• Solmate launched the UAE’s first bare-metal Solana validator, minting blocks at 0% commission.

• Acurast and Irys partnered to turn Solana mobile devices into decentralized cloud storage nodes after raising $5.2M.

• Solana ETFs recorded seven straight days of positive inflows, totaling $294 million and signaling growing institutional interest.

Solmate Infrastructure has officially launched the UAE’s first bare-metal Solana validator, running at zero percent commission and minting the country’s very first Solana block. The company, listed on Nasdaq under the ticker SLMT, announced the deployment on November 6, marking a major step for the region’s crypto infrastructure. With institutional demand for Solana surging—especially after ETFs recorded $294 million in inflows—the timing couldn’t be better. Solmate’s move sets the stage for the UAE to become a critical node in Solana’s global network.

Solmate’s “Infrastructure Flywheel” Strategy

The company’s ambitious goal is to become one of the top Solana validators worldwide. Solmate describes its approach as an “Infrastructure Flywheel”—a cycle where increased validator performance attracts more staking, boosting treasury yields and reinvesting those returns back into infrastructure. In simpler terms, it’s like a self-fueling engine: more performance means more growth, and more growth means even better performance. The team also plans to expand its SOL inventory to enhance validator capacity, lower latency, and strengthen support for DeFi protocols built on Solana.

Acurast and Irys Push Solana Mobile Forward

Alongside Solmate’s breakthrough, decentralized edge computing network Acurast has teamed up with Irys_xyz to transform Solana mobile devices into decentralized cloud storage nodes. Following a $5.2 million funding round, Acurast CEO Alessandro De Carli said this partnership could redefine how devices handle data, turning everyday phones into parts of a distributed storage web. This opens up a fresh wave of retail use cases for Solana’s growing mobile ecosystem, giving users real utility beyond trading and staking.

Solana ETFs Keep the Momentum Going

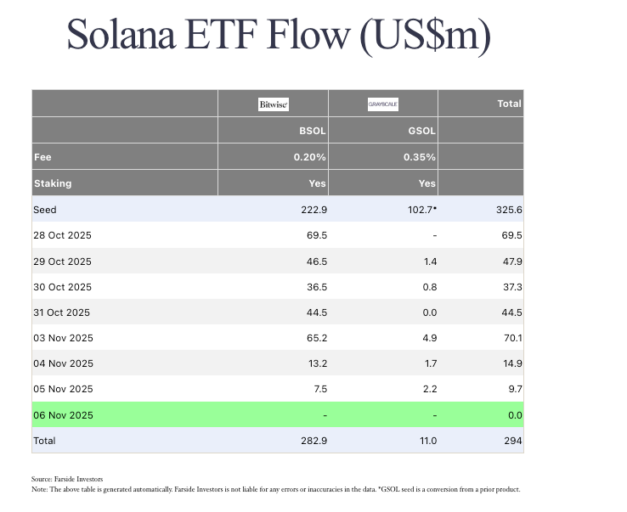

Meanwhile, Solana continues to hold its ground in institutional markets. From October 28 to November 6, both Bitwise and Grayscale Solana ETFs saw seven consecutive days of positive inflows—totaling $294 million, according to Farside Investors.

These consistent inflows reflect how investors are viewing Solana as more than just another Layer 1 chain. With validators like Solmate strengthening the network and new integrations emerging across devices, Solana’s momentum looks far from slowing down.