- Long-term crypto narratives are gaining attention as short-term momentum fades

- If Bitcoin follows Saylor’s path, XRP could theoretically see massive upside over decades

- Supply dynamics and market structure remain the biggest constraints on extreme XRP valuations

With digital asset markets still leaning under macro pressure, investor focus is starting to stretch further out. Instead of chasing short-term rallies, more people are asking what crypto might look like years, even decades, down the line. One idea gaining traction is how major altcoins, especially XRP, could perform if Bitcoin ever reaches the ambitious long-range vision laid out by Michael Saylor.

Earlier in the cycle, expectations were centered around fast upside and explosive moves. That tone has cooled. Tighter financial conditions and reduced risk appetite have pushed the market toward longer-term valuation models, where patience matters more than momentum.

Michael Saylor’s Big Bitcoin Bet

Michael Saylor has never been shy about his Bitcoin outlook. Through Strategy, he’s overseen one of the most aggressive accumulation efforts in corporate history, building a position of more than 660,000 BTC. That alone makes his long-term thesis hard to ignore, even for skeptics.

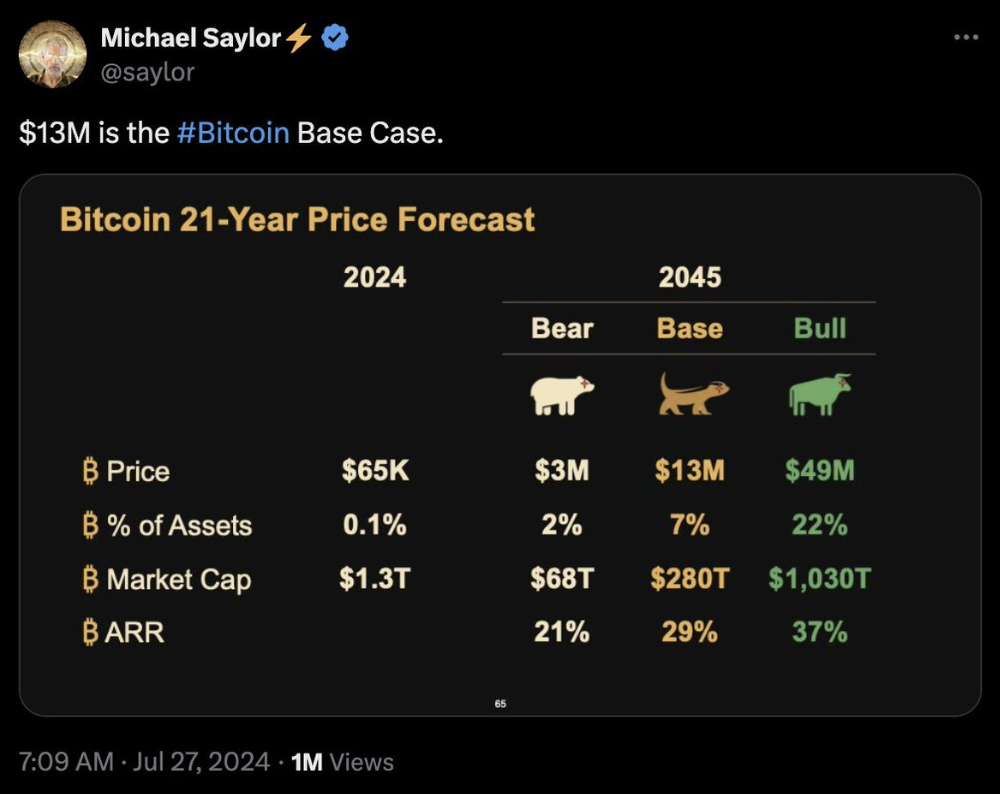

Back in July 2024, with Bitcoin trading near $65,000, Saylor floated a bold projection: $49 million per Bitcoin by 2045. Since then, BTC climbed to a new all-time high above $126,000 in October 2025 before pulling back amid macro headwinds. Even at current levels near $90,000, Bitcoin would still need to rise more than 54,000% to reach that target, which puts the scale of the forecast into perspective.

Where XRP Fits Into That Scenario

While Saylor’s thesis is Bitcoin-only, its ripple effects matter for the broader market. Bitcoin’s dominance means long-term appreciation often drags other large assets along with it, especially during expansion phases. XRP has historically moved in the same general direction as BTC, though with sharper swings on both sides.

In recent months, XRP has fallen more than Bitcoin, underscoring its sensitivity to broader market cycles. If Bitcoin were to follow anything close to Saylor’s projected path, proportional models suggest XRP could see dramatic long-term gains as well. Under those assumptions, XRP moving from around $2 today to four-digit prices over the coming decades isn’t mathematically impossible, even if it feels distant.

Optimism Meets Reality Checks

Some long-range forecasting platforms lean into that possibility. Changelly, for example, has projected XRP reaching the $1,100 range by the early 2040s, assuming sustained adoption and expanding use cases. Those models hinge on XRP becoming deeply embedded in global payment and settlement infrastructure.

Critics push back hard, though. XRP’s large circulating supply creates serious valuation constraints, and at four-digit prices, its implied market cap would stretch beyond $100 trillion. For many analysts, that crosses into territory that existing global financial systems simply can’t support, at least not as they exist today.

In the end, Saylor’s Bitcoin forecast offers a framework, not a guarantee. XRP’s future will depend on its own fundamentals, regulatory clarity, real-world adoption, and how markets evolve over time. High-end projections make for interesting discussion, but they remain speculative and should be weighed carefully against economic reality.