- Canary Capital’s XRPC ETF launched strongly with over $277M in XRP holdings.

- If XRP followed Bitcoin’s 103% ETF-driven yearly growth, its price would hit $4.83.

- Analysts like EGRAG still project much higher long-term targets between $6.5–$27, with an average path around $11.

With the crypto market buzzing over the rise of spot Bitcoin ETFs, XRP holders have started wondering… could XRP experience something similar? The conversation heated up fast after the launch of the Canary Capital XRP ETF (XRPC) — the first-ever spot XRP ETF. Its debut was surprisingly strong, pulling in roughly $245 million in inflows and then adding more over the next two days, bringing its holdings to $277.82 million worth of XRP.

Some users pointed out that XRPC’s first-day performance actually beat BlackRock’s IBIT debut — which pulled in about $111.6 million — though it didn’t maintain the same explosive follow-through IBIT saw afterward. Still, the early results opened the door for one big question: What happens to XRP if ETF inflows ramp up the way Bitcoin’s did?

Could XRP ETFs do for XRP what Bitcoin ETFs did for BTC?

Bitcoin’s ETFs changed everything. A year after launching on Jan. 11, 2024, Bitcoin ETFs had accumulated over $36.2 billion in net inflows. XRP supporters don’t expect XRP ETFs to attract that level of institutional money — XRP is smaller, less dominant, and has a very different market structure.

But here’s the twist:

Because XRP’s market cap is much smaller than Bitcoin’s, it wouldn’t need billions and billions to move the price dramatically. Even moderate inflows could create outsized effects, especially if the ETF narrative catches fire.

What XRP’s price could be if it followed Bitcoin’s ETF trajectory

We looked at Bitcoin’s performance one year after ETF trading began. When IBIT and the other BTC ETFs launched, Bitcoin was trading around $46,678. By Jan. 11, 2025 — exactly one year later — BTC had climbed to $94,975. That’s a 103% increase.

Now apply that same trajectory to XRP:

- When XRPC launched on Nov. 13, 2025, XRP was priced at $2.386.

- If XRP mirrored Bitcoin’s +103% ETF-driven run…

- XRP would reach approximately $4.83 by November 2026.

Not a moonshot, but a new all-time high nonetheless.

Analysts say the real target could be much higher

While $4.83 fits the BTC-style growth model, many XRP analysts argue that a proper bull run — combined with ETF momentum, reduced supply, and macro catalysts — could send XRP far beyond modest projections.

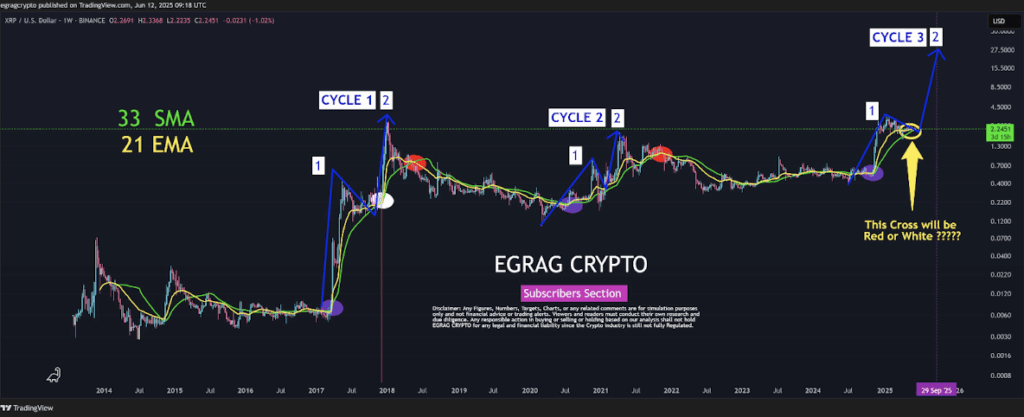

Back in June, market analyst EGRAG outlined targets between $6.5 and $27, depending on which technical model played out.

More recently, he released four XRPBTC simulation paths, each pointing to different long-term outcomes. When averaged together, these simulations place XRP around $11 — a level EGRAG suggested in July was plausible, while noting that $27 “isn’t off the table.”

So while a $4–$5 XRP would match Bitcoin’s ETF-era growth, many in the XRP community believe the next cycle could fuel something far bigger.

The bottom line

If spot XRP ETFs manage even a fraction of the traction Bitcoin’s did, XRP could easily set a new ATH around $4.8… but the more aggressive models still point sharply higher. Whether those upper targets ever hit depends on liquidity, macro trends, ETF flows, and of course, investor conviction — all things XRP holders will be watching closely over the next year.