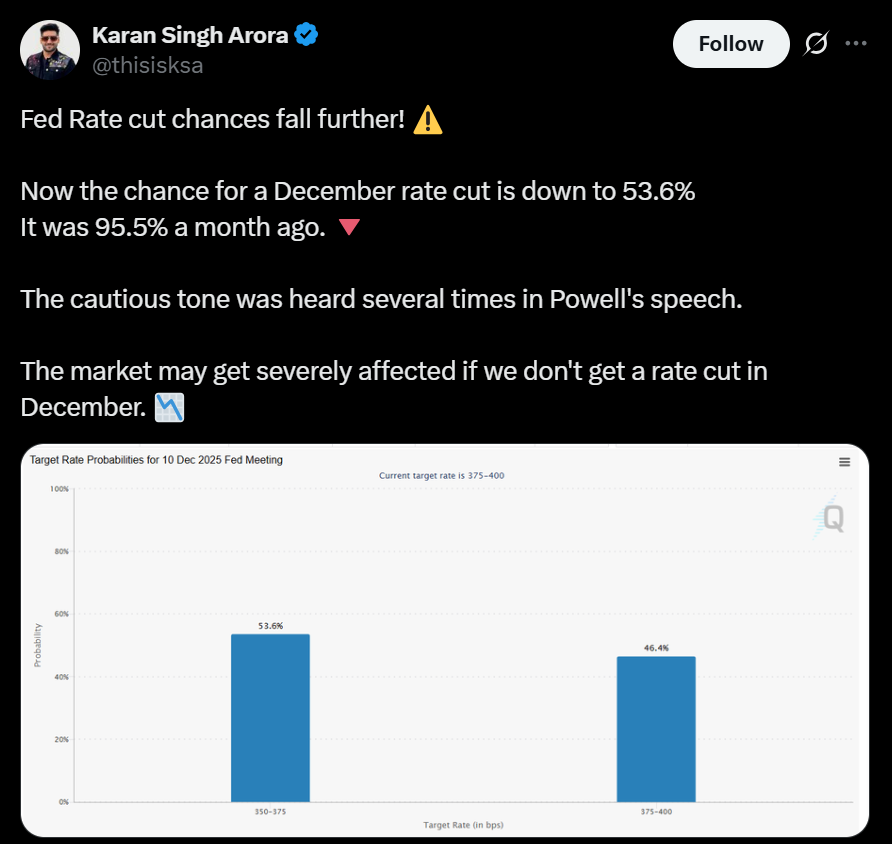

- Odds of a December Fed rate cut have fallen to 52%, down from 95% a month earlier.

- A cut would lower the benchmark rate range to 3.5%–3.75%.

- Reduced expectations for easing may continue to limit upside in bitcoin and other crypto assets.

Investor confidence in a December Federal Reserve rate cut has slipped dramatically, with odds dropping to about 52% according to CME’s FedWatch tool. Just a month ago, markets were almost certain a cut was coming, pricing the probability near 95%. Even last week, expectations were sitting comfortably above 60%. Now, with the Dec. 10 meeting approaching, uncertainty is rising fast. If the Fed does move forward with a cut, the benchmark range would fall to 3.5%–3.75%, marking another step in its gradual pivot away from tight policy.

Why Markets Are Rethinking the December Cut

The shift reflects growing caution across financial markets as investors weigh mixed economic signals. While inflation has cooled from last year’s highs, policymakers remain divided on whether conditions justify a cut before year-end. Traders are now treating December as a true toss-up, bracing for a scenario where the Fed delays easing until early 2026. That hesitation is already visible in bond yields, futures positioning, and broader risk-asset sentiment.

Impact on Bitcoin and the Crypto Market

The fading probability of a December rate cut is creating a headwind for cryptocurrencies, which typically benefit from looser financial conditions. With uncertainty rising, BTC has stalled near $103,000, showing little movement as traders wait for clearer signals. A confirmed rate cut could revive risk appetite and offer a short-term boost to crypto, but a delay may keep gains muted or trigger further consolidation. Until the Fed provides clarity, the market is likely to remain cautious.