- LINK reserves climbed to $11M, with steady accumulation showing no major outflows for months.

- Chainlink remains a core infrastructure layer across DeFi, enterprise systems, and multichain environments.

- Growing reserves and rising ecosystem reliance may signal long-term confidence despite short-term price stagnation.

Chainlink has been quietly stacking reserves this month, with the LINK reserve climbing to about $11 million—something that caught the eye of analysts who’ve been tracking the project’s underlying activity. LINK traded near $13.42 earlier in the day before slipping to around $12.94 as Bitcoin suddenly plunged under the $90,000 mark. The move pushed LINK about 6.65% lower in 24 hours, giving it a market cap close to $9.01 billion. Trading volume jumped sharply to $739.32 million, up nearly 28% from the previous day, which usually suggests traders are reacting to more than just price noise.

With 696.84 million LINK circulating out of its one billion max supply, the token’s movements this week fit into a larger conversation about Chainlink’s place in the broader crypto stack. Many analysts pointed out that Chainlink has become a backbone for countless on-chain systems—almost every major app seems to rely on it before going live. That’s because it handles price feeds, cross-chain messaging, private computation, compliance tools, and links to traditional financial systems. A lot of the value DeFi secures flows through Chainlink’s rails. Despite that, LINK itself kept trading in a narrow zone, showing no major push in either direction.

Rising LINK reserves hint at long-term confidence

One of the more interesting updates came from a Chainlink dashboard showing the reserve has now reached $11 million. The reserve currently holds about 803,388 LINK at an average cost basis of $20.06. The chart revealed steady accumulation from early August to early November—no sharp drops, no sudden liquidations, just a slow, consistent build.

People tend to pay attention when reserves grow like this because it gives a pretty clear view of how resources inside the ecosystem are shifting. A rising reserve suggests new inflows and, potentially, a quiet form of long-term confidence. Some traders argued that if this trend continues, it could influence expectations over time—even if it doesn’t guarantee any short-term price action. Others simply noted that the steady rise adds another piece to the puzzle: a picture of increasing activity around the network.

Chainlink’s role expands as the multichain world gets noisy

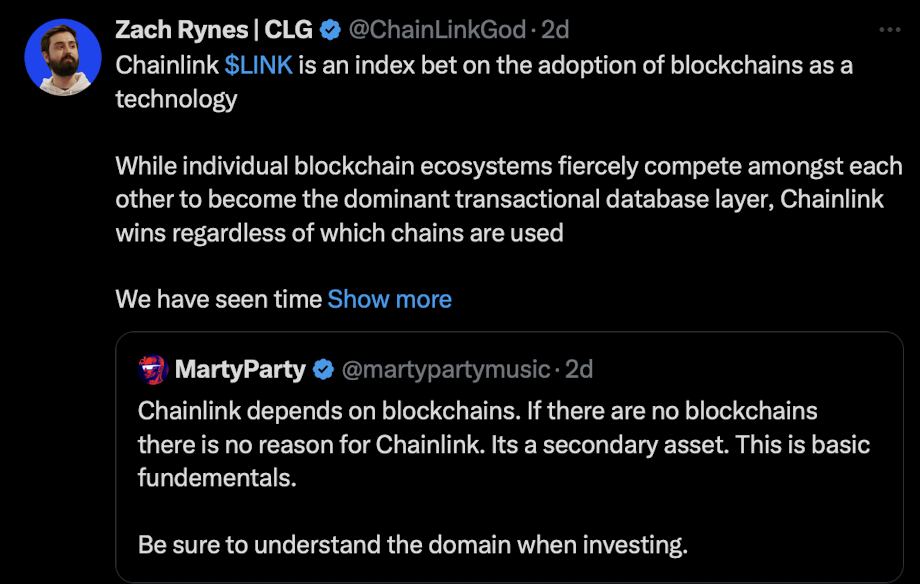

Another layer of the discussion revolved around how Chainlink fits into a multichain environment that grows more chaotic by the month. Supporters stressed that Chainlink isn’t tied to just one virtual machine—it works across EVM chains, SVM chains, MoveVM chains, and the list keeps expanding. That versatility is why people call it blockchain agnostic. It’s built to connect ecosystems that normally don’t talk to each other.

As new blockchains launch, each brings its own isolated environment that needs secure data feeds, cross-chain movement, and infrastructure that actually works in complex environments. Industry voices have been calling Chainlink a kind of “global orchestration layer,” able to connect both on-chain and off-chain systems through consistent standards.

A bigger picture that ties everything together

Observers linked these broad capabilities—price feeds, cross-chain tools, enterprise integrations, DeFi security—to the rising reserve numbers. The idea is simple: if Chainlink continues to sit at the center of more blockchain systems, more financial institutions, and more cross-network infrastructure, then increased accumulation inside its reserves isn’t surprising. It’s part of a longer story forming quietly in the background, even as LINK’s price looks indecisive in the short term.