- XRP just bounced from the major $1.75–$1.85 support zone where investors previously accumulated 1.80B XRP, forming a bullish Morning Star pattern.

- Exchange reserves are dropping, ADX is rising above 34, and whale accumulation signals early bullish momentum despite CMF still showing weak inflows.

- XRP must hold above $1.85 and break $2.07 to confirm reversal; liquidation clusters at these levels could trigger a fast directional move.

XRP is finally starting to flash signs of life again — the kind of little spark you sometimes see right before a bigger shift. After weeks of sliding and dropping more than 29%, the fourth-largest crypto just printed a clean 4.55% daily rebound, and the timing of that bounce is what has traders talking. It showed up right at the $1.85 support, a level that historically flips sentiment and often marks major reset points in XRP’s structure.

At the moment, XRP is trading around $2.03, up 6.50% on the day. Oddly enough, trading volume dropped more than 52%, which usually signals hesitation… almost like the market is testing the waters but not fully convinced yet.

Still, on-chain data and chart structure are both hinting that this downtrend might be running out of steam.

XRP Is Resting on Its Key Support — And Buyers Know It

On-chain metrics show that the $1.75–$1.85 zone isn’t just another random dip area. It’s where buyers previously scooped up a massive 1.80 billion XRP, making it one of the biggest accumulation clusters of the year. When price revisits a level where that much demand existed, traders pay attention.

The daily chart is starting to form a Morning Star pattern, a classic bullish reversal structure that usually appears after a heavy selloff. It doesn’t guarantee anything, but the fact that it formed directly at support gives it more weight than usual.

XRP is still below the 200-day EMA, meaning the macro trend is technically bearish — but rebounds often begin before the EMA flips, not after.

RSI is rising and the ADX has climbed above 34, which suggests strong directional momentum building behind the latest move. The only red flag here is CMF — still negative at -0.07, meaning capital inflows aren’t strong yet, and sellers haven’t completely stepped aside.

Early Bullish Signs Are Showing Up On-Chain

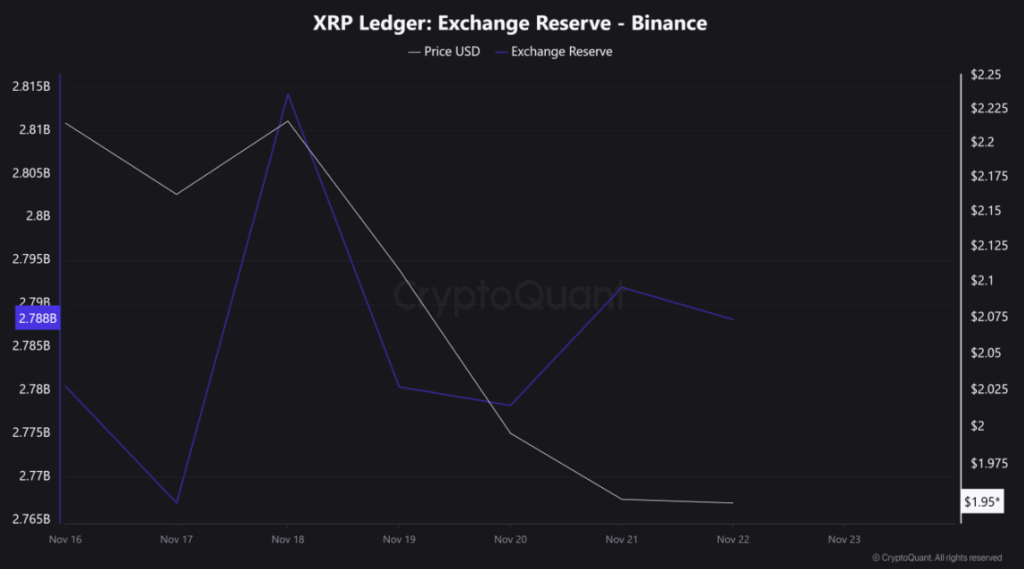

CryptoQuant data confirms that Binance’s XRP reserve has dropped by 3 million tokens. When exchange reserves shrink, it usually means one thing: investors are withdrawing their XRP into wallets — classic accumulation behavior.

Derivatives trading also looks interesting. CoinGlass shows:

- Major liquidation levels around $2.006 (support)

- Another cluster near $2.072 (resistance)

These zones house $22.55M in long liquidations and $10.39M in short liquidations, so whichever side gets triggered next could fuel a sharp move.

Traders are slowly leaning bullish again, especially intraday buyers following whale positioning — which has been net positive over the last two sessions.

Does This Mean XRP’s Downtrend Is Over?

Not quite, but it might be close.

If XRP holds above $1.85 and breaks cleanly above $2.07, the next leg up could form quickly. But if it slips back under the support, the entire setup weakens, and bears regain control.

Right now, XRP is sitting at an important crossroads — but for the first time in weeks, the chart isn’t just bleeding… it’s actually showing structure again.