- Gary Gensler calls exchanges unqualified custodians saying that just because a crypto trading platform claims to be a qualified custodian doesn’t mean that it is.

- The new SEC proposal requires investment advisors to look for qualified custodians for storing assets including crypto.

- Qualified custodians will be subject to independent audits and regular disclosures.

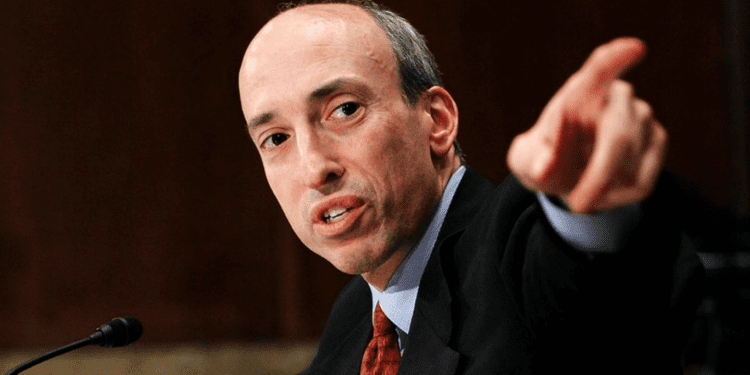

Gary Gensler, Chairperson of the U.S. Securities and Exchange Commission (SEC), renewed his attack on crypto exchanges by terming them as potentially unqualified custodians.

Earlier in February, the SEC proposed a regulation that instructed registered investment advisors (RIA) to look outside the crypto industry as they seek qualified custodians to store their customer’s assets, including cryptocurrency.

While addressing an Investor Advisory Committee meeting on Thursday, Gensler referred to this proposed regulation and stated that it significantly upgrades current protection measures. He further noted that cryptocurrency exchanges should not be considered safe based on those guidelines.

“Make no mistake: Based upon how crypto platforms generally operate, investment advisers cannot rely on them as qualified custodians,” Gary said, adding, “To be clear: Just because a crypto trading platform claims to be a qualified custodian doesn’t mean that it is.”

Gensler cited the previous high-profile bankruptcies in the crypto industry, saying that instead of being returned to the owners, the consumer assets held by those firms were now part of the bankruptcy estate.

Furthermore, Gensler spoke of the legislative support backing the SEC as it potentially worked to change the current requirements for custodians. He said, “The proposal takes up Congress’s 2010 provision for us to expand the custody rule to cover all of an investor’s assets, not just their funds or securities.”

As he closed, he added, “Congress granted us new authorities to expand the custody rule in response to the financial crisis and Bernie Madoff’s frauds. The expanded custody rule would help ensure that advisers done inappropriately use, abuse, or lose investors’ assets.”

SEC’s Proposal

The proposal, approved by the SEC in a 4-1 vote, is an amendment to the current regulation that requires investment advisers to hold customers’ money and assets with a “qualified custodian.” However, if approved, the new rule will extend that protecting responsibility to any assets that investment advisers are entrusted with, including cryptocurrency, thus sidelining crypto firms.

Gensler said, “Rather than properly segregating investors’ crypto, these platforms have commingled those assets with their crypto or other investors’ crypto,” He added, “When these platforms go bankrupt – something we’ve seen time and again recently – investors’ assets often have become the property of the failed company, leaving investors in line at the bankruptcy court.”

In addition to that, the proposal also provides that the qualified custodians would be required to undergo independent audits, provide regular disclosures, and categorize customer assets into accounts under the customers’ identity.

While the SEC stated that the regulation was not crypto-specific, formal statements strongly highlighted the industry.

Nonetheless, not all proposals are permanently adopted. The SEC has scheduled a 60-day feedback period during which the crypto industry will voice its concerns. The SEC is then required to analyze and factor in the stakeholder’s views which is a lengthy process. The rule will then be ruled and approved by the SEc before it is finally enforced.