- Ethereum is consolidating around $2,717, showing stability despite recent volatility.

- A whale bought 114,684 ETH in 48 hours, raising holdings to roughly $1.34B—a sign of long-term confidence.

- ETH must break $2,800 soon to aim for $3,000; failure could send price back toward $2,500.

Ethereum has slipped into one of those quiet consolidation phases where the price doesn’t move much, but the market feels like it’s holding its breath. ETH is trading around $2,717, barely shifting in the last 24 hours, which often happens right before momentum flips one way or the other. It’s not bullish yet—far from it—but the stability itself is interesting given everything happening behind the scenes.

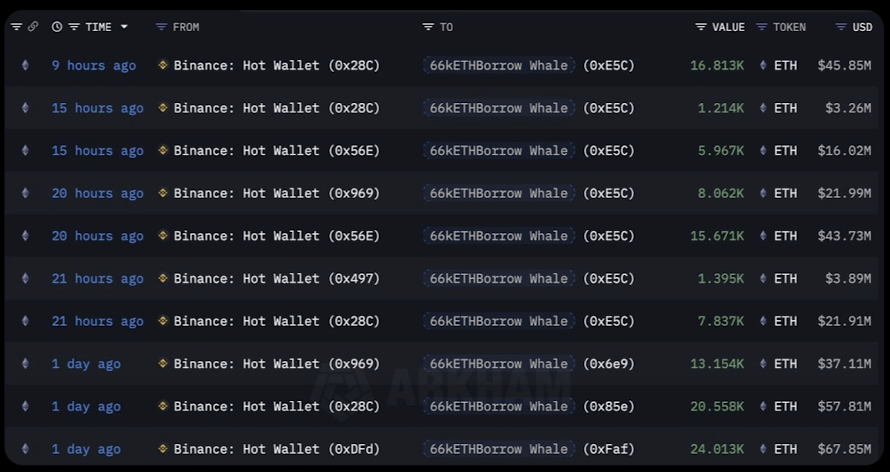

Crypto analyst ToraX highlighted a particularly massive move: a whale scooped up 114,684 ETH in just 48 hours. That’s roughly $314 million added to their bag, bringing their total holdings to 489,696 ETH, now valued around $1.34 billion. You don’t spend that kind of money unless you’re thinking long-term. With Ethereum 2.0 upgrades rolling out and DeFi still anchored to ETH, this kind of accumulation feels more like positioning than speculation.

Market stays steady despite large moves

What’s interesting is how the price barely reacted. Even with such a huge buy, ETH didn’t spike—it stayed calm. That usually signals cautious optimism: people aren’t panicking, but they’re not rushing in either. It might also hint that institutional-style buying is happening quietly, in a way that avoids triggering big volatility.

Whether other large players follow remains to be seen, but when a whale accumulates this aggressively into weakness, it tends to catch attention fast.

Ethereum technicals still lean bearish

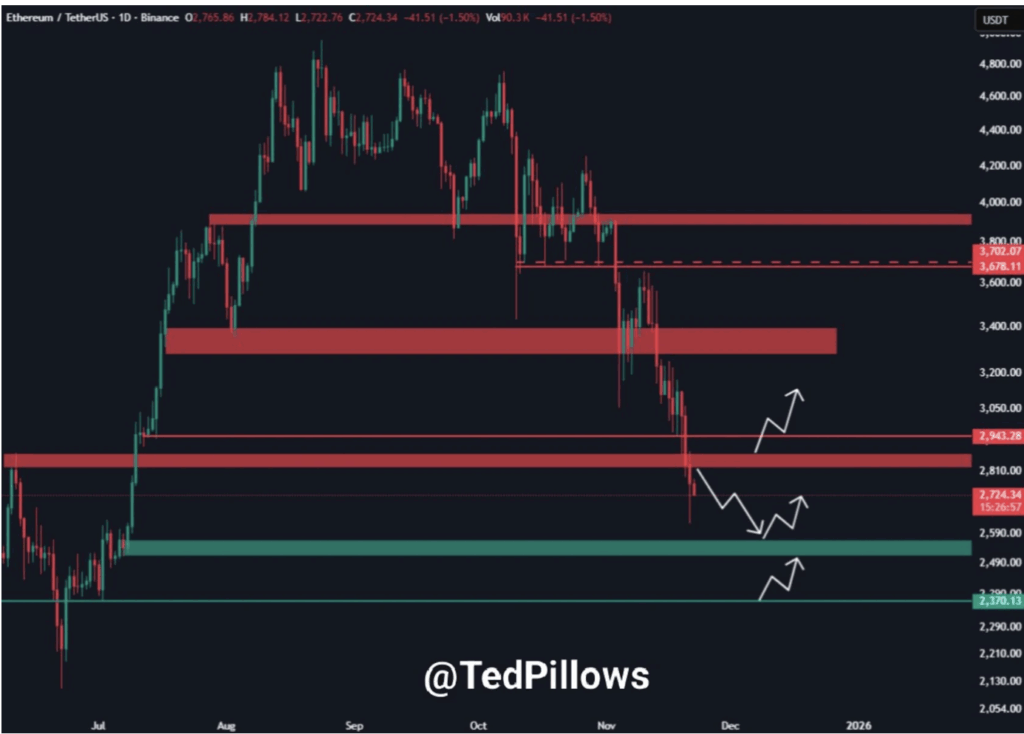

Zooming out to the weekly chart, ETH’s overall trend still looks… well, heavy. The price has fallen far below the 50-week and 100-week moving averages, though it’s still holding above the 200-week MA, which is acting as long-term support. Considering ETH came from a high of $3,981, the decline is still dominant, and the broader downtrend hasn’t structurally reversed yet.

The RSI at 38.65 shows bearish momentum but not oversold conditions — meaning a reversal is possible if sentiment flips. Meanwhile, MACD remains bearish, with a deeply negative reading at -210.00123. The growing histogram bars reinforce ongoing selling pressure, though this sometimes appears right before a trend cools off.

Can ETH finally break $2,800—or is a drop toward $2,500 next?

Yesterday, ETH nearly touched $2,600, but resistance kicked in hard. Now, all eyes are on the $2,800 resistance level. A clean break above that zone would shift short-term sentiment and possibly open the door toward $3,000—a level the market hasn’t tested in a while.

But here’s the other side of that coin:

If ETH fails to reclaim $2,800, momentum could slide back and push the price below $2,500, signaling another leg down. Traders will be watching closely to see whether support or resistance asserts itself in the next few sessions.

This next move—up or down—will likely define Ethereum’s short-term trajectory.