- UNIfication finally turns on Uniswap’s protocol fees after five years, adds a deflationary burn model, and even merges Labs with the Foundation, triggering a 44% one-day surge in UNI’s price.

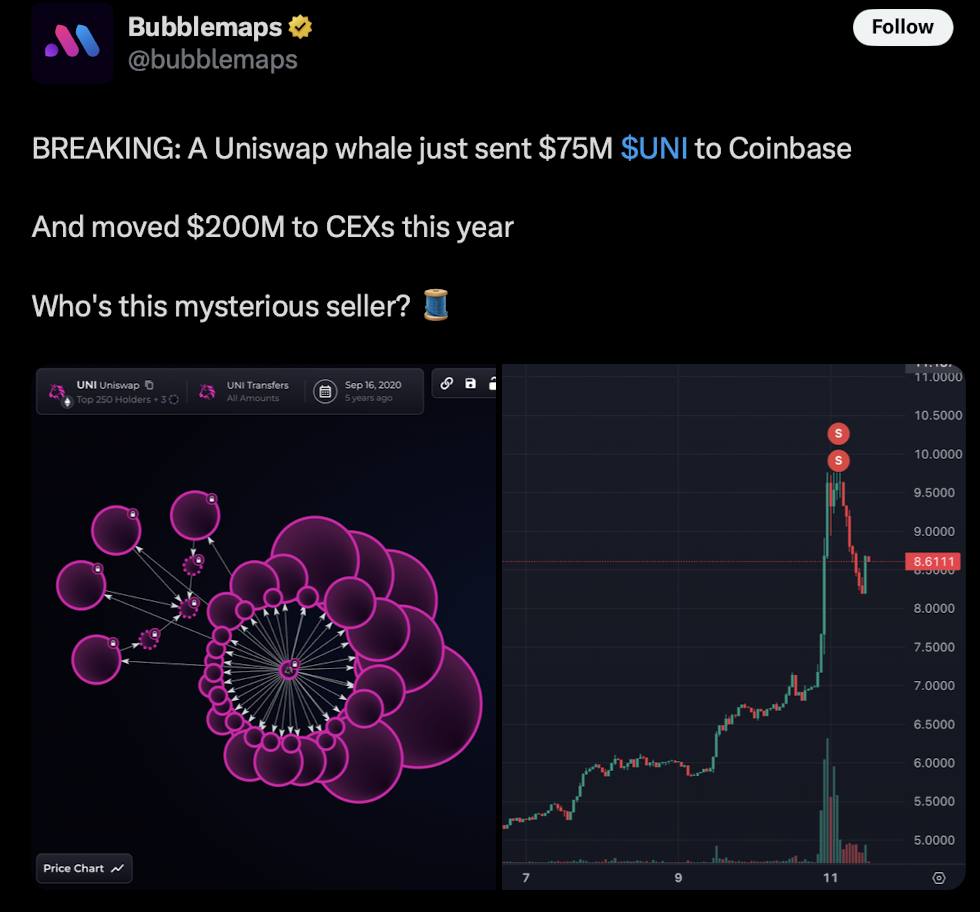

- On-chain sleuths tracked a 2020-era whale cluster that moved roughly $200 million in UNI to exchanges in 2025, including a $75 million dump perfectly timed with the UNIfication pump, raising serious insider-dump suspicions.

- While the proposal boosts value capture for UNI holders via fee burns, critics warn of a potential “death spiral” for LPs and growing centralization risk, arguing the rally looks more like distribution by early whales than organic long-term growth.

Uniswap’s UNI token ripped about 44% in just 24 hours after founder Hayden Adams rolled out a new governance proposal called “UNIfication” on November 10. On the surface, the story sounds clean and bullish: after five years of operation, Uniswap finally moves to activate protocol fees, introduce a deflationary burn, and tighten the relationship between Uniswap Labs and the Uniswap Foundation. The plan includes turning on protocol fees for the first time, burning 100 million UNI from the treasury, and basically reshaping how value flows back to token holders. It’s no surprise the market reacted fast. But in the middle of all that hype, some very old money quietly headed for the exit.

A 2020-era whale that “knew too much”

Behind the scenes, on-chain data started flagging a 2020-era whale that, frankly, seemed to know way too much at exactly the right time. Using Bubblemaps analysis, researchers traced four wallets that were originally funded from Uniswap’s investor contract back in 2020. These wallets were all tied to a single Coinbase deposit address and together funneled 36 million UNI into exchanges. That’s a serious stack.

In 2025 alone, this same entity has already shipped roughly $200 million worth of UNI to exchanges. On May 14, they sold 12 million tokens. Then, on November 10, just hours before Adams’ UNIfication announcement, another 9 million UNI hit the market. And right as the proposal pumped price and trading volume, the whale sent in a final blast — around $75 million worth — perfectly synced with the surge. Hard to call that “random,” honestly.

More whales rushing for the exit

It didn’t stop with just one entity either. Lookonchain picked up more suspicious flows around the same window. One whale moved 2.8 million UNI into Coinbase Prime minutes after the proposal went public, almost like they’d been waiting for that exact headline. Another long-term holder decided to send 1.7 million UNI (around $15 million) to Binance, even locking in a $1.45 million loss just to exit into the strength.

On X, the reaction was blunt. One user summed it up as: whales pump UNI and retail lines up to get dumped on. Others called it exactly what it looked like to them: “not accumulation, but distribution with a storyline,” and “the perfect narrative to exit on.”

What UNIfication actually changes

Underneath all the drama, UNIfication itself is actually a huge shift for Uniswap. For years, the protocol generated billions in fees for liquidity providers without directing anything explicitly to UNI holders. The new proposal flips that logic.

It introduces protocol fees that skim around 16.7–25% of LP fees on Uniswap v3 pools, plus 0.05% on v2. Instead of going into some treasury to sit around, all these captured fees are used to buy and burn UNI, creating a continuous deflationary pressure. On top of that, there’s a one-time burn of 100 million tokens from the treasury, and based on current volumes, ongoing monthly burns could hit something like $38 million.

With v4, Uniswap is also talking about “aggregator hooks” to capture external revenue and auctions that let traders bid for discount windows with lower or zero protocol fees. On paper, it’s a pretty powerful value-capture upgrade for token holders.

Distribution disguised as growth

The result? Trading volume exploded over 500% to roughly $4 billion, sending UNI to around $9 and pushing market cap to about $5.6 billion. That’s the bullish, headline-friendly part. But when you stack that against the roughly $200 million in UNI that whale clusters have pushed onto exchanges this year, the picture starts to look less like pure organic growth and more like a carefully timed exit.

Critics worry that siphoning 16.7% of LP fees to token burns could eventually create a “death spiral” for liquidity providers, who might feel their returns getting squeezed. There are also rising concerns that merging Labs and the Foundation under a five-person board led by Adams increases centralization risk, even as the proposal claims to create more value for holders.

So, UNIfication does what UNI holders have been asking for: it finally gives them a direct value loop via protocol fees and burns. But if the on-chain data is anything to go by, the first group to really cash in on that excitement weren’t smallholders or late buyers — it was well-positioned insiders and early whales using the perfect narrative to lighten their bags into a freshly pumped market.