- The Trump “tariff dividend” and shutdown optimism trade is fading as the math, details, and messaging around $2,000 payments get softer and more complicated.

- The market was heavily over-leveraged into that narrative, so once sentiment cracked, liquidations across derivatives turned a normal pullback into a $100B flush.

- Legal doubts over Trump’s tariff authority and ongoing U.S.–China trade risks are darkening the macro backdrop, undercutting the stimulus narrative that helped fuel the last rebound.

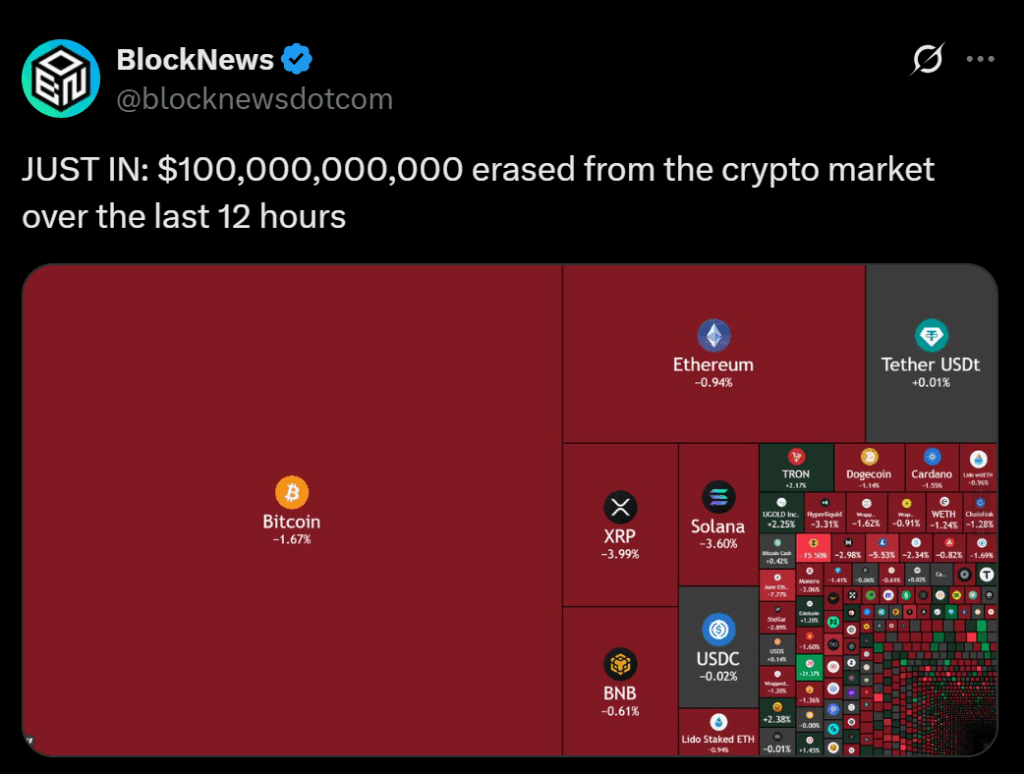

The last 12 hours have been ugly. Roughly $100 billion in crypto market cap has vanished as Bitcoin slipped back toward the low six-figure range and altcoins flipped from green to deep red. What makes this sting more is that it comes right after a strong rebound fueled by two big storylines: Donald Trump’s promised $2,000 “tariff dividend” checks and growing optimism that the record government shutdown would finally be resolved.

For a few days, that mix was textbook “front-run the good news.” Traders priced in stimulus vibes and a clean political off-ramp. Now that narrative is starting to fall apart.

Trump has repeatedly talked up the idea of sending “at least $2,000 per person” to most Americans, funded by tariff revenue on Chinese imports – branding it as a patriotic “tariff dividend.” It spread fast across Crypto Twitter, prediction markets, and headline feeds. But as people dig into the details, the numbers don’t really line up. Current and projected tariff income doesn’t neatly cover that scale of payout, and economists have been quick to point out the huge net cost once you factor in trade distortions and downstream effects.

At the same time, administration voices have begun softening the language. Instead of hard promises of $2,000 checks to nearly everyone, you’re suddenly hearing more about “tax relief,” credits, and targeted support – which is a long way from “free money soon.” That kind of shift is classic buy the rumor, sell the news fuel.

Layer in the shutdown angle and you get the other half of the comedown. Polymarket odds and news chatter moved heavily toward a shutdown-ending deal this week, which markets initially loved. But once a resolution looks likely, the trade flips. The fear around “worst-case shutdown” was already priced in. The relief rally already happened. After that, there just isn’t much fresh good news left to buy.

So the Trump-check + shutdown combo that helped drive the last leg up is now reversing. Today’s dump is basically that narrative getting marked back to reality.

Leverage and Liquidations Turned a Normal Pullback Into a Full Flush

The second driver is structural: too much leverage stacked on top of a shaky story.

After Bitcoin briefly dipped below $100,000 and then snapped back on the policy headlines, traders rushed to “buy the bottom” with size. Longs piled into majors and high-beta names. Tokens like SPX, PUMP, ASTER, XPL and similar speculative plays saw aggressive inflows. Funding rates turned positive across a lot of perpetual pairs, open interest climbed, and suddenly the market was leaning heavily in one direction again.

That left everything fragile. Once spot rolled over and BTC failed to hold higher levels, the dominoes started to fall. As prices slipped, forced liquidations kicked in across derivatives platforms. Over the last day, trackers have flagged hundreds of millions of dollars in positions being auto-closed, heavily skewed toward over-leveraged longs. Altcoins, where order books are thinner and depth is shallow, took the hardest hit.

Every leg down triggered more margin calls and more forced selling. As exchanges liquidated positions, that extra sell pressure pushed prices lower, which then tripped the next batch of stops.

This is how you get from “healthy pullback” to $100 billion erased in 12 hours without some single catastrophic headline. Fundamentally, not much changed overnight. Structurally, though, the market was loaded with leveraged bets on a narrative that couldn’t carry the weight. Once sentiment cracked, the mechanics of leverage did the rest.

Legal and Trade Overhang: Supreme Court Tariff Risk and China Tensions

The third big piece sits where law, policy, and macro collide: uncertainty around Trump’s tariff authority and the broader U.S.–China relationship.

While social feeds were focused on “tariff dividends,” legal and policy circles were locked on the Supreme Court’s growing skepticism about how far presidents can stretch old emergency and trade laws to impose sweeping global tariffs. Several justices have already signaled discomfort with using decades-old statutes as a blank check for massive trade actions.

If the Court ultimately narrows or rolls back that authority, it could limit future tariff revenue, punch holes in the funding logic behind “tariff checks,” and even raise the possibility of refund questions around existing duties. Markets hate that kind of legal overhang – especially when it directly touches one of the core narratives that just pumped prices.

On top of that, the China angle is still hot. Even as officials talk about stabilizing supply chains, Beijing has plenty of levers it can pull if it feels the U.S. is overreaching: export controls on critical materials, tech restrictions, regulatory pressure on American companies operating in China, and so on. Each time headlines hint at renewed friction, global risk appetite tightens. Equities wobble, credit spreads widen a bit, and high-beta corners like crypto get hit first and hardest.

Put together, this creates a macro backdrop where legal risk + trade uncertainty sit directly under the market’s favorite short-term story – tariff-funded support and “easy” stimulus. As those risks get louder, traders don’t wait around for perfect clarity. They de-risk, especially from positions that ran hard on optimism and leverage.

Bottom Line: Narrative Cracked, Leverage Amplified the Pain

Today’s wipeout doesn’t come from a single shock. It’s the collision of three live forces: a fading political-stimulus story, an over-levered market, and rising legal and trade uncertainty.

The same reflexivity that sent prices ripping higher last week is now working in reverse. Could crypto snap back again? Sure. If the legal picture around tariffs stabilizes, policymakers find a credible way to deliver support, and leverage gets fully flushed, the next leg up can be just as violent as today’s drop.

For now, though, the message is pretty simple: the story that lifted the market isn’t holding up under scrutiny, and with leverage stacked on top of it, the comedown was always going to be rough.