- Ripple CEO Brad Garlinghouse told CNBC the company is actively targeting traditional finance, using blockchain and Web3 tools to deliver crypto-enabled solutions to legacy institutions.

- XRP remains central to Ripple’s strategy, with growing utility through institutional collaborations and a clear focus on scaling products that keep the token at the core of the ecosystem.

- With potential SEC approval for XRP ETFs on the horizon, institutional inflows could significantly boost XRP’s profile, as the token trades near $2.40 amid rising ETF and TradFi integration buzz.

Ripple Labs is no longer positioning itself as just a crypto company — it’s openly aiming at traditional finance. Speaking with CNBC’s Crypto World in New York, CEO Brad Garlinghouse said Ripple’s strategy is to bridge Web3 and legacy financial infrastructure, using blockchain as the backbone for the next era of money movement.

Garlinghouse argued that financial systems built on blockchain rails can disrupt the existing market structure and push global finance into a new phase. His goal, as he put it, is for Ripple to “invest in the future and get ahead of where that market’s going,” by buying and building assets on the traditional finance side, then layering crypto-enabled solutions on top.

In short, Ripple doesn’t just want to coexist with banks and asset managers — it wants to become a financial services powerhouse that they simply can’t ignore.

XRP at the Center of Ripple’s Institutional Push

Garlinghouse highlighted that several major asset managers and global banks are already working with Ripple on fintech and cross-border settlement solutions. He described a shift “happening in real time,” where the United States has moved from “leaning out on crypto” to “leaning in”, and warned that many people still underestimate how big that pivot really is.

Within that shift, XRP sits at the core of Ripple’s strategy. Every new product, payment rail, or institutional integration is designed to pull more utility through the XRP ecosystem. As Garlinghouse put it, “the more we can build utility and really scale solutions that take advantage of XRP at the core, the more that will be uniquely good for the XRP ecosystem.”

That framing puts XRP not just as a speculative token, but as infrastructure for Ripple’s institutional products — a key narrative as capital flows increasingly favor assets with visible real-world use.

XRP ETF Hopes Raise the Stakes

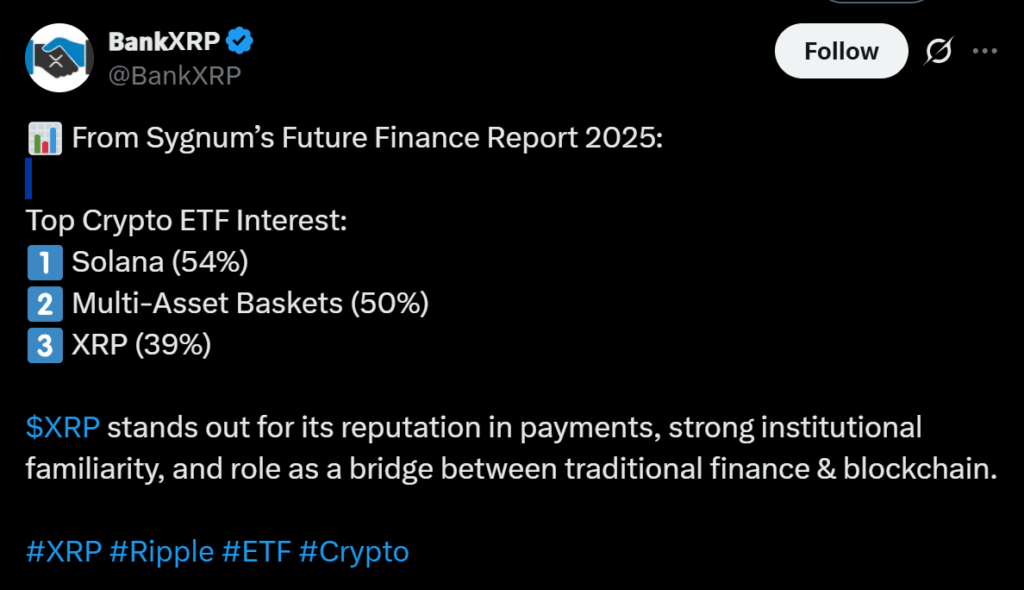

All of this is happening as XRP inches closer to potential SEC approval for spot XRP ETFs. Multiple asset managers with trillions in assets under management are circling the space, and an approved ETF could open the door for large-scale institutional allocations that were previously hard to access.

If greenlit, XRP could see a significant influx of institutional funds, reshaping how it trades and where it sits in the broader crypto rankings. For Ripple, an ETF would effectively plug XRP deeper into the traditional toolkit of portfolio managers, tying directly back into the company’s plan to blend Web3 rails with legacy finance.

As of Wednesday, XRP is trading around the $2.40 level, with sentiment increasingly driven by this mix of institutional partnerships, ETF anticipation, and Ripple’s louder push into traditional finance.