- U.S. stock indexes hit or approached record highs this week.

- Rate cuts and earnings optimism helped fuel the rally.

- Markets are strong, but polls remain mixed — and the two rarely reflect the same sentiment.

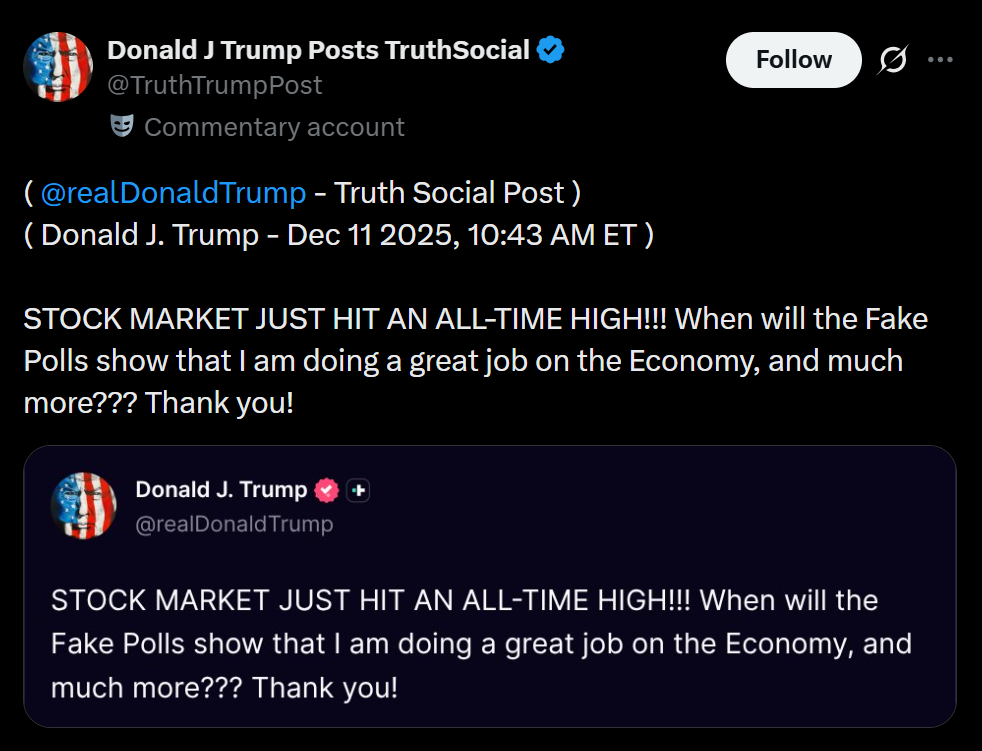

U.S. equities surged on December 10–11, with several major indexes either reaching or approaching all-time highs. The Dow climbed toward 48,057 — up about 13% this year — while the S&P 500 closed near 6,886, just shy of its October peak. The Nasdaq has gained more than 22% year-to-date, and the Russell 2000 even printed a fresh closing record. These moves provide the backdrop for Trump’s claim that the “stock market just hit an all-time high,” which is partly true, depending on the index cited.

What’s Fueling the Rally

Investors have been buying risk assets on the back of the Federal Reserve’s latest rate cut, which brought the benchmark range to 3.5%–3.75%. Lower borrowing costs typically support equities, and optimism around corporate earnings — especially in tech, manufacturing, and industrials — continues to push capital into stocks. Still, the advance has not been perfect. Some mega-caps, including Oracle, have sold off sharply, and the S&P 500 and Nasdaq have seen occasional pullbacks even as the Dow climbs.

Markets Say One Thing, Polls Say Another

Trump’s post ties strong market performance to his dismissal of negative polling, but markets and public sentiment rarely move in sync. Equity indexes reflect investor expectations about future profits, liquidity, and monetary policy — not voter confidence, wage pressure, or cost-of-living stress. That is why markets can reach record highs even while polls show a more divided electorate. Economic optimism on Wall Street does not automatically translate to economic comfort on Main Street.

The Gap Between Market Gains and Real-World Conditions

It’s common for presidents to point to stock gains as proof of economic leadership, and the rally numbers he cites are real. But using the market as a universal scorecard oversimplifies the picture. Many households still face elevated prices, tight credit conditions, or slower wage growth, even as investor portfolios rise. In other words, the rally doesn’t erase the economic pressures many voters continue to report.

Conclusion

The data confirms that markets are strong, and Trump is leaning into that narrative. But polls tell a different story — one that reflects voter sentiment rather than investor appetite. With the election cycle heating up, both signals matter, but they measure very different things.