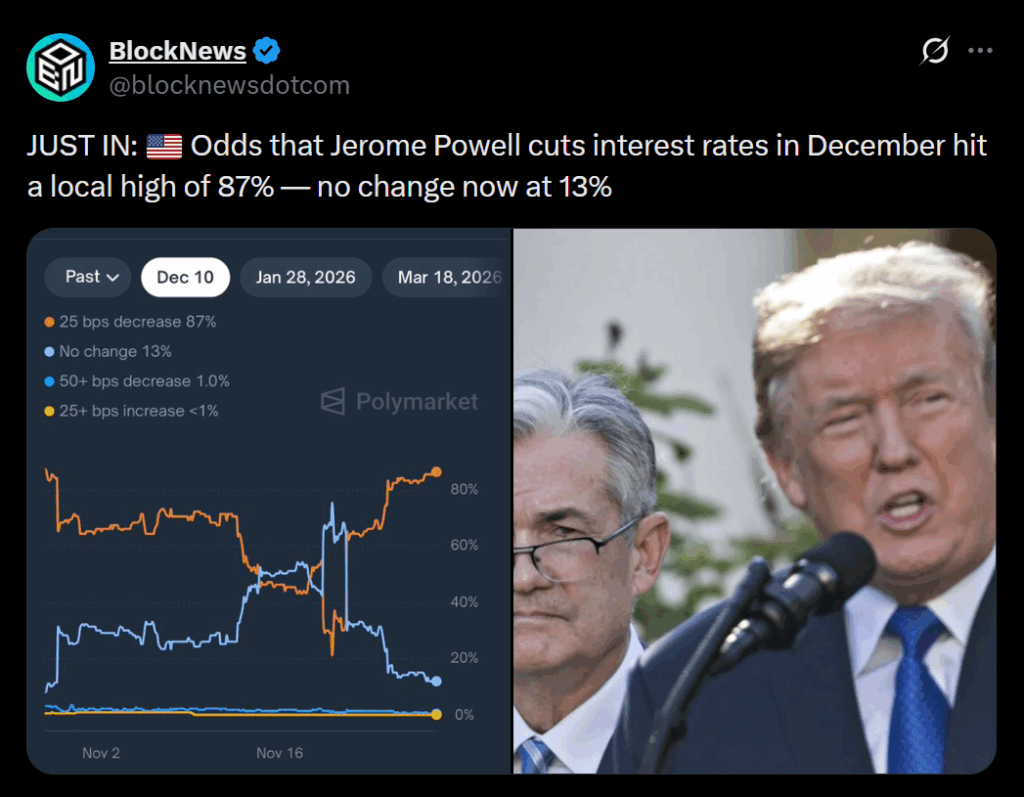

- JPMorgan now expects a December 10 rate cut with odds rising back toward 85 percent.

- Fed officials have turned more open to near-term easing as labor data softens and no major reports remain before the meeting.

- A December cut would align with historically strong year-end market performance, potentially setting off a powerful rally.

JPMorgan has abruptly reversed its earlier stance, now forecasting that the Federal Reserve will cut interest rates by 0.25% at the December 10 meeting. This is a sharp departure from weeks of messaging suggesting the Fed would delay until January. The shift comes just as several Fed officials have grown more open to easing sooner, especially amid cooling labor conditions. With odds climbing back toward 85%, markets are quickly adapting to the renewed possibility of a December policy shift.

Why December Expectations Have Whipsawed

The path to December has been unusually volatile. Rate-cut odds hit nearly 100% in late October, plunged to 30% in early November when the government shutdown delayed key economic data, and surged again as policymakers suggested more urgency. New York Fed President John Williams signaled that a December cut may be appropriate to prevent further weakness. With no major data releases before the December 9–10 meeting, the runway for a pre-holiday rate move is now open.

Why a December Rate Cut Could Supercharge Stocks

If the Fed cuts this month, the timing is powerful. Lower rates typically boost equities by reducing borrowing costs and lifting valuations — but December historically amplifies that effect. The S&P 500 finishes December higher nearly 73% of the time, while the Dow posts its best average monthly return. The Santa Claus rally window — the last five trading days of the year and the first two of January — delivers gains almost 80% of the time. A December cut could fuel an even stronger year-end rally heading into 2026.