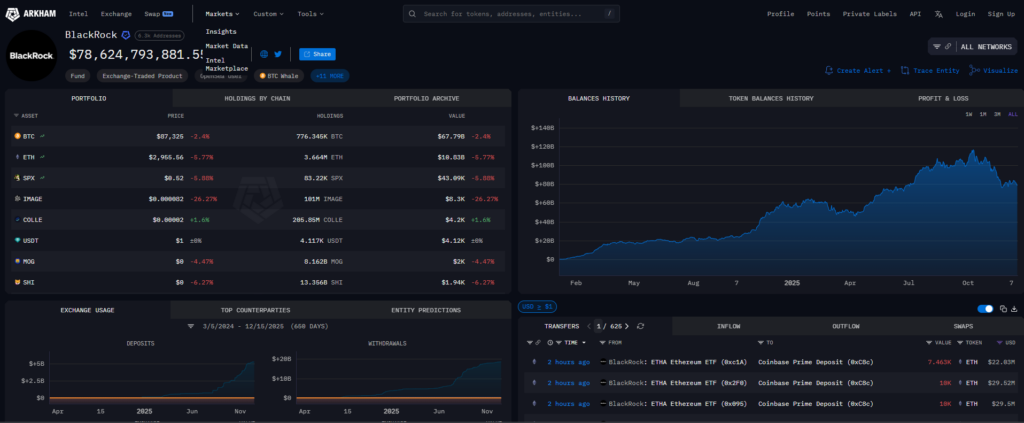

BlackRock transferred roughly 47,500 Ethereum, valued at around $140 million, to Coinbase Prime earlier today, according to data from Arkham Intelligence. The move landed during a rough stretch for the market, with Ethereum trading near $2,954 at press time and posting a decline of more than 6% in the last 24 hours. ETH slipped below the $3,000 level on Monday as broader selling pressure pushed Bitcoin under $86,000, dragging sentiment lower across major assets.

ETF Outflows Add Pressure to Ethereum

The timing of BlackRock’s transfer lines up with increasingly unstable flows in its Ethereum ETF, ETHA. Data from Farside Investors shows the fund recorded a $139 million net outflow yesterday, making up the bulk of the $225 million pulled from U.S.-listed Ethereum ETFs overall. These outflows reflect growing caution among institutional investors, especially as volatility continues to shake confidence in near-term price stability.

BlackRock Falls Behind in the ETH Accumulation Race

As of December 12, ETHA held approximately 3.7 million Ethereum, worth more than $11 billion at current prices. While that still places BlackRock among the largest ETH holders in the market, it now trails Tom Lee’s BitMine Immersion, which has rapidly expanded its balance to nearly 4 million ETH over the past week. The shift highlights how competitive institutional positioning around Ethereum has become, particularly during periods of market stress.