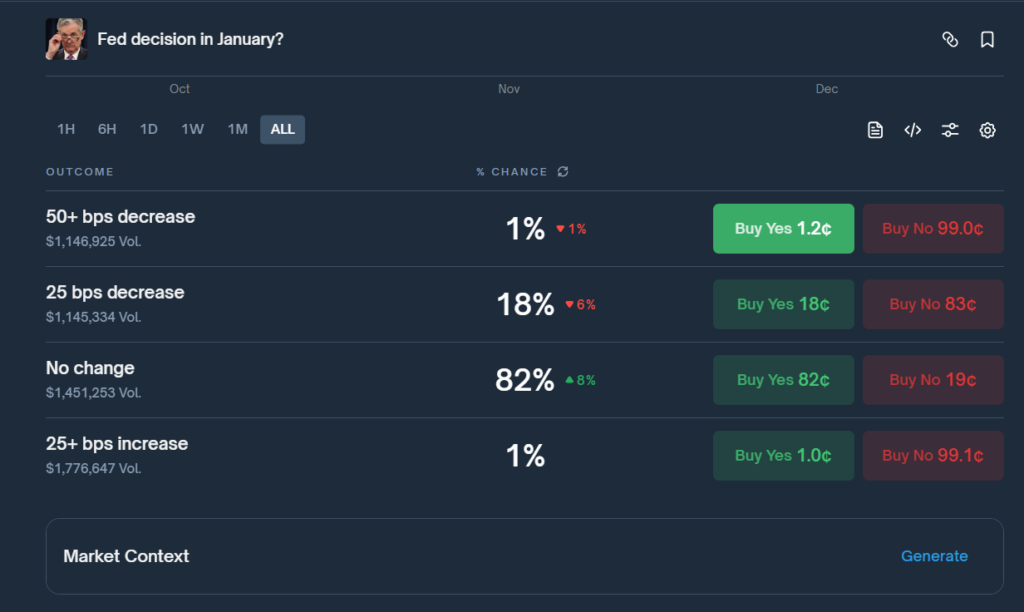

- Polymarket odds for a January rate cut have collapsed to 18 percent, the lowest on record.

- Powell signaled patience after the December cut, reinforcing market doubts about immediate easing.

- Upcoming labor and inflation data will determine whether odds rebound ahead of the January FOMC meeting.

Expectations for another Federal Reserve rate cut in January have dropped sharply, with Polymarket data showing odds falling to just 18 percent—an all-time low for the contract. This shift comes only days after the Fed delivered its December cut, marking a clear cooling in market conviction that Chair Jerome Powell will continue easing at the start of 2026. The sudden repricing signals a market adjusting to a more cautious central bank narrative, especially after Powell emphasized the need to wait for more economic data before committing to further cuts.

Fed Split Deepens as Powell Signals No One Expects a Rate Hike

During Wednesday’s press conference, Powell made one thing clear: he does not see a rate hike as any policymaker’s base case. However, he also stopped short of promising additional cuts. With three dissenting votes in the latest FOMC decision, the deepest division in more than a decade, markets have begun scaling back expectations for early-2026 easing. Inflation remains above target, and the labor market continues to soften, creating a difficult environment for a central bank trying to navigate competing risks.

Political Pressure and Economic Uncertainty Push Markets Into Wait-and-See Mode

President Donald Trump has intensified calls for faster and larger rate cuts, claiming the Fed’s most recent move should have been “at least doubled.” Yet despite political pressure, Powell signaled patience, highlighting the need to observe how 2025’s cuts flow through the economy. With inflation data distorted by the prolonged government shutdown and unemployment creeping up to 4.4 percent, investors are shifting from aggressive rate-cut bets toward a more cautious stance reflected in the new 18 percent odds.

Markets Now Watching January Data as the Key Deciding Factor

With the Fed’s Summary of Economic Projections showing only one expected cut in 2026, traders are now waiting on crucial labor and inflation reports set to arrive before the January FOMC meeting. Any further softness in employment could boost cut expectations again, but if inflation remains sticky, the Fed may pause longer than previously assumed. This uncertainty has become the primary driver behind Polymarket’s steep decline in cut projections.

What the New Odds Signal for Markets Going Into 2026

A drop to 18 percent odds indicates a broad belief that January may be too soon for another policy shift. Instead, markets expect a more staggered easing cycle later in 2026, potentially influenced by whoever President Trump appoints as the next Fed chair. With Kevin Hassett still viewed as the frontrunner, the market may reverse quickly once clarity emerges. For now, though, traders appear aligned with Powell’s statement that the Fed is well-positioned to wait and evaluate incoming data before moving again.