- Bitwise becomes the first issuer to enable staking inside a spot Avalanche ETF.

- BAVA offers the lowest sponsor fee among AVAX ETFs, with a full fee waiver on early inflows.

- The ETF aims for Q1 2026 approval as competition heats up across major exchanges.

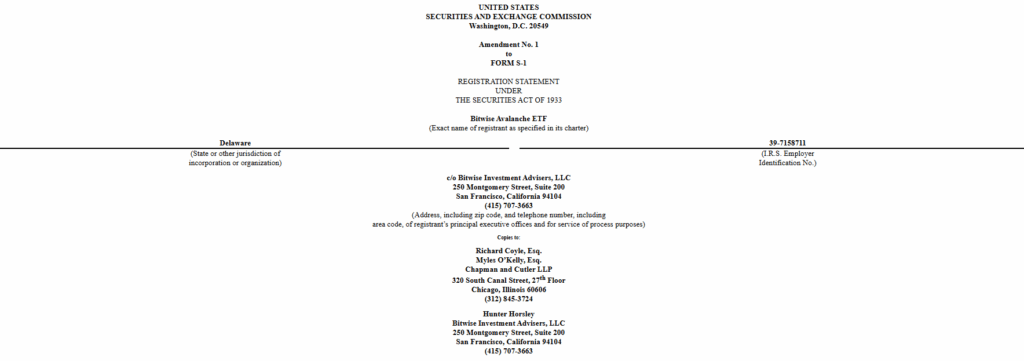

The race to launch the first U.S. Avalanche ETF just got a lot more competitive, with Bitwise updating its SEC filing and becoming the first issuer ready to include staking directly inside a spot AVAX ETF. The amendment shifts the fund to the new ticker BAVA and locks its sponsor fee at 0.34%, undercutting rivals like VanEck at 0.40% and Grayscale at 0.50%. The move signals Bitwise’s intent to dominate the Avalanche ETF lane while also giving investors a low-friction way to tap into yield.

Introducing Yield Through Staking for Traditional Investors

In a notable shift for ETF design, Bitwise says BAVA will be able to stake up to 70% of its AVAX holdings, generating additional tokens through the Avalanche proof-of-stake network. It’s the first U.S. ETF proposal to openly embrace staking after new IRS guidance cleared the way for yield-generating crypto ETFs without creating tax complications. Bitwise plans to take a 12% cut of staking rewards to cover expenses while passing the rest back to shareholders, creating a hybrid model that blends traditional ETF structure with native crypto yield.

BAVA Aims to Become the Cheapest Route Into Avalanche

To sweeten the offering, Bitwise is waiving all sponsor fees for the first month on the initial $500 million of inflows, making BAVA the lowest-cost entry point for institutions that want exposure to Avalanche alongside staking income. The filing also introduces a liquidity reserve, tighter custody arrangements with Coinbase, and expanded risk disclosures covering everything from quantum-computing threats to exchange-level vulnerabilities. It’s a more robust structure than earlier drafts and signals Bitwise’s push to secure early institutional credibility before launch.

Eyes on Q1 2026 for Final Approval

If approved, Bitwise’s BAVA ETF will trade on NYSE Arca, while Avalanche products from Grayscale and VanEck are targeting the NASDAQ instead. All three issuers are now aiming for approval in Q1 2026, creating one of the most competitive ETF lineups since Bitcoin and Ethereum entered the regulated ETF landscape. For Avalanche, the introduction of staking inside a spot ETF could be a defining moment that reshapes institutional access heading into the next cycle.