- Bitcoin weakens under $100K as U.S. trading-hour selling continues.

- Traders debate whether shutdown drama or broader sentiment is to blame.

- Crypto stocks tumble, and analysts warn 2025 highs may already be in.

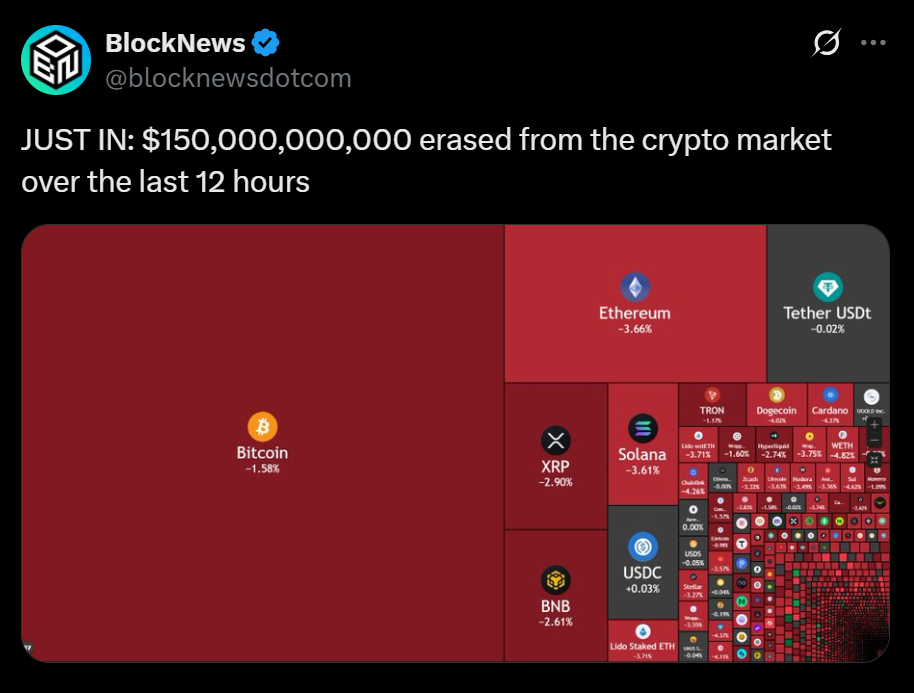

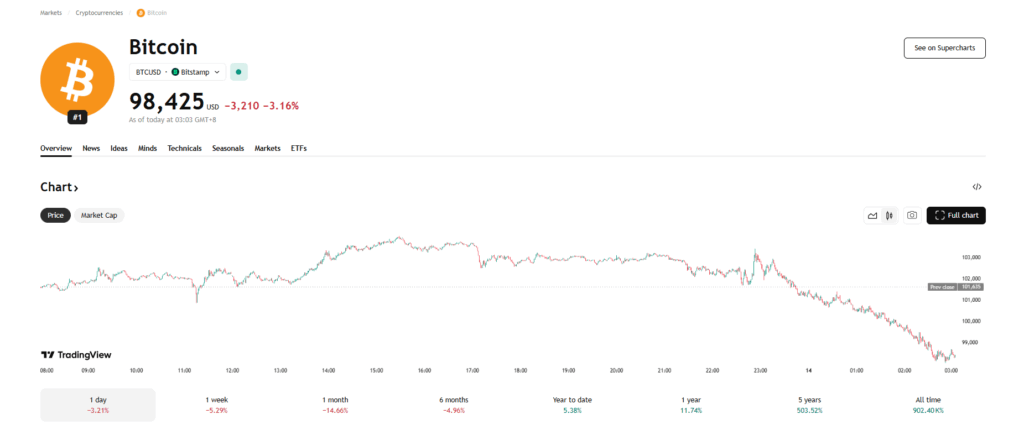

Bitcoin broke below $100,000 again on Thursday, repeating a pattern traders are getting used to: strength during overnight sessions, followed by sharp weakness the moment U.S. trading opens. The liquidity environment has tightened significantly, and the temporary government funding patch hasn’t eased market stress. While headlines say the shutdown “ended,” traders know it’s only a stopgap that kicks the problem into early 2026 — and that lingering uncertainty continues to pressure risk assets.

Traders Split Over Shutdown Impact and Market Sentiment

Debate across X has intensified. Some analysts argue the market is reacting to the shutdown on a delay, claiming the budget extension doesn’t solve anything long-term and that investors are waking up to the lack of a real fix. Others disagree, saying the shutdown wasn’t a meaningful driver in the first place. Instead, they point to weeks of soft sentiment, persistent macro headwinds, and a brief rally earlier this week that was fueled more by emotion than fundamentals. Either way, traders agree the market tone is tired — and that Bitcoin needs clear catalysts before regaining momentum.

Crypto Stocks Hit Hard as Analysts Question 2025 Highs

The biggest damage wasn’t in Bitcoin, but in crypto-linked equities. Miners such as Bitdeer, Bitfarms, Cipher and IREN plunged 10%–19%, while Galaxy, Bullish, Gemini and Robinhood all booked steep declines. With the probability of a December Fed rate cut now split nearly 50/50, the risk-off tone has accelerated. Some analysts believe the highs for 2025 may already be behind us, unless liquidity rebounds quickly. On the bright side, strategists note that spending could increase heading into next year, potentially breathing life back into risk markets once political uncertainty clears.