- Sui remains under heavy selling pressure as on-chain demand and derivatives interest both decline

- Long liquidations are accelerating, pushing positioning further in favor of shorts

- A break below $1.50 shifts focus to $1.39 unless buyers reclaim key resistance

Sui is still under heavy pressure, extending losses by about 1% at press time on Tuesday and marking its third straight red session. The weakness isn’t isolated. On-chain demand is cooling off, derivatives traders are pulling back, and broader market sentiment remains firmly risk-off. Taken together, the setup leaves SUI vulnerable, with $1.39 shaping up as the next level traders are watching closely.

This isn’t a sudden breakdown either. The selling has been steady, almost methodical, which often makes it harder for buyers to step in with confidence.

Retail and On-Chain Demand Both Start to Fade

Derivatives data shows traders backing away. CoinGlass reports that SUI’s futures open interest dropped nearly 10% in the last 24 hours, falling to around $679.7 million. When open interest shrinks like this, it usually means positions are being closed, not replaced, a clear sign of reduced risk appetite.

Liquidations tell a similar story. Long positions took the brunt of the damage, with roughly $3.14 million wiped out compared to just $89,000 in shorts. That imbalance pushed the long-to-short ratio down to 0.92, meaning bearish positioning is starting to dominate. Bulls are getting flushed, and that tends to weigh on price even more.

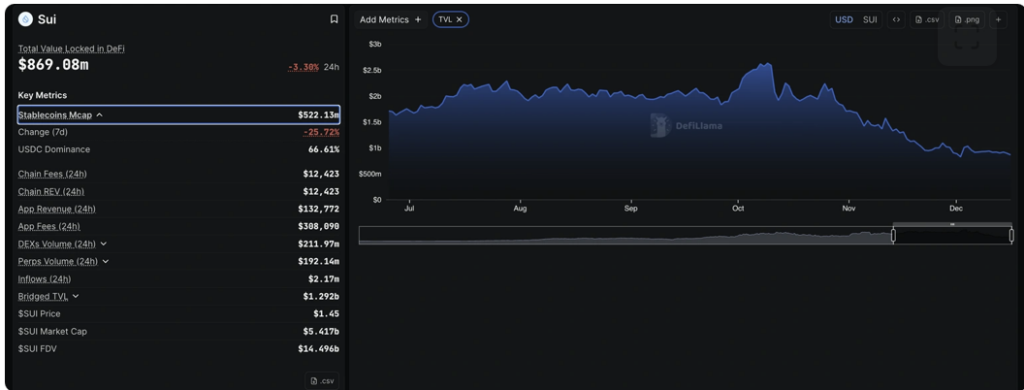

On-chain metrics aren’t offering much relief either. Total value locked on the Sui network slipped 3.3% over the past day to $869 million, signaling users are pulling assets rather than committing new capital. Liquidity is thinning as well, with the stablecoin market cap on Sui down more than 25% over the past week. That kind of drop usually reflects shrinking activity, not growth.

Breakdown Below $1.50 Shifts the Technical Bias

Technically, Sui broke below the $1.50 level after a sharp 5% drop on Monday. That move confirmed a bearish breakout from a descending triangle pattern on the 4-hour chart. At the time of writing, price is trading below the S1 pivot near $1.47, with downside momentum pointing toward the S2 pivot around $1.39.

Momentum indicators are lining up with that bearish view. RSI sits near 28, pushing deep into oversold territory. If it stays below 30 for any length of time, it often signals that sellers remain firmly in control. The MACD is also drifting further into negative territory, reinforcing the idea that bearish momentum is still building, not easing.

What Would Change the Picture

For now, the path of least resistance remains lower. That said, markets rarely move in straight lines forever. If SUI manages to reclaim the $1.50 level, it could open the door for a short-term bounce toward the 50-period EMA around $1.57. That would ease some immediate pressure, though it wouldn’t erase the broader damage overnight.

Until then, the structure stays fragile. Weak demand, shrinking liquidity, and aggressive long liquidations suggest Sui still has work to do before buyers feel comfortable stepping back in.