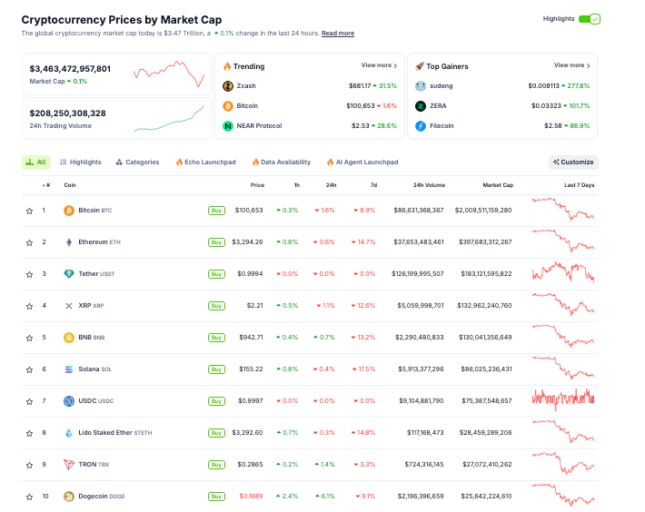

- Dogecoin jumped about 6.5% to around $0.17–$0.18 on Nov. 7, outperforming the top 10 coins while Bitcoin and Ethereum dropped 2% and 3%.

- The move came after Tesla shareholders approved Elon Musk’s record $1 trillion compensation plan, reviving the “Musk effect” narrative around DOGE.

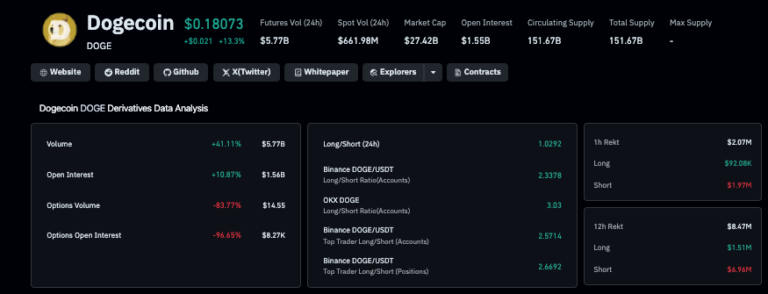

- Dogecoin derivatives volume spiked 41% and open interest rose 10.5%, with traders now eyeing a potential push toward the psychological $0.20 level.

Dogecoin popped about 6.5% to the $0.17–$0.18 range on November 7, while Bitcoin and Ethereum slipped 2% and 3%, as Tesla shareholders approved Elon Musk’s record $1 trillion compensation package. The vote, backed by over 75% of investors, revived the classic “Musk effect” narrative, with traders piling into DOGE as a high-beta bet on Musk’s growing market power and future wealth.

Musk headlines, meme coin hype, and Intel noise

The rally came alongside news that Musk is exploring a potential chip partnership with Intel to support Tesla’s expanding AI and self-driving ambitions, adding extra tech-hype fuel to the story. Meme coins tied to Musk, like Dogecoin and previously Floki Inu, have a history of reacting sharply to his wins, jokes, and business milestones, and this time was no different as DOGE outperformed the entire top 10 crypto pack.

Derivatives spike as traders eye $0.20

On derivatives platforms, Dogecoin saw a 41% jump in trading activity and a 10.5% rise in open interest on November 7, signalling a wave of fresh speculation. With spot buying leading the move rather than just heavy leverage, traders see a reasonable setup for a push toward the psychological $0.20 level if momentum and Musk-driven headlines keep flowing, though meme coin volatility means sharp reversals are always on the table.