- ETH futures-to-spot ratio surged to 6.84, signaling aggressive leverage and rising volatility expectations.

- Bitcoin open interest fell while ETH remained stable, suggesting risk rotation toward Ethereum.

- Bulls are eyeing $3,390 as the next major liquidity and resistance zone if $3,000 successfully flips to support.

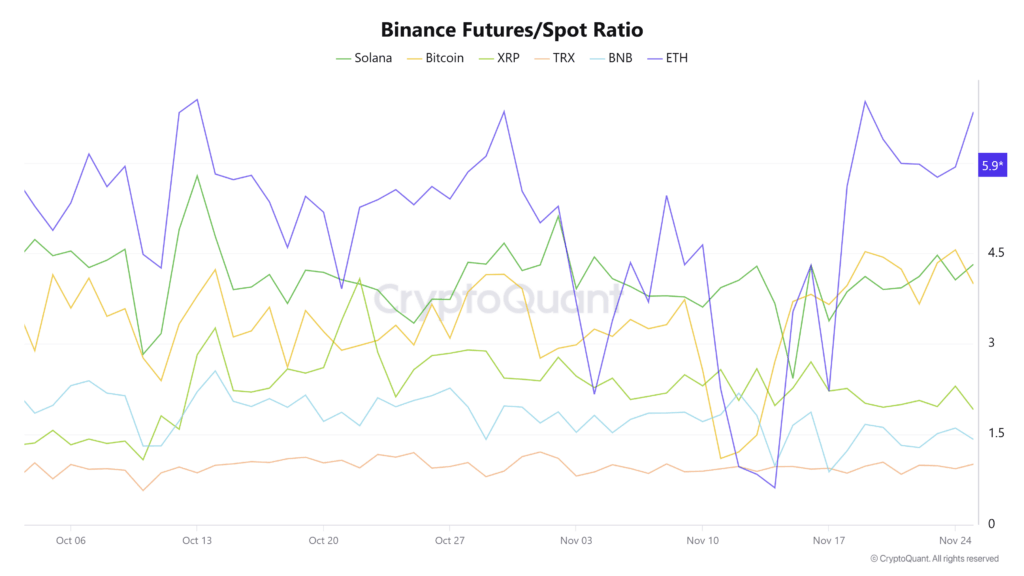

Ethereum traders have quietly flipped back into risk mode, with fresh derivatives data showing a sharp shift in positioning while ETH pushes deeper into a critical technical zone. Binance’s futures-to-spot ratio for Ether jumped from roughly 5 to 6.84, marking its highest level of Q4 and signaling that traders are choosing leverage over spot accumulation again. Compared to Bitcoin and Solana — sitting closer to 4 and 4.3 — ETH has become the most aggressively positioned large-cap crypto, and that divergence usually hints at expectations of incoming volatility or a catalyst on the horizon.

Bitcoin Open Interest Fades While ETH Holds Steady

On-chain derivatives data also shows ETH holding its ground more firmly than Bitcoin. BTC’s open interest has seen a steady unwind over the last two weeks, while ETH’s has dipped only slightly, averaging a soft 0.47% daily pullback. The pattern suggests traders are quietly rotating risk capital from Bitcoin’s tired uptrend into what they see as a higher-beta opportunity in Ethereum. This shift comes just as ETH reclaimed the $3,000 level, dragging attention back toward whether the asset can finally turn this build-up of leverage into a clean breakout.

Can ETH Break the $3,390 Liquidity Cluster?

Not everyone agrees on where this move leads next. Trader Scient argues that ETH looks structurally stronger than Bitcoin right now, noting a reinforced 4-hour support base around $2,800 that has held repeatedly. Bulls want to see that level attract fresh buyers if retested, potentially opening the door toward $3,050 and then the major liquidity pocket sitting around $3,390. That region lines up with the yearly open, a fair value gap, and a high-time-frame resistance zone — basically the level most watchers agree ETH needs to clear to confirm momentum.

Analysts Split as “Thanksgiving Lull” Sets the Tone

Others stay cautious. Lab Trading’s Ken warned that ETH has been rejected over and over at the four-hour 100-EMA, and unless ETH flips $3,000 cleanly into support, another downside extension is still on the table. Meanwhile, Kingpin Crypto highlighted that ETH recently tapped the 0.618 retracement of the entire 2025 rally, calling the current setup a perfect “springboard” for a December push if liquidity rotates back in. With Bitcoin dominance starting to soften and seasonal flows historically favoring ETH, traders say a so-called “Ethereum Santa rally” into the $3,300s isn’t impossible — it just needs stronger confirmation than what we’ve seen so far.