- Grayscale’s proposed Dogecoin ETF could launch by Nov. 24, 2025, becoming the first memecoin ETF in the U.S.

- DOGE is deeply in the red across all major timeframes, and the broader market remains fragile and risk-averse.

- A DOGE ETF would be a major milestone and could drive hype and access, but it may not guarantee an immediate price rally in this environment.

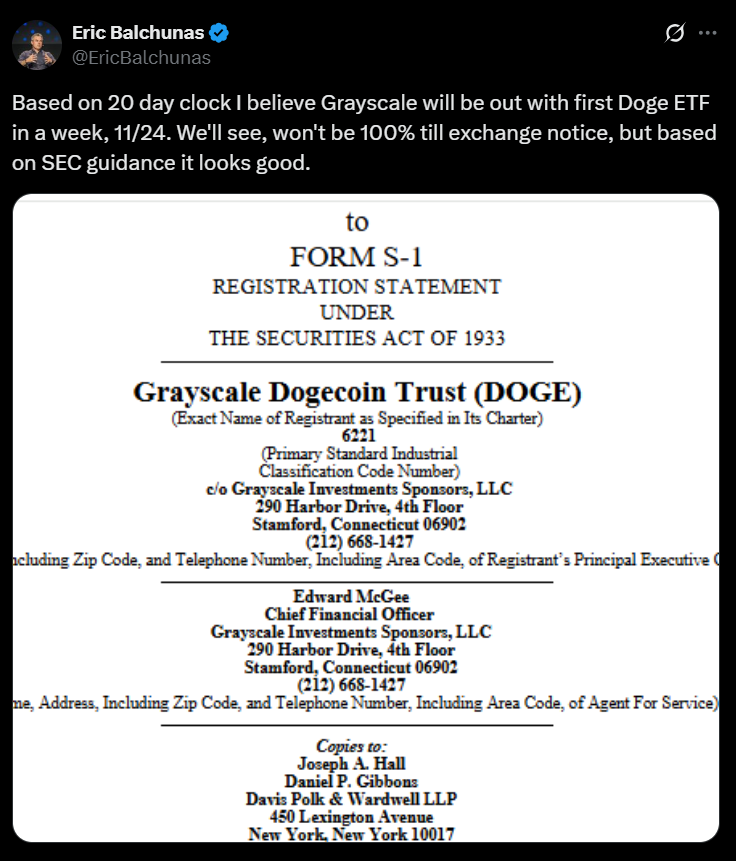

According to Bloomberg ETF analyst Eric Balchunas, Grayscale’s proposed Dogecoin ETF could hit the market as early as Nov. 24, 2025. He’s not “100%” certain, but says that based on current SEC signals, the odds look pretty good. If this thing goes live, it would become the first memecoin ETF in the U.S. — a pretty wild milestone for a coin that started as a joke. The big question, though, is simple: does an ETF actually help DOGE moon again, or is this just another headline in a rough market?

How Previous Crypto ETFs Performed

ETFs have already played a huge role in pushing both Bitcoin and Ethereum to new highs, but their stories unfolded very differently. Bitcoin exploded almost immediately after its spot ETF debut in 2024, printing multiple all-time highs in rapid succession. Ethereum, on the other hand, needed close to a year before its ETF-driven momentum really showed up in price. Then you have Solana: its own ETF launch grabbed attention, but the underlying SOL price didn’t exactly go vertical afterward. So even with strong products, nothing is guaranteed — and it’s not obvious which path Dogecoin would follow, if any.

Why a DOGE ETF Might Not Pump Right Away

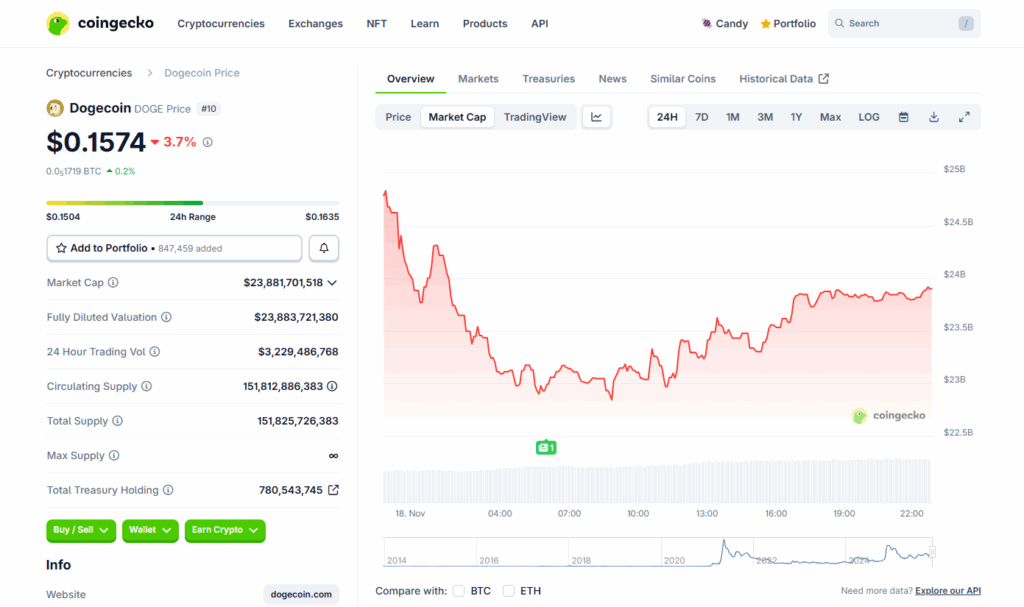

Dogecoin is already under pressure. Over the past 24 hours it’s down around 3.1%, 11.4% over the last week, 4.3% in the past 14 days, 16.2% over the previous month, and a brutal 58.2% since November 2024. On top of that, the broader crypto market feels fragile. Investors are nervous, liquidity is patchy, and a lot of big players are stepping back from high-volatility bets. DOGE, as a memecoin, automatically sits higher on the risk ladder. In that kind of environment, even a shiny new ETF might not be enough to trigger a sustained rally right away — at least not without a cleaner macro backdrop.

What a Dogecoin ETF Would Still Change

Even if the price doesn’t rip out of the gate, a Dogecoin ETF would still be a huge symbolic moment for both crypto and traditional finance. A memecoin getting wrapped into a regulated, exchange-traded product is something most people would’ve laughed off a few years ago. It makes DOGE accessible to a totally different crowd: people who don’t want to mess with wallets, exchanges, or custody, but are happy to click “buy” in a brokerage account. And here is where the real impact could show up over time — hype alone can drive fresh inflows, especially if the ETF becomes a cultural talking point the way DOGE itself once did.

Could Hype Alone Carry It?

Memecoins live and die on narrative. If the ETF becomes a meme in its own right — “the first memecoin ETF,” “Wall Street finally listing the dog,” and so on — you could easily see a wave of speculative interest roll in. But without stronger risk appetite and a healthier market, any big move might fade just as fast. For now, the setup looks like this: structurally bullish in the long term, but shaky in the short term. The ETF, if it launches on schedule, might be the start of Dogecoin’s next chapter, just not necessarily the instant comeback some people are hoping for.