- Bitcoin slipped to $86,000 as macro uncertainty weighed on risk assets

- Analysts see orderly consolidation rather than panic-driven selling

- Long-term capital and ETFs continue to reshape Bitcoin’s market structure

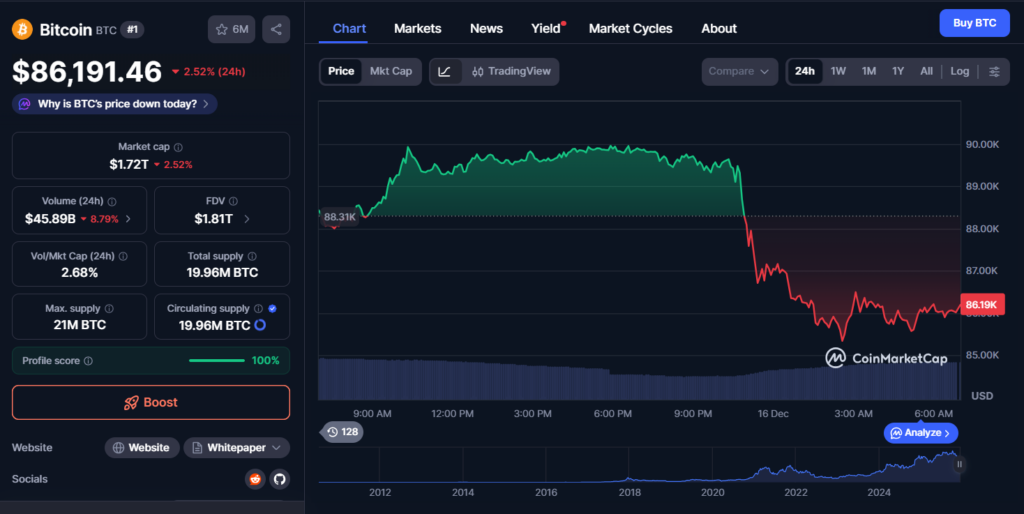

Crypto markets remained under pressure on Monday as Bitcoin slipped to the $86,000 range during U.S. afternoon trading, extending losses from the weekend. The move came as investors continued to digest mixed macro signals, with caution returning despite relatively modest declines in traditional equity markets. Bitcoin’s pullback pushed it below a range it had held for over two weeks, raising questions about near-term direction rather than signaling outright panic.

Major altcoins followed Bitcoin lower, with Ethereum, XRP, and Solana each falling more than 5% on the day. Crypto-linked equities saw even steeper declines, as firms like Strategy, Galaxy Digital, and Circle posted losses exceeding 8%. The selling pressure contrasted with U.S. stock markets, where the Nasdaq and S&P 500 finished only slightly lower, highlighting crypto’s sensitivity to shifts in sentiment.

Macro Signals Create Choppy Trading Conditions

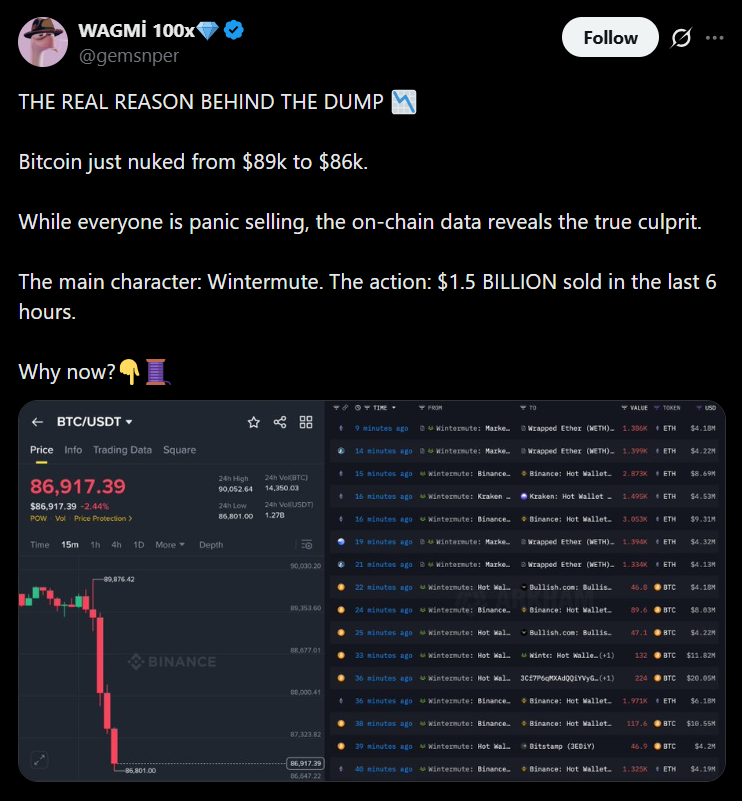

Market participants pointed to lingering macro uncertainty as the primary driver behind the downturn. Trading firm Wintermute described the environment as one of digestion rather than outright risk-off behavior, noting that both equities and crypto are struggling to find clear direction. Bitcoin’s drop below $86,000 has sparked debate, but analysts see no signs of forced selling or liquidity stress at this stage.

The Federal Reserve’s recent rate cut initially supported risk assets, but forward guidance surprised markets with a more cautious tone. Projections now suggest only one additional cut in 2026, clashing with market expectations that had priced in several. This disconnect between policy signaling and investor positioning has created instability, especially as global central banks, including the Bank of Japan, prepare for tightening measures that could affect liquidity flows.

Why Analysts See Orderly, Not Disorderly, Risk

Despite the sharp moves, analysts emphasize that current conditions remain structurally different from past crypto drawdowns. Bitcoin’s market is increasingly dominated by long-term holders, ETF inflows, and institutional capital, which has helped absorb supply and dampen extreme volatility. Drawdowns since 2024 have been noticeably shallower, reinforcing the idea that Bitcoin is transitioning into a more mature asset class.

Some analysts argue that Bitcoin now behaves more like gold than a speculative tech asset, with price action driven by patient capital rather than leverage. Historically, Bitcoin has lagged gold rallies by several months, and with gold posting strong gains this year, some believe Bitcoin may follow after a period of consolidation. For now, however, traders expect choppy ranges and selective dip-buying rather than a clean breakout.

What Comes Next for Crypto Markets

Looking ahead, market participants expect volatility to persist into early 2026 as investors await clearer signals on growth, liquidity, and policy. Regulatory developments in the U.S. could reintroduce optimism, but macro forces remain the dominant influence. Until confidence improves, crypto is likely to trade in wide ranges, with rallies viewed as tactical opportunities rather than the start of a new trend.

For Bitcoin bulls, the absence of forced selling offers some reassurance, but patience may be required. The next sustained move will likely depend on how global monetary policy, liquidity conditions, and institutional flows evolve in the months ahead.