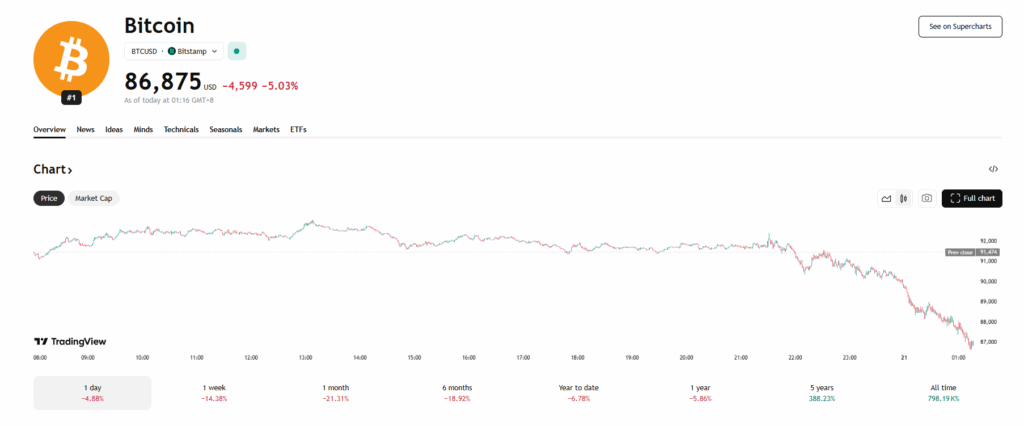

- Bitcoin is down nearly 30% from its peak and trading near $92,783.

- Rate-cut odds collapsing to 33% have dragged sentiment sharply lower.

- Key levels: resistance at $93K, support at $89K as BTC enters consolidation.

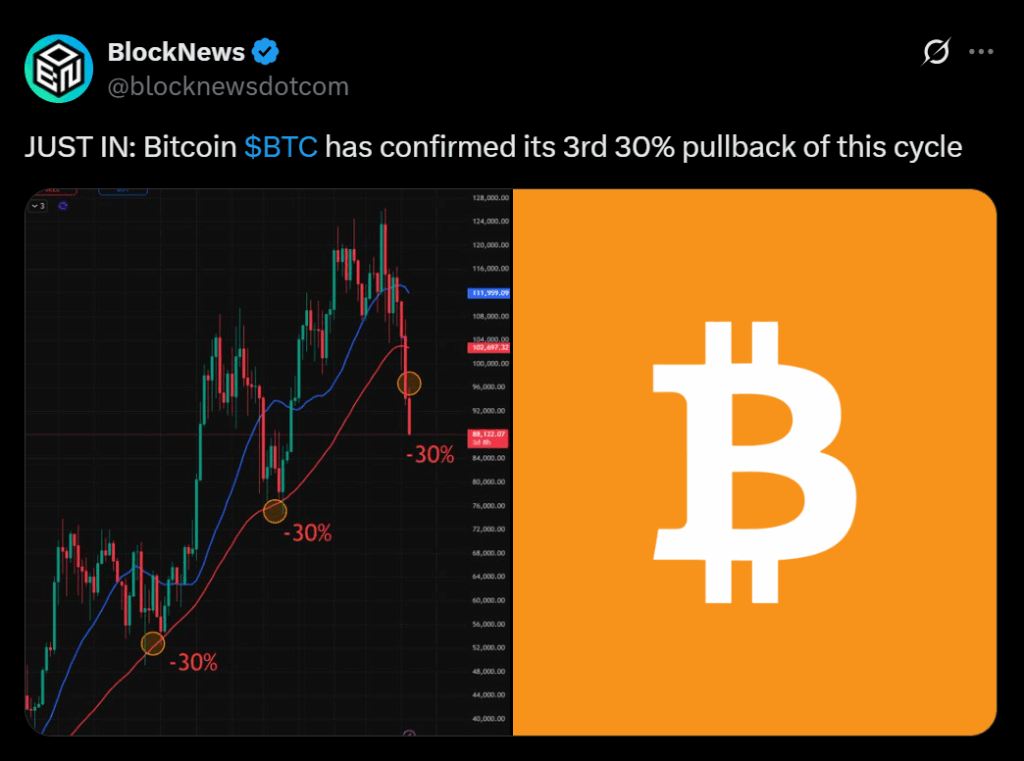

Bitcoin has now fallen nearly 30% from its all-time high above $126,000, erasing nearly a year of gains and contributing to more than $1 trillion in total crypto-market losses over the past few weeks. The asset traded around $92,783 on Thursday, posting a mild 2% rebound over the last 24 hours but still sitting deep within its month-long downtrend.

Analysts say BTC’s drop mirrors fading sentiment across the entire market, with traders shifting into caution as macro pressure intensifies. Many large funds have paused new inflows into Bitcoin after weeks of heavy selling, although long-term institutional holders continue to sit on their exposure rather than fully exiting positions.

Market Pressure Builds as Macro Conditions Shift

According to market desks, Bitcoin’s 15% slide over the past 30 days reflects a combination of cooling ETF inflows, shrinking liquidity, and the collapse of expectations for a December Fed rate cut. The odds of a rate cut have now fallen to roughly 33%, a steep reversal from the near-certainty traders priced in just a month ago.

That shift has weighed on Bitcoin sharply. Short-term holders sent more than 65,000 BTC to exchanges at a loss this week, increasing sell-side pressure. Despite that, on-chain activity remains strong, with more than $6 billion in daily transactions signaling that network usage remains healthy even during the downturn.

Key Levels to Watch in the Coming Days

Traders now see $93,000 as immediate resistance, a level BTC has struggled to reclaim after slipping below it earlier this week. Support remains near $89,000, the zone where buyers stepped in after BTC briefly revisited the $89,500 range.

Some analysts warn that liquidity remains thin, meaning any new wave of selling could force Bitcoin to revisit the mid-$80,000 range. Others argue that consolidation is the logical next phase, especially with long-term models still calling for higher peaks into 2025 if macro conditions stabilize.

Analyst Outlook: Consolidation or Deeper Correction?

While some experts believe Bitcoin could hold between $92K and $125K if institutional demand improves, the downside remains in play. Analysts note that a pullback toward $78K–$84K is possible if liquidity tightens or rate-cut expectations decline further.

The broader consensus suggests that Bitcoin is entering a consolidation window, with long-term projections still favoring a climb toward new highs — potentially $175,000 by late 2025 — if favorable macro conditions return.