- Crypto analyst STEPHISCRYPTO shared a “worst-case scenario” chart for XRP that shows a possible deeper dip into lower support before a sharp reversal toward the $4 region, emphasizing it as a scenario, not a guarantee.

- The focus of the analysis is mental and emotional preparedness — staying disciplined through volatility so traders and holders are still positioned if a strong recovery eventually plays out.

- Community responses ranged from calling $4 “too conservative” to suggesting a $5 worst-case target, with many citing Ripple’s growing payments volume, acquisitions, and RLUSD stablecoin as support for a more bullish long-term outlook.

Crypto analyst STEPHISCRYPTO has laid out what he calls a structured “worst-case scenario” for XRP — and interestingly, it’s not all doom and gloom. His chart doesn’t just show downside; it maps out a potential deep pullback followed by a strong recovery that could send XRP toward much higher levels later on.

Instead of shouting predictions or calling exact tops and bottoms, the whole idea of his post is different: it’s about helping traders mentally prepare for volatility. Not just emotionally survive it, but plan for it.

What the Scenario Actually Shows

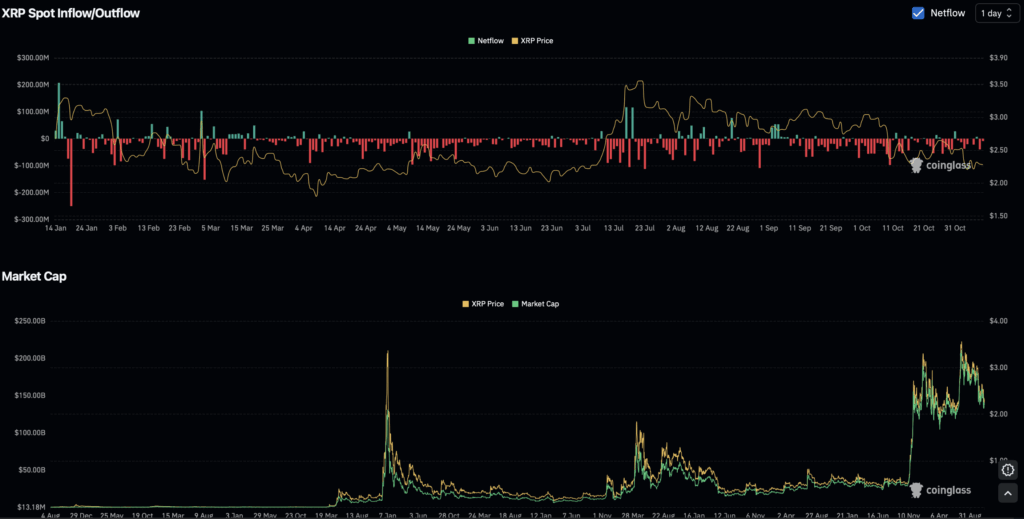

In the chart he shared, XRP is shown consolidating for a bit, moving sideways in a tight range, before taking another leg down into a lower support zone. It’s the kind of move that usually shakes out impatient holders and late buyers who weren’t ready for more pain.

From that lower zone, though, the roadmap flips. The model suggests a sharp reversal, almost like a snapback rally, that pushes XRP into an accelerated uptrend. In his sketch, that move eventually drives price toward the area near 4 dollars.

The key thing: he’s not saying “this will happen,” he’s saying “this could happen.” It’s a stress-test path — what the market might look like if things get rough before momentum really comes back.

The message underneath is pretty simple but harsh: if you can’t stay consistent when the chart looks ugly, you might not be around when it looks amazing again.

It’s About Mindset More Than Targets

One of the main points in STEPHISCRYPTO’s post is psychological, not technical. He leans hard into the idea of mental readiness — being prepared, ahead of time, for deeper drawdowns, fake-outs, and frustrating sideways chop.

He implies that the people who survive those phases with a clear head are often the same ones who are positioned when the big recovery finally shows up. The market likes to test conviction, and XRP has a pretty long history of doing exactly that.

So instead of promising a moonshot, his chart works more like a rehearsal. “If this happens, how will you react?” is basically the question between the lines.

How the Community Reacted

As usual, crypto X (Twitter) did not stay quiet. The scenario pulled in replies from other traders and XRP watchers, some agreeing, some pushing back, some leveling things up.

AltcoinsBitcoin, another user on X, argued that people should weigh in more than just the chart. He pointed at Ripple’s growing role, future utility, and broader development around XRP as reasons why a top around $4 might actually be underestimating things.

He basically questioned whether the market is still underpricing what XRP could become — or if everyone’s simply working with incomplete information.

Then you had The Runaway Princess coming in even more bullish. From her point of view, the “worst case” isn’t $4 at all — it’s XRP hitting $5 within the year. That kind of comment shows a slice of the community that still expects strong performance in the medium term, even if the path getting there is messy and full of fake scares.

So while STEPHISCRYPTO framed his chart as a cautious, disciplined scenario, others spun it as almost conservative.

Fundamentals Still Feeding the Long-Term Story

Behind all this chart talk, there’s also the fundamental side that some investors keep pointing to. Ripple has continued pushing forward on the corporate and network fronts:

- Growing payment volumes across its payment corridors

- Strategic acquisitions

- More activity around its stablecoin efforts through RLUSD

Supporters tend to treat these things as building blocks. Not instant price rockets, but bricks in a longer-term story of adoption and real usage.

Of course, none of that guarantees price performance. Fundamentals can look great while the chart still chops or even bleeds out for a while. But when people talk about future recovery scenarios, they keep coming back to these developments as part of the justification for expecting higher levels down the line.

A Map, Not a Prophecy

In the end, STEPHISCRYPTO’s “worst-case scenario” is less of an omen and more of a mental framework. It sketches one possible path where XRP dips harder before it rips higher — and it stresses that how you behave during the dip might decide whether you’re even around for the rip.

The replies from AltcoinsBitcoin and The Runaway Princess show just how wide the range of expectations still is: some think $4 is conservative, others think $5 is a low bar. But they’re all touching the same core idea — stay aware, stay realistic, and don’t get blinded by either fear or euphoria.

Because in a market like XRP’s, the story can change fast… but your mindset needs to be ready before the chart does.