- Ethereum closed November down sharply, dragged by heavy ETF outflows and early-month whale selling that pushed the price toward $3,030.

- Derivatives data turned bullish late in the month, with whales stacking over $700M in long positions around the $2,960 support zone.

- December’s outlook hinges on ETH breaking the $3,100 resistance, where a short squeeze could send the price toward $3,500.

Ethereum limped into the end of November, drifting down toward the $3,030 range after a month packed with ETF outflows, whale unwinding, and a general mood that felt… well, kinda heavy. Even with that rough 21% monthly drop, though, some late-month shifts in derivatives and returning whale interest are hinting that December might not follow the same gloomy script.

ETF Outflows Hit Hard, but Late Support Tries to Patch the Damage

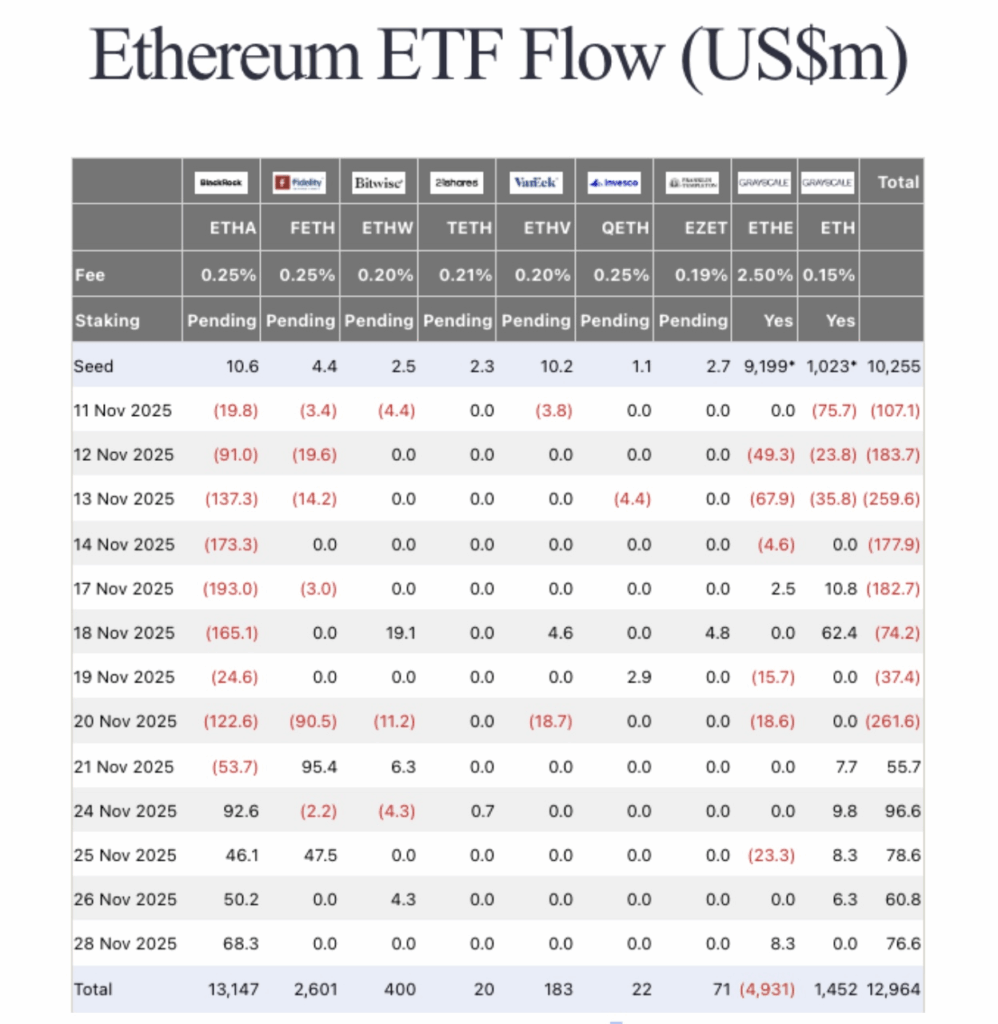

Through the first stretch of the month, the pain mostly came from whales ditching large amounts of ETH while broader markets reacted to the US political mess and the looming government shutdown chatter. At the same time, US-listed Ethereum ETFs bled out $1.28 billion across eight straight days of selling between Nov. 11 and Nov. 20. The rebound came late—ETF issuers finally switched back to inflows in the last week of November, adding about $368 million—but it wasn’t enough to erase the earlier rout. By the time the books closed, Ethereum ETFs were still staring at roughly $1.4 billion in net monthly withdrawals.

Bitmine, the Tom Lee-led giant and the largest Ethereum corporate treasury holder, tried to soften the blow a bit. Near the end of November, it grabbed 14,618 ETH—roughly $185 million—signaling that at least some US institutional players still feel pretty committed, especially now that geopolitical fears cooled off a bit.

Derivatives Flip Bullish as Whales Stack $700M in Longs Around $2,960

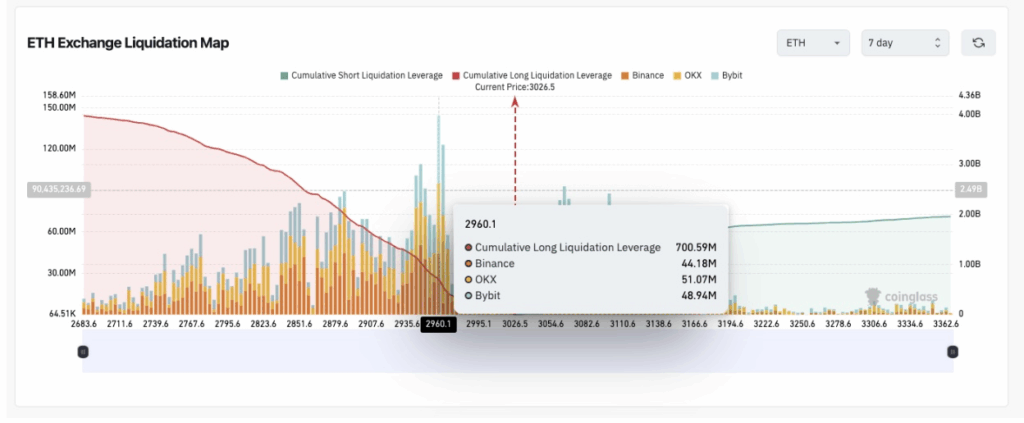

Even though the buying wave wasn’t strong enough to undo the 21% drop on the spot charts, the derivatives market started sending more encouraging signals. Coinglass data showed bulls taking the driver’s seat toward the end of the month, holding nearly 3.97 million active long ETH contracts—comfortably outweighing the short side, which totaled about $1.9 billion.

What really stood out was the massive cluster of long positions deployed right at the $2,960 mark. Over $700 million in long exposure landed there, forming a sort of psychological shield that helped ETH hold the line around $3,000—even when Bitcoin slipped under $90,400 on Nov. 29 and caused some temporary tremors. It’s pretty clear whales are defending that zone, almost using it as a staging ground for whatever December brings.

December Outlook: A Lot Depends on $3,100 and the Short Squeeze Waiting Above It

Heading into December, sentiment in derivatives leans noticeably bullish, but there’s a key hurdle right above: the $3,100 region. More than $1.3 billion of the active $1.96 billion short positions are piled up around that exact level. That kind of concentration can act like a ceiling—bears might swarm in to protect it if ETH tries to climb.

But here’s the twist: if ETH does punch through it, the setup is perfect for a sharp short squeeze. And that squeeze could shove Ethereum quickly toward the $3,500 zone, maybe even faster than traders expect.

Technical indicators paint a similar picture. ETH is still trading above its 20-day EMA, showing that near-term demand has been quietly recovering. At the same time, the 200-day moving average is sitting close to $3,130 and still trending down, echoing the resistance sitting near the same area in the derivatives data. RSI sits at a neutral-ish 51, leaving room for a move in either direction, though recent volume tilt suggests buyers have a small edge right now.

If bulls manage to keep defending that $2,960 base—just like they did during the final stretch of November—Ethereum has a realistic path toward making $3,500 the big upside target for December 2025. If that level breaks down instead, though, the charts open up toward $2,880 and $2,820, and things could get shaky pretty fast.