- Ethereum is preparing for Fusaka in December and a targeted 5x gas limit expansion in 2026 to boost throughput without overloading nodes.

- Average Ethereum fees have fallen to around $0.31, still above Solana’s ~$0.0022, but the gap has narrowed significantly since 2024.

- Aggressive scaling is aimed at keeping Ethereum competitive with Solana and other L1s while empowering L2s and preserving decentralization.

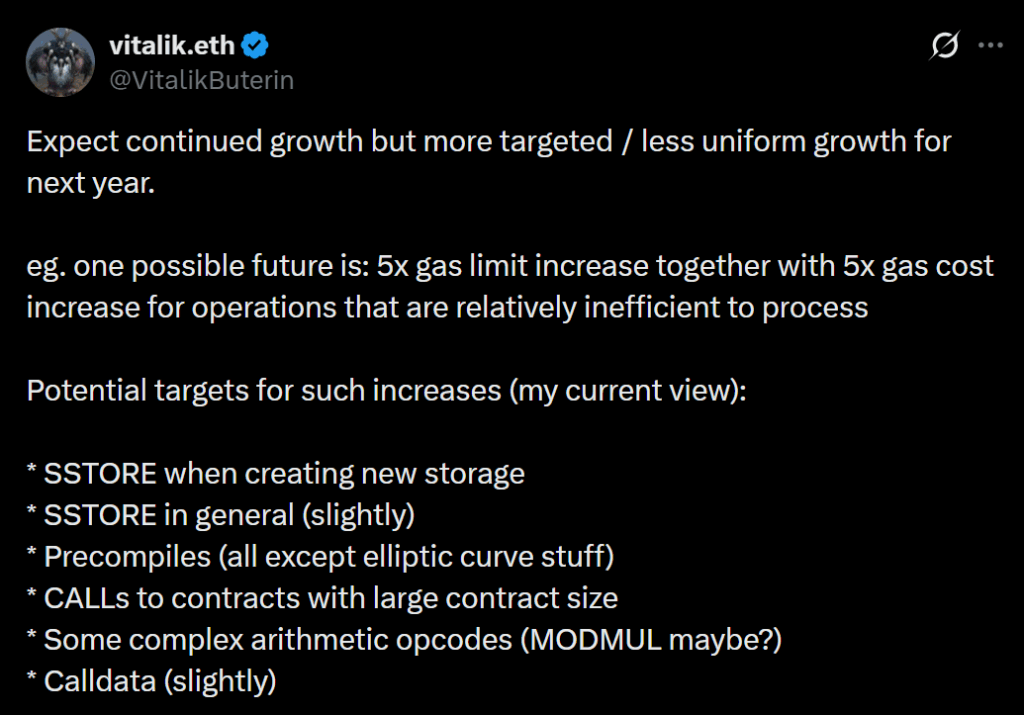

Even with the Fusaka upgrade scheduled for early December, Ethereum is already staring further down the road. In a recent post on X, co-founder Vitalik Buterin said he expects “targeted growth” that could support roughly a 5x gas limit increase in 2026, instead of just blindly cranking capacity higher.

For anyone not deep in the weeds, raising the gas limit means more computation per block, which translates into higher throughput and the ability to pack more transactions into each block. In plain terms, that keeps Ethereum faster and helps Layer 2 fees stay lower, even as usage ramps.

But Vitalik also flagged a key constraint. He doesn’t want a free-for-all where heavy, inefficient operations clog the network. Under his vision, those types of transactions would simply become more expensive, pushing developers toward more efficient designs and preventing nodes from being overloaded with storage and execution bloat.

Where Ethereum Gas Limits Stand Today

As of November 2025, Ethereum’s gas limit sits at about 60 million gas per block. That’s already double what it was roughly a year ago, when researchers like Toni Wahrstätter from the Ethereum Foundation were openly pushing for higher limits. The network has, in other words, quietly been scaling in stages rather than through one huge leap.

This year, the Pectra upgrade was the main pillar of that progress. Pectra improved validator operations, boosted Layer 2 scalability, and made wallet interactions smoother. It didn’t grab headlines like some earlier hard forks, but it laid a ton of groundwork behind the scenes.

Now Fusaka is lined up as the final major scaling step for this cycle. Set for activation in early December, Fusaka aims to raise effective block capacity and simultaneously make node operations lighter. If it lands as designed, the upgrade should increase throughput, trim costs, and create more breathing room for both mainnet and rollups.

The 2026 plan then builds on top of this base: more optimization, more “targeted” efficiency gains, and smart use of gas pricing to steer the network away from wasteful behavior.

Why Ethereum Is Pushing So Hard on Scaling

All this talk about gas limits, validator efficiency, and node load isn’t happening in a vacuum. Ethereum is scaling aggressively because the competitive pressure from other Layer 1 chains, especially Solana, is very real.

Ethereum still holds the stronger decentralization narrative. It has more battle-tested infrastructure, deeper institutional trust, and a massive ecosystem orbiting its base layer and rollups. That’s why big funds still treat it as a core piece of the crypto stack.

But Solana has carved out a powerful identity of its own: fast, cheap, and very “retail-friendly.” During the memecoin supercycle, that mattered. Traders could spin up and flip tokens for fractions of a cent, while Ethereum mainnet regularly charged $10 or more for similar activity, sometimes much higher whenever things got busy.

Over the past couple of years, Ethereum has been quietly closing that gap. Average transaction fees were cut roughly in half in 2024, settling near $5. Then Pectra and later improvements dragged that number even lower through 2025.

Fee Gap With Solana Is Shrinking (But Not Gone Yet)

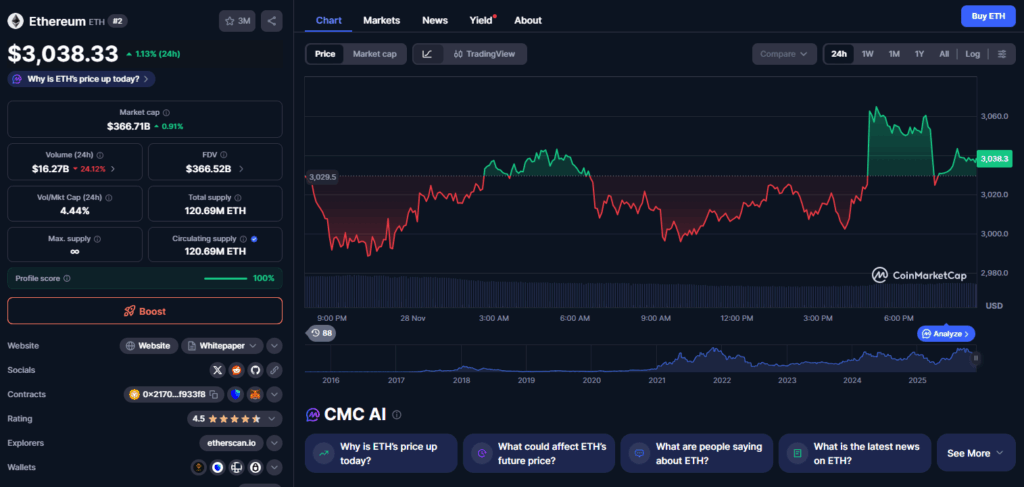

Today, the numbers tell a clearer story. According to recent data, average Ethereum transaction fees have dropped below $1 and sit around $0.31 at the time of writing. That is a huge psychological shift compared to the 2021–2022 era, when “gas pain” was a daily meme.

Solana, though, is still dramatically cheaper on paper. Typical transaction costs hover near $0.0022 — essentially fractions of a cent. That cost advantage is one of the reasons Solana became the default playground for high-velocity memecoin trading and micro-speculation.

Ethereum’s answer is not to try to win a pure fee war at the base layer, but to push enough scaling so that:

L2s can reliably offer sub-cent or low-cent fees for end users.

Mainnet remains secure, decentralized, and attractive for high-value settlement.

Heavy or inefficient contracts effectively “self-select” into higher fee tiers.

If Vitalik’s targeted 5x gas limit growth and follow-on optimizations land in 2026, Ethereum will likely narrow the practical gap even further. Users won’t just compare raw base-layer fees; they’ll compare the full experience across rollups, wallets, and apps running on Ethereum’s broader ecosystem versus a single-chain environment.

In that sense, Fusaka is not a finish line; it’s more like the final step before Ethereum hits another gear in 2026, pushing throughput higher while trying to keep its core values intact.