- BitMine Immersion named Chi Tsang as its new CEO, replacing longtime leader Jonathan Bates.

- The company added three new independent board members as part of a broader leadership expansion.

- BMNR continues its aggressive ETH accumulation strategy, now holding 3.5 million ETH and aiming for 5% of all circulating supply.

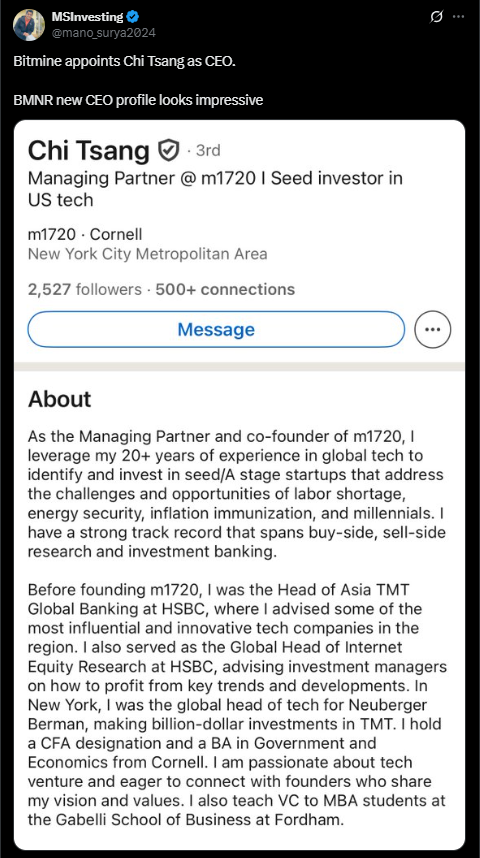

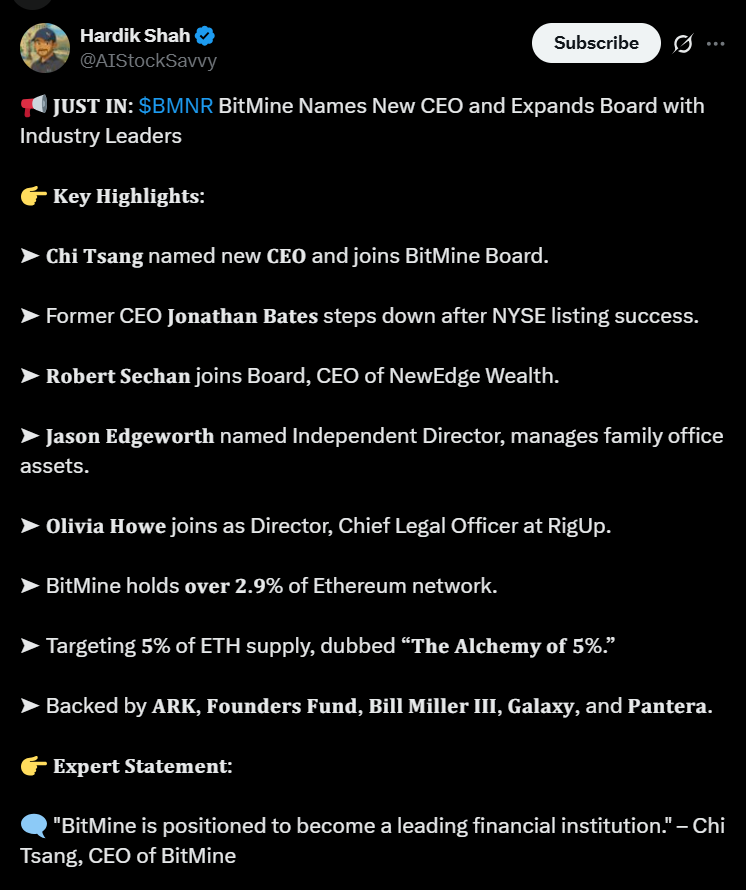

BitMine Immersion (BMNR), known as the largest corporate holder of Ethereum, announced a major leadership shift on Friday. The firm appointed Chi Tsang as its new CEO, replacing Jonathan Bates, who guided the company from its early beginnings all the way through its NYSE American listing. The timing comes as the broader crypto market continues to slide, putting extra pressure on ETH, which dropped nearly 9% in the last 24 hours and now sits about 6% down for the year.

Leadership Reshuffle and New Board Appointments

Alongside its new chief executive, BitMine Immersion has added three fresh independent board members. These include Robert Sechan, the founder of NewEdge Capital Group, Olivia Howe, chief legal officer at RigUp, and Jason Edgeworth, an asset manager with JPD Family Holdings. All appointments take effect immediately, reflecting a fast-moving shift in the company’s core leadership structure.

BMNR’s Aggressive Ethereum Strategy

Formerly a bitcoin mining firm, BMNR surprised the market earlier this year by pivoting toward an Ethereum-focused digital asset treasury strategy. With Wall Street veteran Thomas Lee as chairman, the firm aggressively accumulated 3.5 million ETH since July. This makes BMNR the second-largest ETH holder in the world, trailing only Michael Saylor’s Strategy. Their long-term goal is ambitious: securing 5% of Ethereum’s circulating supply, up from the current 2.9%.

Stock Pressure Continues as the Market Turns Red

Despite the leadership news, BMNR stock has not been spared by the ongoing market correction. Shares slid another 4.5% pre-market to $35 after dropping nearly 10% on Thursday. As digital asset treasuries face mounting pressure, BMNR’s price has mirrored the broader slump. But here is why this moment matters: the company’s significant ETH bet positions it in a unique place once markets stabilize and institutional demand begins rising again.