- BlackRock’s new ETHB ETF plans to stake 70%–90% of its Ethereum holdings and distribute rewards to shareholders.

- Coinbase Custody and Anchorage Digital Bank will serve as custodians, with third-party validators handling staking.

- ETHB signals a major step in institutional staking and expands regulated access to Ethereum’s yield ecosystem.

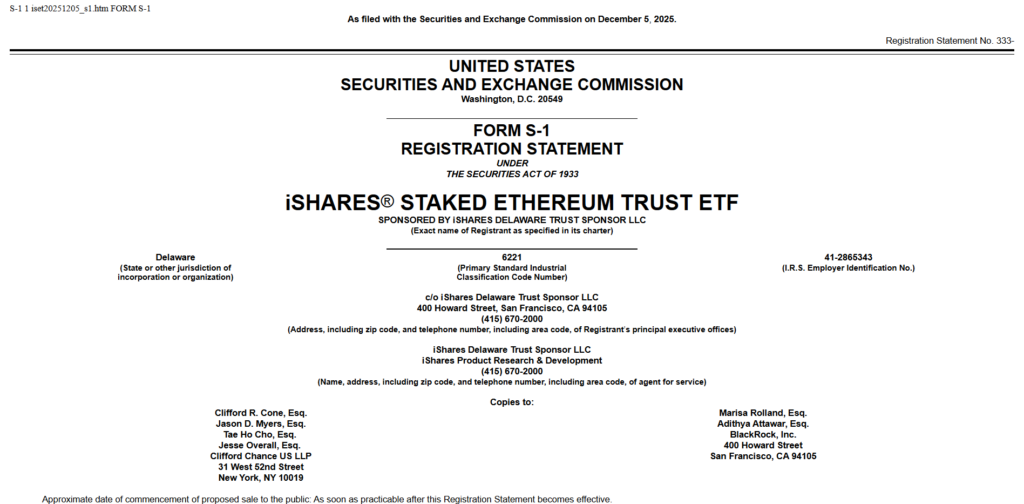

BlackRock is making one of its biggest moves in crypto yet, unveiling plans to stake the majority of its Ethereum holdings through a new exchange-traded fund structure. In a fresh SEC filing, the firm detailed its iShares Staked Ethereum Trust (ETHB) — an ETF designed to stake 70% to 90% of its ETH “under normal market conditions.” The trust will accumulate staking rewards and distribute them to shareholders every quarter, minus the platform’s fees. It’s another sign that BlackRock isn’t just offering exposure to Ethereum; it’s actively leaning into Ethereum’s yield mechanics.

How ETHB Will Operate Behind the Scenes

The ETF will rely on third-party staking service providers chosen by the custodian to operate network validators. Coinbase Custody remains the primary custodian for ETHB, while Anchorage Digital Bank has been added as the alternative custodian — giving the structure an institutional-grade, multi-venue safety net. The filing also notes that BlackRock may scale staking down if regulatory risks increase or if doing so protects the trust’s tax classification. Even with those guardrails, ETHB appears built to take advantage of Ethereum’s yield system at a scale only the world’s largest asset manager can deploy.

Why This Matters for ETH and Institutional Adoption

A staking-enabled ETF changes the calculus for institutional participation. For years, one of the biggest barriers for big investors has been the operational complexity of running validators. ETHB removes that friction while turning staking rewards into a transparent, regulated income stream. It also positions BlackRock as an active participant in Ethereum’s security model — not just a passive holder waiting for price appreciation. Shares of the ETF will trade on Nasdaq under the ticker ETHB, giving traditional investors easy access to staked ETH exposure without touching crypto wallets, keys, or node software.

A Signal of Ethereum’s Maturing Financial Infrastructure

This move comes at a moment when Ethereum’s role in global tokenization and institutional settlement continues to accelerate. With BlackRock — a firm overseeing more than $10 trillion — committing to staking through a regulated ETF wrapper, the message is pretty clear: staking is no longer “too technical” for Wall Street. It’s becoming part of the core investment structure. The long-term impact could be enormous, from tighter ETH supply to deeper institutional yield strategies built directly on-chain. And if ETHB succeeds, more staking-based ETFs could follow next year.