- Franklin Templeton’s EZRP XRP ETF launches today, marking the largest institutional entry into XRP so far.

- XRP is trading near $2.24, with volume up 70% as interest surges around ETF-driven momentum.

- A multi-day wave of XRP ETF launches is underway, signaling regulatory approval and strong institutional demand.

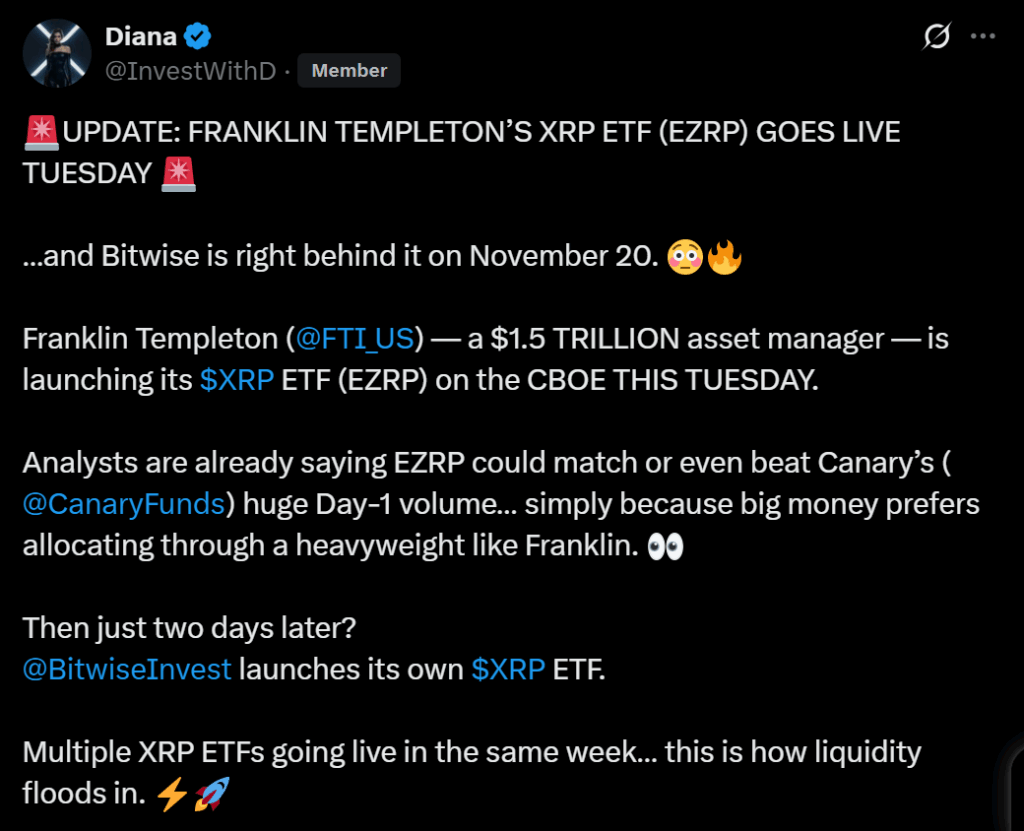

The long-awaited XRP ETF from Franklin Templeton is officially launching today, November 18, 2025 — and the timing couldn’t be more dramatic for the crypto market. The $1.5 trillion asset manager is debuting its Ripple-based EZRP fund on the Chicago Board Options Exchange, arriving just days after Canary Capital’s XRPC ETF shocked the market with $247 million in first-day inflows. Momentum around institutional XRP products is accelerating faster than anyone expected, and analysts are already rewriting their forecasts.

Franklin Templeton Enters the XRP Arena — A Historic Shift in Wall Street Positioning

This launch marks Franklin Templeton’s first direct step into the XRP ETF space — a massive leap considering Canary’s inaugural fund was backed by only $20 billion in assets under management. Franklin Templeton, by comparison, controls over $1.5 trillion. Their involvement signals a clear shift: XRP is no longer being viewed as just a remittance token but as a legitimate institutional-grade asset worthy of regulated exposure.

One ETF analyst highlighted how strong demand has already been for XRP-based products, noting that Canary’s debut logged the highest day-one volume of any ETF this year — narrowly edging out Solana’s own launch. With EZRP going live today, expectations are even higher for stronger inflows and broader institutional participation.

XRP Price Reaction: Momentum Finally Returning

XRP is trading near $2.24, up roughly 2% over the last 24 hours with daily trading volume spiking nearly 70%. Many analysts believe Franklin Templeton’s ETF could become the trigger XRP needed after several weeks of downward pressure across the crypto market.

Some traders point out that XRP has broken above weekly Bollinger Bands — often an early signal of renewed upside momentum — and suggest that a push toward $3 is possible if current support holds. Others are even revising forecasts into the $4–$5 range if institutional capital continues pouring in.

Multiple XRP ETFs Are Launching This Week — A Rare Institutional Wave

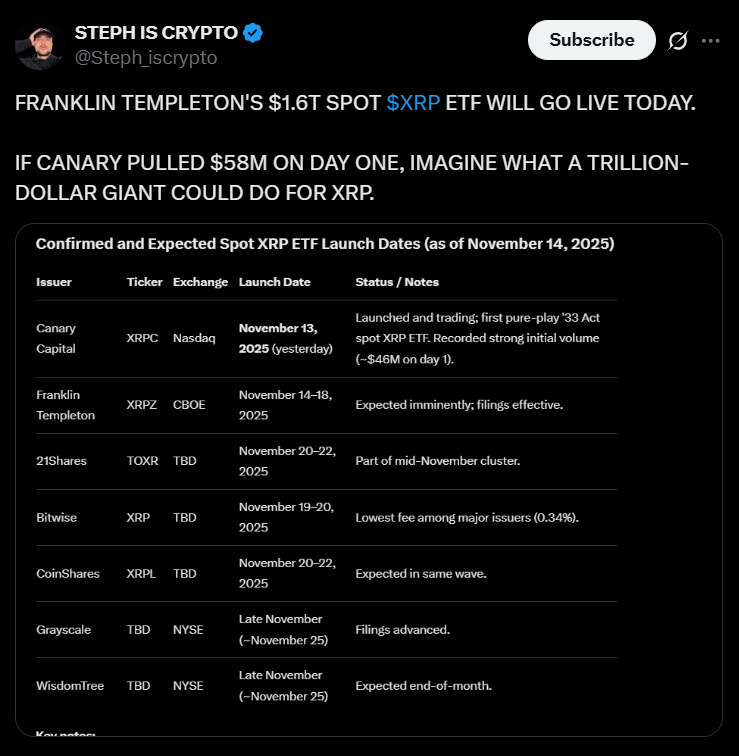

Franklin Templeton isn’t alone. A coordinated, multi-day stretch of XRP ETF launches is hitting the market:

- Bitwise on November 20

- 21Shares on November 21

- CoinShares and Grayscale on November 22

This type of rollout is extremely rare and suggests regulators have greenlit the entire ETF class at once. That’s a powerful indication that XRP is entering a new regulatory chapter — one that provides more clarity, stronger guardrails, and fewer barriers for institutional money.

Why This Launch Matters for XRP’s Future

The timing is striking. The U.S. government has just reopened after a record shutdown, markets are shaky, and investors are repositioning in the face of rising national debt and macro uncertainty. As risk appetite rebuilds slowly, regulated crypto products — especially ETFs tied to established assets like XRP — are drawing fresh attention.