- Ethereum is rebuilding momentum with higher lows and aims to reclaim key resistance levels toward $4,200.

- The December 3 FUSAKA upgrade could spark a strong post-upgrade rally similar to past network updates.

- Falling exchange reserves signal reduced selling pressure, strengthening ETH’s chances of a year-end breakout.

Ethereum has started to look a little more confident heading into December, even after a few rough weeks of pressure that pushed traders into caution mode. Price is sitting close to $2,990 right now, slowly carving out higher lows and tightening its structure as the market braces for the upcoming FUSAKA upgrade. With exchange reserves drifting lower and several bullish indicators finally flickering back to life, ETH might actually be gearing up for a proper run toward the $4,200 zone before the year wraps up… assuming buyers don’t lose their nerve halfway through.

ETH Price Structure Firms Up as Momentum Starts Rebuilding

Ethereum spent most of the past month dealing with heavy pushback, but things are starting to change. Buyers stepped in around the $2,772 region and kept defending it, giving ETH a steady run of higher lows — a small but clear signal that the structure’s shifting. The next big target is $3,058, a level Ethereum couldn’t reclaim in earlier attempts. If ETH can finally flip that zone, it opens the door to $3,618, an area that has triggered strong reactions before. Breaking through there could set up a cleaner path toward $4,200 before the new year rolls in. The MACD even printed a bullish crossover, lifting off its lower range, which is the kind of momentum shift traders look for when a bigger move might be forming.

FUSAKA Upgrade Sparks Fresh Optimism

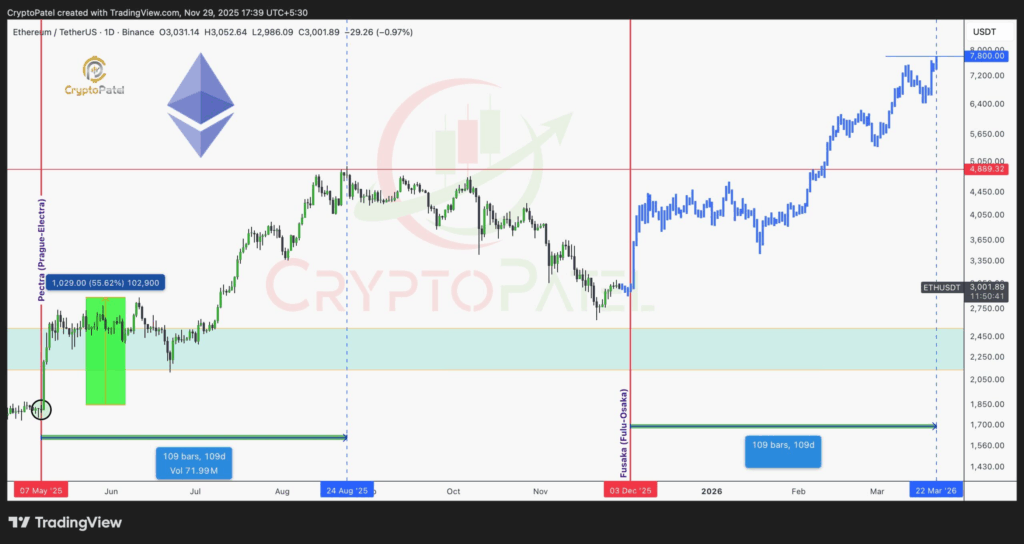

A major catalyst is right around the corner: Ethereum’s FUSAKA network upgrade goes live on December 3. Historical behavior after the May 2025 Pectra upgrade showed ETH jumping 55% in little more than a month, and 168% over 109 days — not small numbers by any stretch. Analysts think FUSAKA could bring similar energy, projecting targets around $4,500 roughly 35 days after the rollout. That extends just a bit beyond the end of 2025, but it aligns neatly with the $4,200 range technical analysts are already watching. Investors tend to front-run upgrades, and if Ethereum can reclaim resistance levels afterward, the rally case becomes even stronger.

Whale Selling & ETF Outflows Weigh on Short-Term Sentiment

Of course, not everything has been smooth. Q4 ETF data shows Ethereum ETFs saw $1.42 billion in outflows during November — more than triple the outflows from March earlier in the year. A large early-stage whale also sold 87,824 ETH worth around $270 million, spreading the transactions across multiple exchanges. This whale originally accumulated ETH at $517 and still holds over $200 million, which does hint at long-term conviction despite the sell-off. Even with those outflows, ETH managed to clock a 10% weekly gain, but traders are cautious; if ETH loses the rising trendline it’s been riding since late November, a 5–6% correction could hit quickly.

Falling Exchange Reserves Strengthen the Bullish Case

CryptoQuant data shows Ethereum’s exchange reserves dropped 2.11%, meaning less ETH is available for immediate selling. When reserves fall while price builds structure, it usually sets the stage for stronger reactions at key resistance points.

If Ethereum retests $3,058, flips it, and pushes into the $3,618 range, the shrinking supply could amplify the move. It’s the kind of setup where, with the right spark, ETH could realistically grind its way toward $4,200 by year-end — especially with the upgrade hype, lower supply, and improving chart behavior lining up at the same time.