- U.S. interest in ETH is recovering as the Coinbase Premium Index moves toward neutral.

- Whales accumulated 440K ETH while ETFs saw nearly $97M in new inflows.

- ETH hovers near $3,000, needing a break above $3,100 to attempt a stronger recovery.

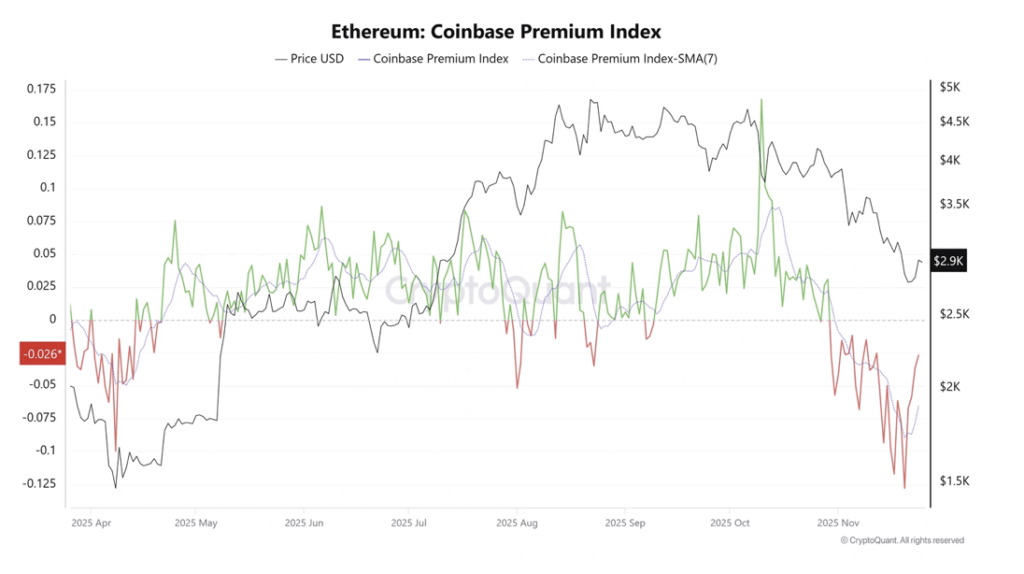

Ethereum has been showing a quiet recovery in U.S. market sentiment these past few days, even if the move feels a bit hesitant at times. The Coinbase Premium Index — a metric traders watch to gauge U.S. investor appetite — inched up from -0.12 last Thursday to around -0.02 on Monday, per CryptoQuant data. It’s still negative, yeah, but the shift suggests U.S. buyers are valuing ETH slightly higher than they were just a week ago, which marks a small but meaningful change in tone.

Institutional flows creep back as ETFs stabilize

Institutional interest, which went cold for a bit, has started trickling back into U.S. spot Ethereum ETFs as well. SoSoValue data showed $96.67 million in net inflows on Monday — the second straight day of positive movement after eight long days of steady outflows. It’s not full-blown enthusiasm just yet, but it’s the kind of steady drip that often hints at renewed confidence returning below the surface.

Whale wallets try to lift ETH back above cost basis

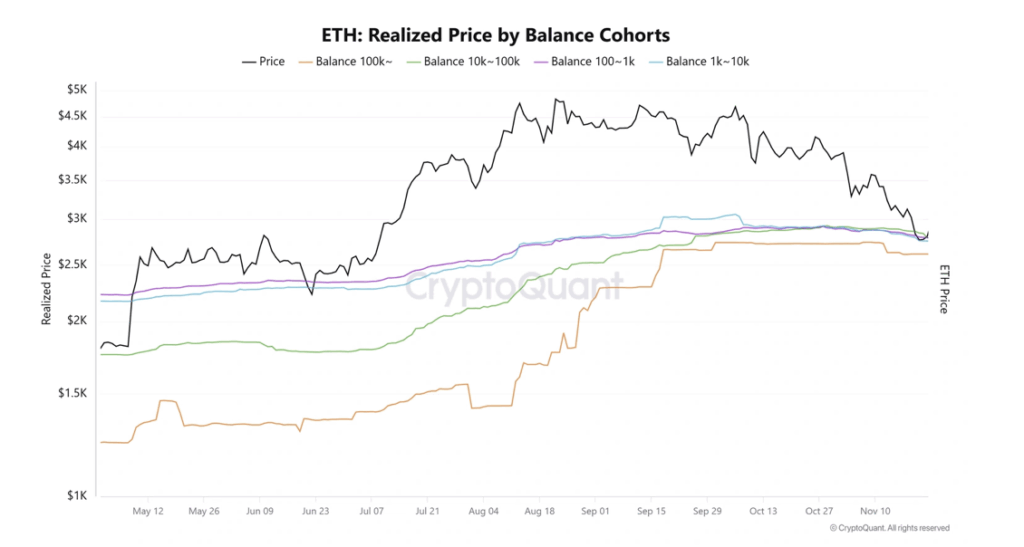

Sentiment shifts are also showing up among whales holding between 10K and 100K ETH. After ETH dropped below their average cost basis, these large wallets began accumulating again, adding roughly 440,000 ETH over the past week. It almost looks like they’re trying to force price back above their break-even zone, or at least defend it with some muscle. Meanwhile, wallets holding 1K–10K ETH and 100–1K ETH moved in the opposite direction, speeding up distribution once ETH got close to their cost basis levels. Those groups offloaded around 100K ETH and 120K ETH respectively, signaling caution instead of conviction.

Futures market remains cautious despite slight inflows

ETH futures traders are still treading lightly. Coinglass data shows net outflows of $4.31 billion over the past week — a sign that leverage continues pulling back. Even so, the past three days brought inflows of about $735 million, suggesting some traders are gradually dipping their toes back in. The sentiment shift also synced with a sudden surge in Fed rate-cut expectations. The odds of a December cut jumped from roughly 30% last Thursday to over 80% by Tuesday, according to CME’s FedWatch tool. Lower rates often boost risk appetite, but it’s still unclear whether ETH has formed a real bottom here or just a temporary floor.

ETH struggles for direction near the $3,000 level

Ethereum saw $80.8 million in futures liquidations over the last 24 hours, powered mostly by $51.3 million in short liquidations, per Coinglass. Yet despite that squeeze, ETH hasn’t chosen a direction. Price is hovering near the key $3,000 psychological zone after reclaiming support at $2,850. If buyers manage to push past the resistance near $3,100 — which sits just under the 20-day EMA — ETH could test the top boundary of its descending channel. If not, and $2,850 breaks again, the channel’s lower boundary may act as the next support cushion. Indicators like RSI and Stoch are creeping upward but still stuck below neutral, showing bearish momentum fading… just not gone yet. Here is where sentiment either flips or stalls again.