- XRP rallied around 12% to roughly $2.56 as 11 XRP ETFs from issuers like Bitwise, 21Shares, and ProShares appeared on the DTCC website, fueling fresh spot ETF speculation.

- The end of the U.S. government shutdown is boosting risk appetite, adding macro support to XRP’s ETF-driven price move.

- Analysts like Ali Martinez and Egrag Crypto are eyeing long-term targets between $6 and as high as $10–$30 if ETF momentum and historical breakout patterns repeat.

The XRP ETF story just got a lot louder. Buzz around XRP leading the next ETF wave has been simmering for weeks, but it’s now boiling over after multiple XRP ETF listings appeared on the DTCC website. That development helped spark the latest surge in XRP’s price, with the token breaking above $2.50 and extending its recent rally.

According to a recent update from CoinMarketCap, XRP jumped around 12% in the last 24 hours, hitting about $2.56, as ETF momentum flipped back into high gear. The current narrative centers on 11 XRP ETFs – including products from Bitwise, 21Shares, and ProShares – showing up in DTCC’s systems, which are often used for pre-launch operational setup. That visibility alone was enough to crank up speculation that the first spot XRP ETF is finally just around the corner.

CMC highlighted that analysts are now openly suggesting that the first XRP ETF could launch this week, which is exactly the kind of headline that tends to pull sidelined traders back into the market. As that chatter spread, XRP reacted fast, rallying sharply and tagging that $2.56 local high.

Shutdown Relief and Risk-On Mood Add Fuel to the Move

The ETF angle isn’t the only thing working in XRP’s favor right now. The end of the U.S. government shutdown is also feeding into the risk-on narrative. With Washington finally moving to reopen federal operations, investors are reading it as a sign that systemic risk is easing and that the worst-case policy outcomes are off the table, at least for now.

That kind of macro relief tends to show up first in higher-beta assets, and crypto is near the top of that list. As confidence slowly returns, capital can rotate back toward more speculative trades, and XRP is perfectly positioned to catch that flow thanks to its ETF narrative and strong social presence.

Put simply, the token is benefitting from a rare combo: a direct catalyst (DTCC ETF listings) plus a broader backdrop of improving sentiment as the shutdown clouds start to clear.

Analysts Map Out Aggressive XRP Upside Targets

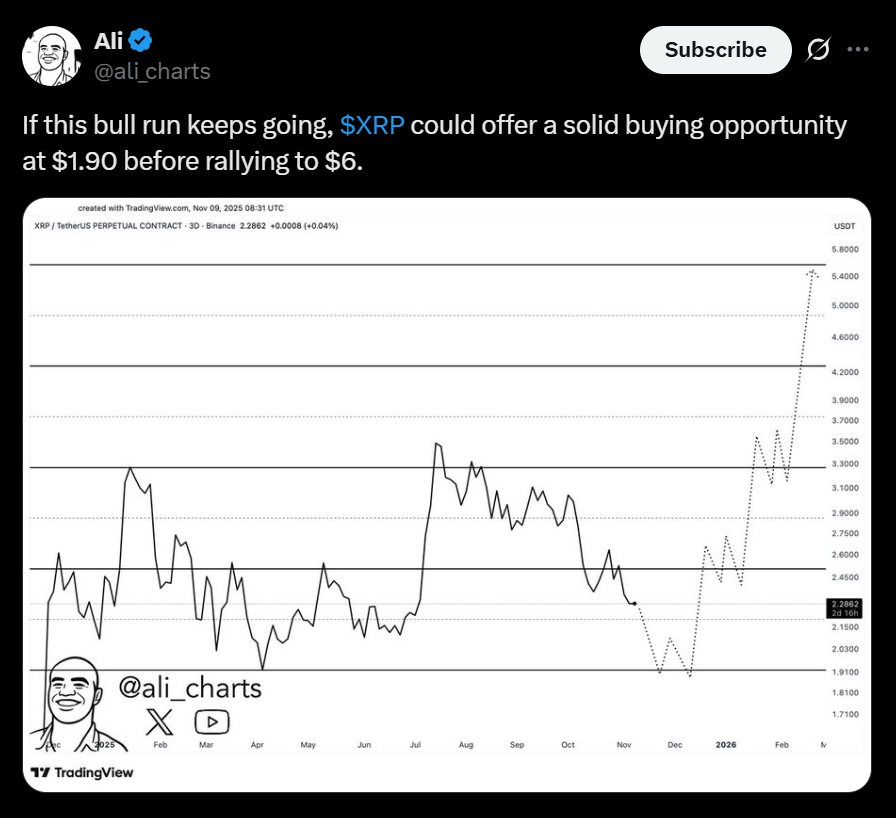

With price momentum picking up, analysts and XRP-focused traders have started dropping fresh targets. Market watcher Ali Martinez has flagged XRP as currently carving out a bullish path that could realistically carry the asset toward the $6 region over the longer term if momentum and ETF flows cooperate.

Another well-known XRP commentator, Egrag Crypto, has taken an even more explosive view. He argues that XRP is lining up for a move reminiscent of its 2017 and 2021 blow-off runs, with a potential target range in the $10 to $30 zone. In his words, if XRP doesn’t soon print a “massive candle” aiming for that area, then doubt is fair—but until then, he remains “ultra bullish,” describing XRP as a coin that “usually melts faces within 4–6 weeks” once it really gets going.

Whether those aggressive targets play out or not, the takeaway is clear: the ETF narrative has reopened the door to big-cycle expectations around XRP. If the first spot XRP ETF does in fact launch in the coming days and attracts meaningful inflows, today’s move above $2.50 could end up being just the opening stage of a much larger trend. If approvals slip or volumes disappoint, though, XRP could see a sharp “sell the news” reset first.

For now, the market is clearly leaning toward the optimistic side of that bet.