- BitMine added over 102,000 ETH, pushing its holdings near 4 million Ethereum.

- The firm now controls the largest Ethereum treasury globally and over $13B in assets.

- A U.S.-based staking network is planned for early 2026 to support long-term strategy.

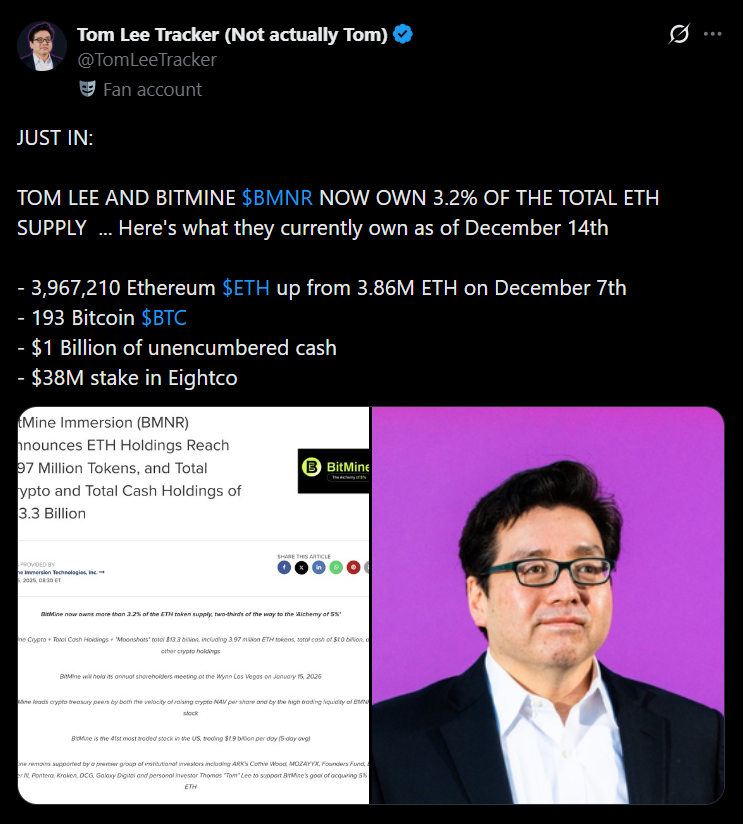

BitMine Immersion Technologies has moved closer to holding 4 million Ethereum after acquiring another 102,259 ETH over the past week. The purchase lifts the company’s total Ethereum position to just over 3% of the circulating supply, a scale rarely seen outside of protocol foundations or exchanges. Led by Thomas “Tom” Lee, BitMine now controls more than $13 billion in combined crypto and cash assets, underscoring its aggressive balance-sheet strategy.

Confidence Returns After October Shock

Lee said crypto prices have shown signs of stabilization over the past week, suggesting markets may be recovering from the sharp selloff that followed the October 10 price shock. In his view, the recent calm reflects improving sentiment rather than a temporary bounce. Regulatory clarity, favorable legislative developments in the U.S., and sustained institutional demand have all contributed to renewed confidence across digital assets, even if volatility hasn’t disappeared entirely.

Largest Ethereum Treasury, Second in Crypto Overall

With its latest buy, BitMine now holds the largest Ethereum treasury globally and ranks second among corporate crypto treasuries overall, trailing only Strategy Inc., which holds more than 671,000 BTC. That positioning gives BitMine an outsized influence on Ethereum’s institutional narrative, especially as more companies explore ETH as a strategic reserve rather than a purely transactional asset.

Staking and the Long-Term Strategy

Looking ahead, BitMine plans to launch its staking solution, the Made in America Validator Network, in early 2026. The initiative aligns with the firm’s longer-term goal of reaching what Lee has described as an “alchemy of 5% target,” blending accumulation with yield generation. For now, the message is clear: BitMine is not slowing down its Ethereum-first approach.